Recent statements from U.S. Federal Reserve (Fed) officials have once again brought rate cut expectations back into the spotlight. Comments from Fed members Schmid and Bostic highlight ongoing uncertainty around inflation and suggest that policymakers are in no rush to ease monetary policy.

Key Messages from Schmid and Bostic

Fed official Schmid noted that the final stage of fighting inflation is proving particularly difficult, adding that price growth is more likely to remain closer to 3% rather than the 2% target. Schmid stated, “I am not in a hurry to cut interest rates. Markets and rate spreads are in good shape; we need definitive data before moving the policy rate.”

Meanwhile, Bostic emphasized that the Fed’s current stance is designed to bring inflation back to the 2% target. However, he also admitted that inflation remains well above this level and that trends in the labor market may pose risks. According to Bostic, a rate cut is still an option for this year, but any decisions must be consistent and strictly data-driven.

Markets Eye Powell’s Jackson Hole Speech

Following these remarks, all eyes are now on the Jackson Hole Symposium. Held annually in Wyoming, the event is seen as one of the most critical gatherings for the global economy. Tomorrow, on Friday, August 22, Fed Chair Jerome Powell will deliver his speech — a particularly significant one as his term is set to end next year. It may be Powell’s final opportunity to send strong signals from the Jackson Hole stage.

Investors are eager to see how Powell will balance concerns over a weakening labor market with the persistence of sticky inflation.

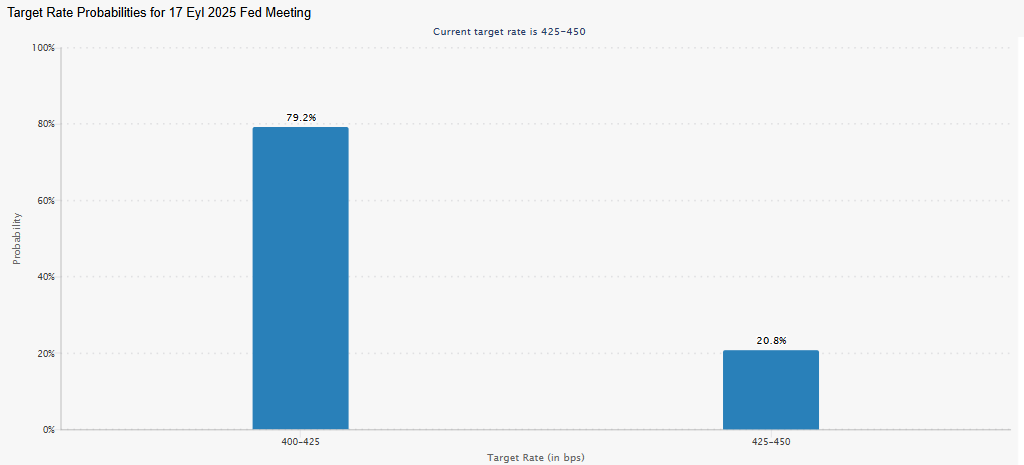

CME Group FedWatch Tool Data

According to the CME FedWatch Tool, market probabilities for rate adjustments are as follows: a 0% chance for the 375-400 bps range, a 79.2% chance for the 400-425 bps range, and a 20.8% chance for the current 425-450 bps range.

This outlook suggests that markets currently see a 25 bps cut as the more likely short-term scenario.

Also, click to read our article, “What to Expect from Powell at the Jackson Hole Meeting?”

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.