Plasma (XPL) is a high-performance Layer 1 blockchain engineered specifically for global stablecoin payments. So, let’s take a look at what Plasma (XPL) is, what kind of tokenomics does it have, what solutions does it offer, and who makes up its team?

What Is Plasma (XPL)?

With stablecoins driving over $250 billion in market supply and trillions in monthly transaction volume, Plasma addresses their unique needs through zero-fee USD₮ transfers, customizable gas tokens, support for confidential payments, and unparalleled scalability for global adoption.

Unlike traditional blockchains that struggle with high-volume, low-cost payment systems due to their lack of stablecoin optimization, Plasma is purpose-built to deliver scalability, reliability, and low latency. By embedding stablecoin functionality at the protocol level, it aims to provide a secure, rapid, and user-centric experience for developers and users alike.

Why Choose Plasma?

Plasma stands out by offering an infrastructure tailored for stablecoin transactions, overcoming the shortcomings of conventional blockchains that weren’t designed with stablecoin demands in mind. It tackles performance bottlenecks in high-throughput, cost-efficient payment systems with the following key features:

-

Stablecoin-Centric Design: Optimized for high-volume, low-cost payments, Plasma ensures scalability, speed, and reliability to meet global stablecoin demands.

-

Native Features: Zero-fee USD₮ transfers, customizable gas tokens, and confidential payment options empower developers to create seamless, cost-effective, and private user experiences.

-

Deep Liquidity: Launching with over $1 billion in USD₮ liquidity, Plasma positions itself as one of the most liquid stablecoin networks globally, enabling developers to tap into robust liquidity from day one.

-

EVM Compatibility: Fully compatible with the Ethereum Virtual Machine (EVM), Plasma allows developers to deploy contracts using familiar tools like Hardhat, Foundry, and MetaMask, streamlining development workflows.

-

Integrated Stablecoin Infrastructure: Plasma provides access to top-tier infrastructure, including card issuance, global on- and off-ramps, stablecoin orchestration, and advanced risk and compliance tools, all supported by trusted third-party providers.

-

Native Bitcoin Bridge: A trust-minimized bridge enables developers to move BTC directly into the EVM environment without centralized custodians, unlocking innovative applications at the intersection of stablecoins and the world’s largest digital asset.

What Can You Build on Plasma?

Plasma equips developers with a robust foundation to create global-scale stablecoin payment systems and financial applications. Using familiar tools like Hardhat, Foundry, and MetaMask, developers can deploy applications and protocols with ease. Plasma’s protocol-level contracts are designed for zero-fee USD₮ transfers, customizable gas tokens, and confidential payments, aligning with EIP-4337 and EIP-7702 smart account standards. These features are set to integrate more deeply with block-building and execution processes over time. From wallets to foreign exchange systems or consumer-facing applications, Plasma offers the speed, liquidity, and flexibility needed to operate at a global scale.

Use Cases

-

Remittances: Instant, low-cost cross-border transfers without intermediaries.

-

Micropayments: Automated, low-fee micropayments for internet-native economies.

-

Global Payouts: Seamless, borderless payments to employees and partners worldwide.

-

Merchant Acceptance: Enables merchants to accept global payments with instant settlement and reduced fees.

-

Dollar Access: Permissionless access to dollars in unstable economies.

-

Permissionless Banking: Open access to saving, spending, and earning without traditional banks.

Technical Architecture

Plasma’s infrastructure is built on three core components:

-

PlasmaBFT Consensus Layer: Powered by a pipelined Fast HotStuff consensus algorithm, PlasmaBFT processes proposals, votes, and commits concurrently, delivering high throughput, low latency, and deterministic finality within seconds. Optimized for stablecoin workloads, it ensures Byzantine fault tolerance for global-scale performance.

-

EVM Execution Layer: Built on Reth, a high-performance, modular Ethereum execution client written in Rust, Plasma’s EVM environment supports standard Solidity contracts with full compatibility for existing wallets, SDKs, and developer frameworks, eliminating the need for custom tools.

