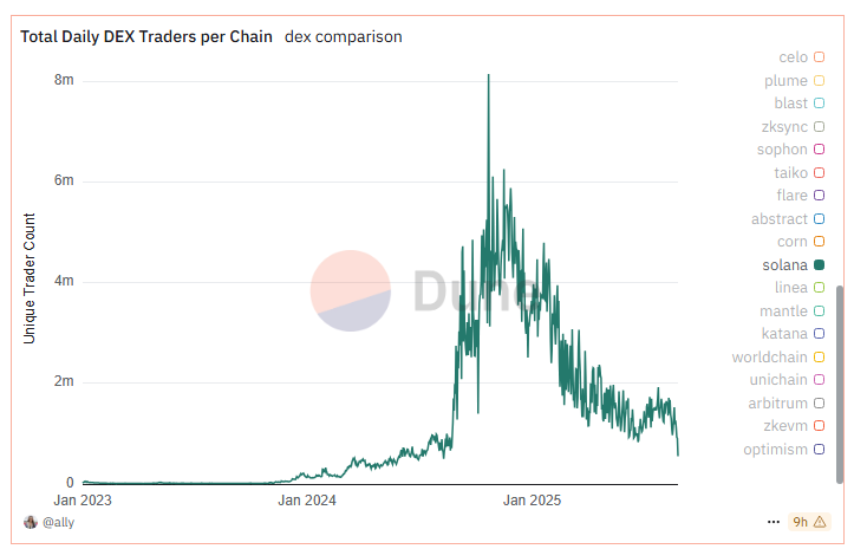

Solana DEX investors declined by 90% within a year. This sparked debates about retail users leaving the network or bots being removed. However, daily DEX trading volume remains between $3–5 billion. This raises suspicion that bots dominate Solana trading activity. Analysts are divided on the causes. Some see the decline as a bear market effect, while others call it a healthy reset supporting long-term growth. On-chain data shows investor numbers have been falling steadily since last October.

Sharp Drop in Solana DEX Users

According to Dune Analytics, daily Solana DEX users numbered over 8 million last October, but now they fall below 1 million. Charts indicate an almost 90% drop over a year. This suggests investors left the network due to lack of profit opportunities. Investor Qwerty commented, “Everyone left the casino or lost it all. wild chart.”

Logically, fewer investors should lead to lower trading volume. However, DefiLlama data shows daily volume still ranges from $3 to $5 billion. This inconsistency fuels doubts about bot dominance. Investor NoCapMat.eth said, “Knowing how many farming and volume bots operate 24/7, the drop in active users is shocking.”

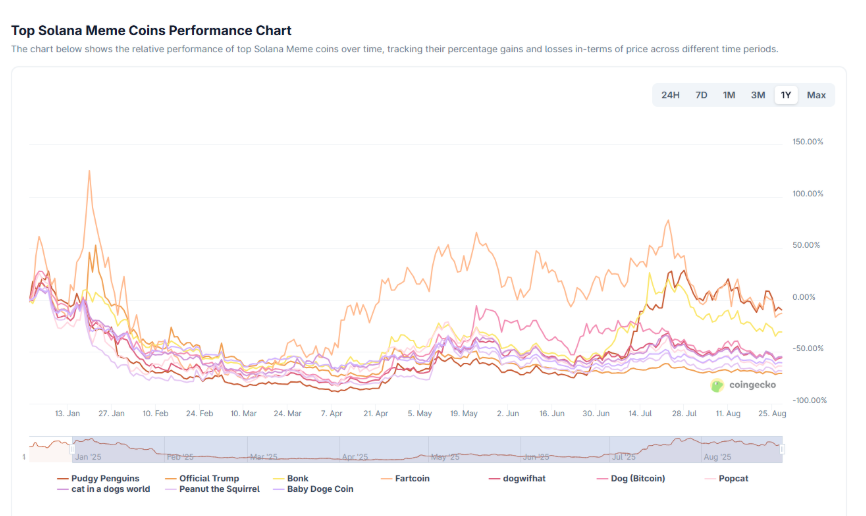

According to CoinGecko, Solana’s most popular tokens performed negatively since the start of the year. Tokens like TRUMP, MELANIA, LIBRA, and YZY initially attracted high interest but later caused distrust. Retail users shifted to other chains or exited completely.

Bullish Perspective and On-Chain Health

Optimistic analysts argue the sharp drop may signal a market bottom. Some claim the seven-million wallet decline reflects bot removal rather than real user exit. With bot addresses no longer profitable, the environment becomes fairer for regular users. Analysts view this as a healthy development for long-term growth.

Messari analyst Matthew Nay questioned the shocking data but noted Solana’s on-chain health remains stable. Nay said, “Transactions, fee payers, and signers remain steady. The decline is not as severe as charts suggest.”

Debates around Solana’s on-chain metrics reflect the network’s complexity. Meanwhile, SOL rose over 35% in August, trading above $210. The altcoin still shows bullish trends, sustaining investor interest.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.