This week, significant movements occurred in the Bitcoin (BTC) and Ethereum (ETH) options markets. Nearly $5 billion worth of options contracts expired. This amount accounts for 8% of the total open interest, which is low compared to historical averages.

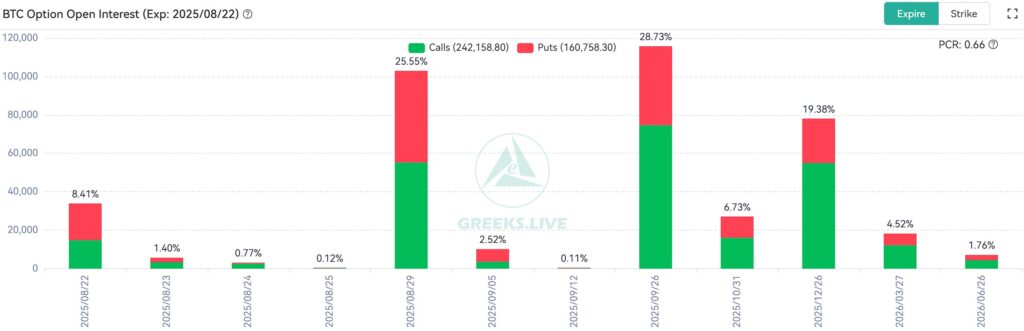

BTC Options

- Expiry: August 22, 2025

- Put-Call Ratio (PCR): 0.66

- Max Pain Level: $118,000

- Notional Value: $3.82 billion

- Expired Contracts: 34,000

BTC’s short-term implied volatility (IV) rose above 35%, showing a strong recovery. This indicates high market expectations for price fluctuations.

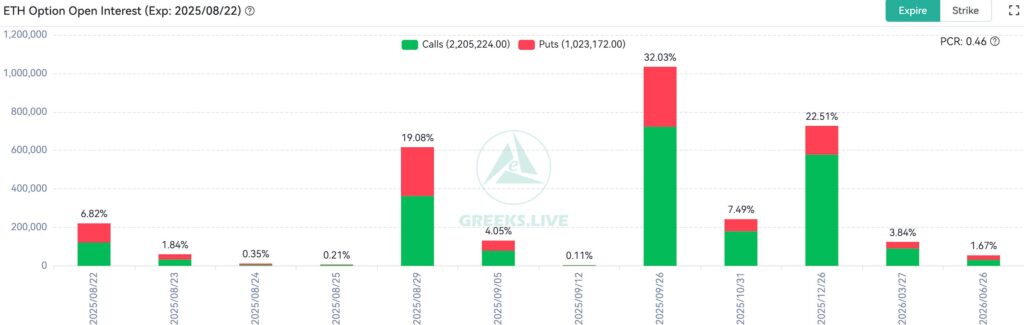

ETH Options

- Expiry: August 22, 2025

- PCR: 0.46

- Max Pain Level: $4,250

- Notional Value: $950 million

- Expired Contracts: 220,000

ETH’s main-term IV stayed below 70%, while short-term IV rose above 80%, reflecting increased volatility expectations.

BTC and ETH traded near historical highs this week, with a market theme of price correction. Investor sentiment remained relatively optimistic. Additionally, recent block trades occurred in both bullish and bearish positions, creating clear divergence in the options market.

BTC Options Scenarios and Macro Impacts

According to Deribit price trends, five BTC price ranges show option imbalances:

- $105,000–$110,000: Call options $210M, put options $2.66B. Accordingly, put options hold a $2.45B advantage.

- $110,100–$114,000: Call $420M, put $1.94B. In this range, puts are $1.5B more favorable.

- $114,100–$116,000: Call $795M, put $1.15B. As a result, puts have a $360M advantage.

- $116,100–$118,000: Call $1.3B, put $830M. Accordingly, calls hold a $460M advantage.

- $118,100–$120,000: Call $1.7B, put $560M. In this case, calls are $1.1B more favorable.

For bullish strategies to gain momentum, BTC must surpass $116,000 by August 29. However, the most critical level is $114,000, where bears are highly motivated to push prices down.

Macro Factors and Market Pressure

FED decisions and technology stock pressures will play a key role in BTC’s direction. Morgan Stanley warned that large tech companies may have limited capacity for share buybacks. Meanwhile, cautious equity markets increase investor concerns. Worries about the AI sector, combined with options market activity, could affect BTC’s short-term performance.

BTC options expirations and macro pressures from the tech sector will determine whether the bull run has truly ended. At the same time, this situation may only represent a temporary pause.

The options market continues to price future volatility strongly. Additionally, max pain levels and PCR ratios remain crucial indicators for short- and mid-term strategies.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.