-

Native Bitcoin Bridge: A trust-minimized, non-custodial bridge allows BTC to be integrated into the EVM ecosystem, enabling smart contract interactions, collateral systems, and cross-asset flows for innovative financial applications.

Stablecoin-Native Contracts

Plasma provides protocol-managed contracts tailored for stablecoin use cases, rigorously audited and designed for integration with smart account wallets. These contracts evolve with the protocol and are built for deeper execution-layer integration:

-

Zero-Fee USD₮ Transfers: A paymaster contract covers gas costs for USD₮ transfers, using lightweight identity verification (e.g., zkEmail) and rate limits to ensure security and prevent spam.

-

Custom Gas Tokens: A secure, fee-free ERC-20 paymaster allows approved tokens to be used for gas payments, removing the need for users to acquire native tokens.

-

Confidential Payments: A privacy-preserving module for USD₮ transfers shields amounts, recipient addresses, and memo data while ensuring regulatory compliance, designed for practical financial use cases like payroll and private settlements.

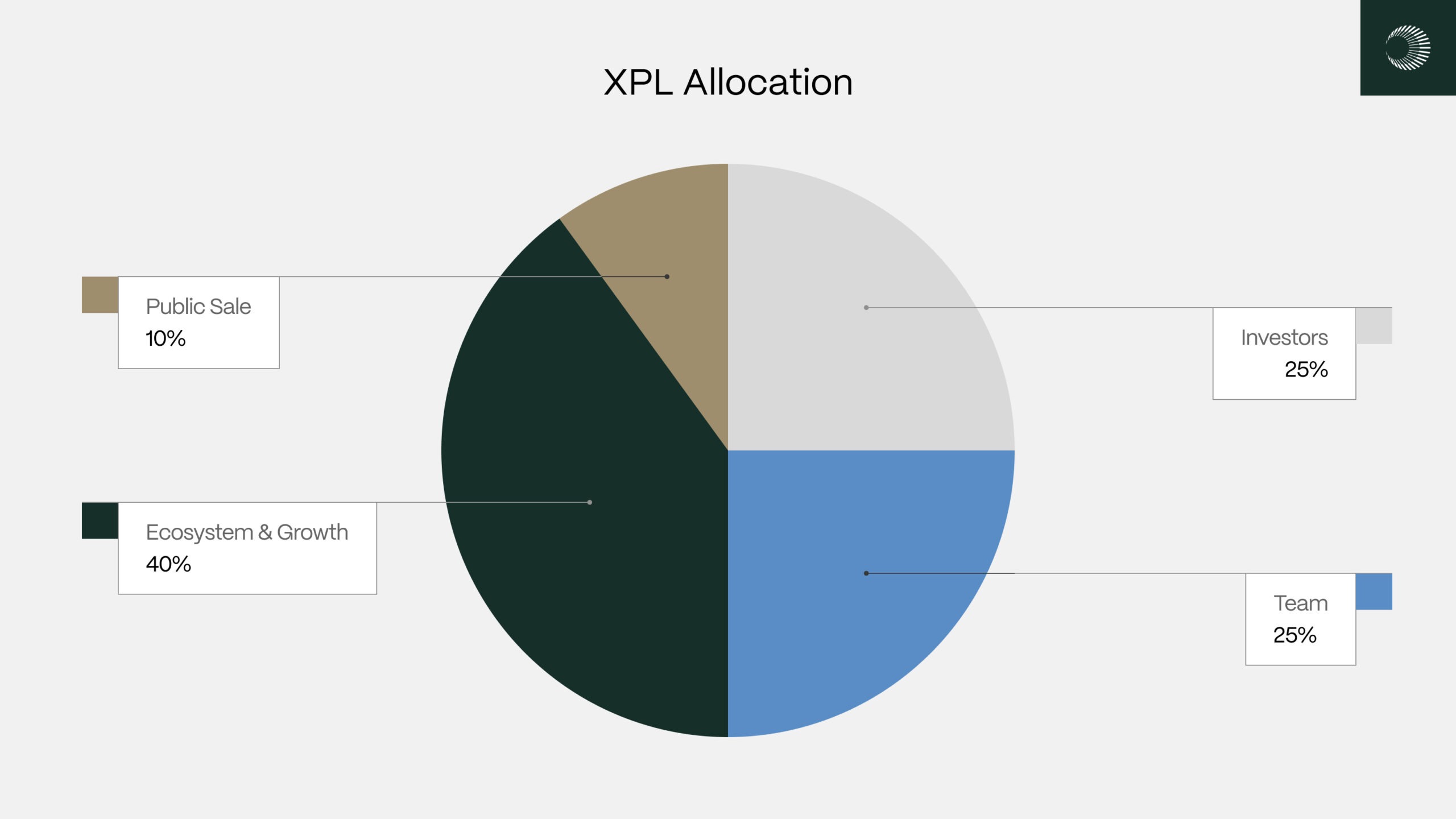

Plasma (XPL) Tokenomics

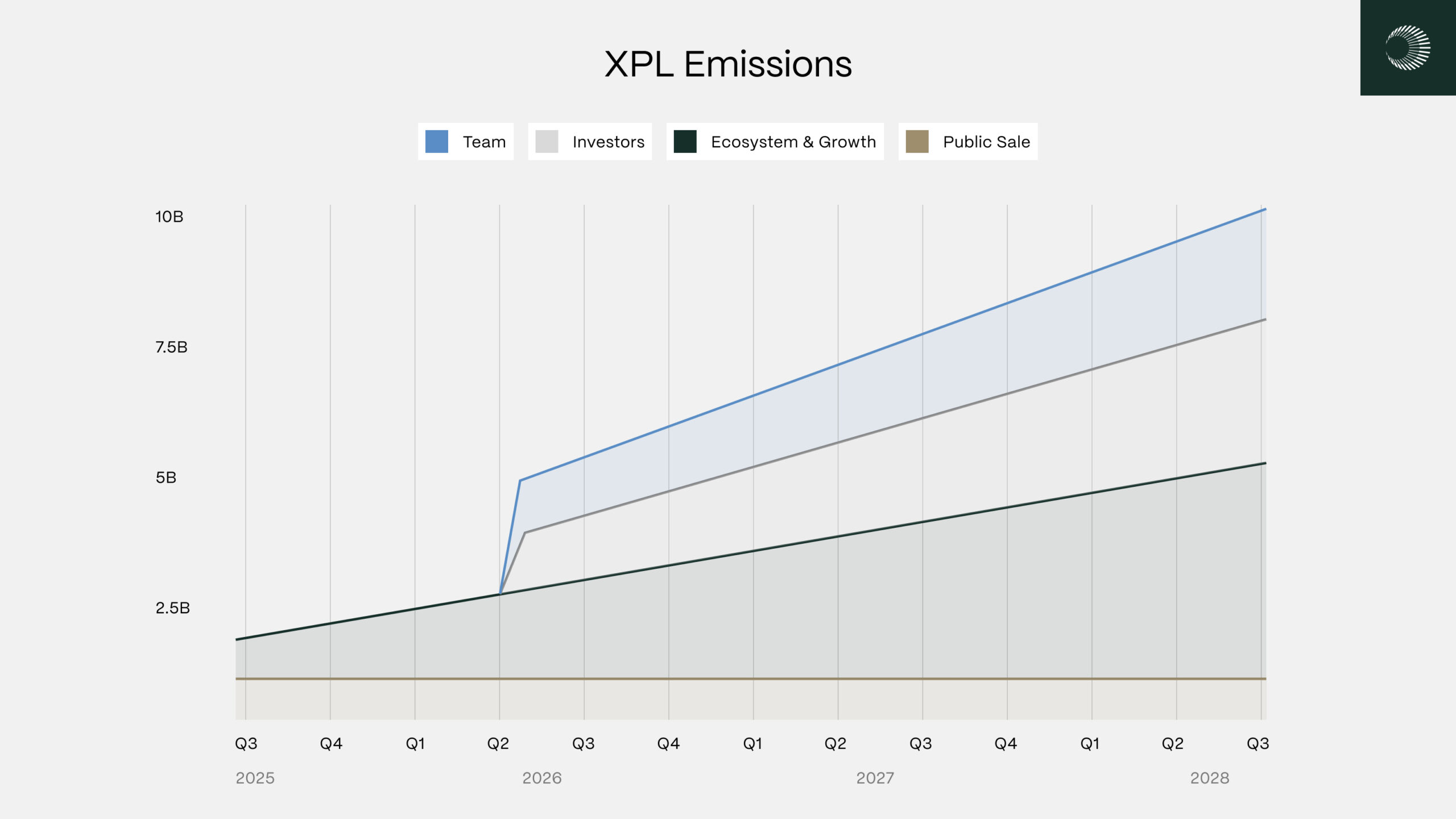

