Ethereum continues to attract institutional investors. Treasuries of 69 different entities now hold 4.1 million ETH, valued at approximately $17.6 billion. This highlights Ethereum’s growing role in corporate portfolios.

Corporate ETH Treasury Accumulations

BitMine Immersion Technologies leads Ethereum treasuries, holding around 1.5 million ETH, valued at over $6.6 billion. The company has shifted from bitcoin mining to ether accumulation. Meanwhile, SharpLink Gaming ranks second with a treasury containing 740,800 ETH worth roughly $3.2 billion. Ether Machine and Ethereum Foundation hold 345,400 and 231,600 ETH, respectively. Digital asset treasuries (DATs) are gaining popularity, and institutional Ethereum accumulation is shaping investment trends in the sector.

Corporate-held ETH totals approximately 2.6 million ETH, worth $10.9 billion. In addition, U.S.-based spot Ethereum ETFs hold 6.7 million ETH, representing about 5.5% of total Ethereum supply. Institutional investments and ETFs therefore have a major impact on the Ethereum market. Strategic ETH accumulation provides trust and liquidity, making Ethereum treasuries attractive for both corporate and individual investors.

ETH Price and Derivatives

Despite a 15% drop over the last six days, ETH found support around $4,070. Ether futures and derivatives indicate investors remain calm, maintaining potential toward $4,700. The annual futures premium remains above 5%, signaling confidence, while on-chain data shows sustained ETH demand. According to DefiLlama, ETH controls 60% of total locked value, and network fees are rising. Professional investors remain composed, and Ether’s recovery is supported by strong fundamentals, keeping the potential for $4,700 alive.

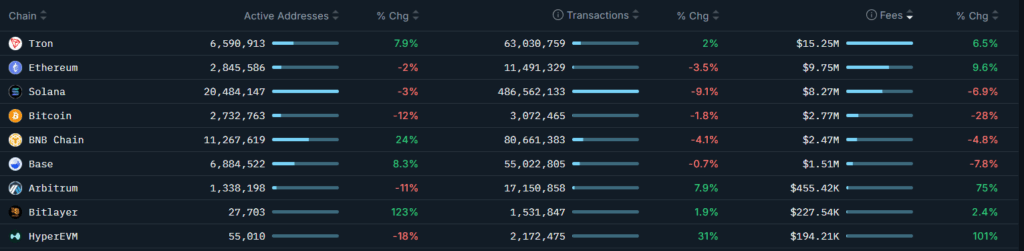

On-chain data confirms continued ETH demand and strong fundamentals. DefiLlama shows ETH controls 60% of total TVL, while network fees rose 38% last week to $11.2 million. In comparison, Solana fees increased 3%, and BNB Chain revenues dropped 3%. In the last 30 days, decentralized exchange volume reached $129.7 billion, with Ethereum maintaining its leadership position.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.