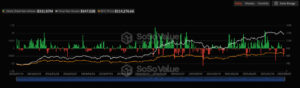

On August 20, a total net outflow of $311.57 million occurred from Bitcoin spot ETFs in the U.S. This marks the fourth consecutive day of net outflows, highlighting investors’ heightened perception of short-term risk.

Historic Outflow in Ethereum Spot ETFs

On the same day, Ethereum spot ETFs saw a net outflow of $240.14 million. This marked the third-largest single-day outflow in Ethereum’s history, indicating that investors were adjusting their portfolios and reassessing liquidity needs.

Impact of ETF Outflows on the Market

Consecutive net outflows in Bitcoin and Ethereum indicate that the market is taking a cautious stance against short-term uncertainties. Analysts note that this trend could amplify price fluctuations, making movements more pronounced on volatile trading days.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.