XPL is the native token of the Plasma blockchain, used for transaction execution, network security, and validator rewards. The initial supply is 10 billion XPL, distributed as follows:

-

Public Sale: 10% (1 billion XPL), allocated through a public sale. Non-US buyers’ tokens are unlocked at the mainnet beta launch, while US buyers face a 12-month lockup until July 28, 2026.

-

Ecosystem and Growth: 40% (4 billion XPL), dedicated to strategic initiatives to boost network utility, liquidity, and institutional adoption. 8% unlocks at launch, with the remaining 32% unlocking monthly over three years.

-

Team: 25% (2.5 billion XPL), incentivizing current and future team members. One-third unlocks after a one-year cliff from the mainnet beta launch, with the rest unlocking monthly over two years.

-

Investors: 25% (2.5 billion XPL), following the same unlock schedule as the team.

Validator Network and Inflation

Plasma operates on a Proof-of-Stake (PoS) model, where validators secure the network by confirming transactions. Future stake delegation will allow XPL holders to delegate tokens to validators and share rewards. Inflation starts at 5% annually, decreasing by 0.5% each year until reaching a 3% baseline. Transaction fees are burned per the EIP-1559 model to balance inflation and limit long-term dilution.

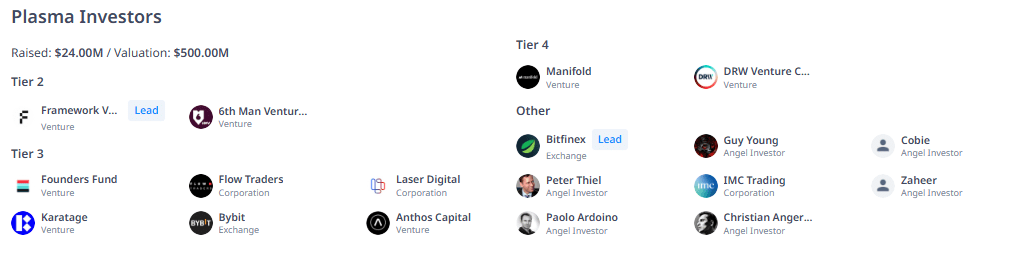

Plasma (XPL) Investors

Plasma raised $24 million at a $500 million valuation, backed by leading venture capital firms and angel investors. Key investors include Founders Fund, Framework Ventures, Bitfinex, 6th Man Ventures, Flow Traders, Laser Digital, Karatage, Anthos Capital, Manifold, DRW Venture Capital, and prominent individuals like Peter Thiel, Paolo Ardoino, Guy Young, Christian Angermayer, Zaheer, and Cobie. This robust investor backing fuels Plasma’s mission to redefine global financial systems.

Plasma (XPL) Team

The Plasma team comprises seasoned industry leaders. Founder Paul Faecks shapes the platform’s vision, while CTO Hans Walter Behrens oversees technical development. COO Lucid manages operational processes, Ecosystem Head Vincent Rong drives ecosystem growth, and Head of Growth Nathan Lenga spearheads expansion strategies. Together, they position Plasma as a leading blockchain for stablecoin payments.

Plasma delivers a revolutionary solution for global stablecoin payments with zero-fee USD₮ transfers, high-performance infrastructure, and compatibility with Bitcoin and Ethereum. By empowering developers and users with speed, liquidity, and flexibility, Plasma aims to reshape the future of finance at internet speed.

Official Links

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.