Veno Finance is a liquid staking protocol operating on Cronos and zkSync Era. It allows users to stake assets like CRO, ATOM, TIA, and ETH and receive liquid, auto-compounding tokens (LCRO, LATOM, LTIA, LETH) in return. This enables investors to earn staking rewards while freely using their tokens within the DeFi ecosystem.

Team & Founders

Veno Finance is backed by a Cronos ecosystem-focused team specialized in node infrastructure and security. The founding team has extensive experience in enterprise-level node operations. The project follows a vertically integrated model, ensuring long-term reliability and low-cost advantages.

Ecosystem & Partnerships

Veno Finance has strategic partnerships to enhance the usage of its liquid staking tokens:

- DeFi Protocols: Integration with VVS Finance, Ferro, Tectonic, SyncSwap, Maverick, and Single Finance for liquidity pools and farming with LCRO, LATOM, LTIA, and LETH.

- NFT Marketplaces: Minted and Ebisu’s Bay allow NFT trading during unstaking.

- Other Projects: Ecosystem integrations with Cronos ID, Candy City, PUN, and Kaching expand utility.

Project Idea

Veno Finance aims to:

- Remove long wait times and validator management from traditional staking,

- Offer users liquid, auto-compounding tokens,

- Maximize the use of these tokens within the ecosystem.

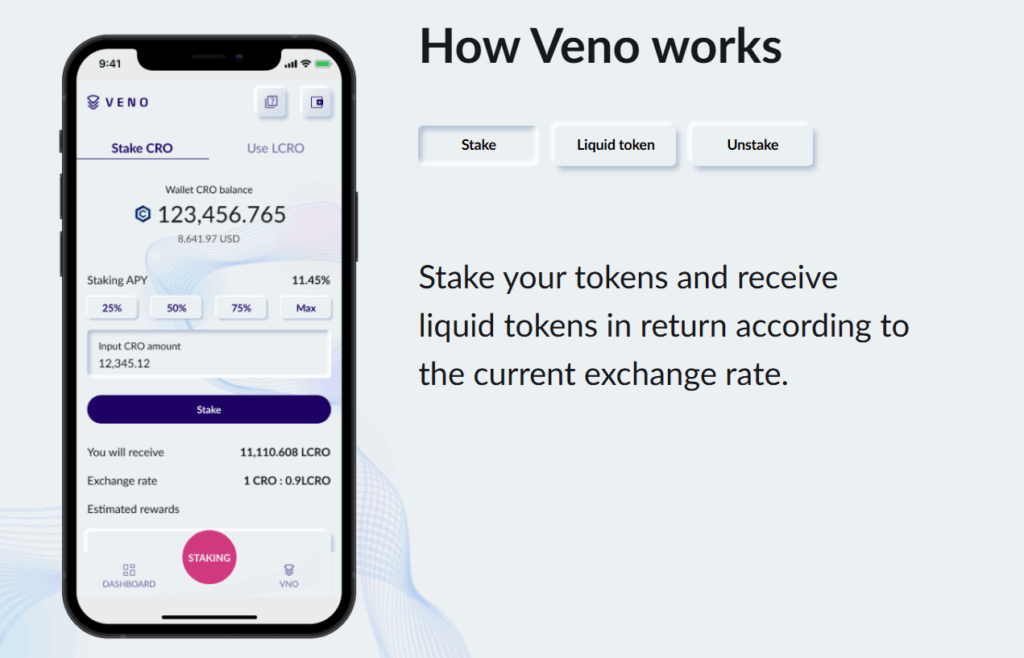

How It Works

- Users stake CRO, ATOM, TIA, or ETH.

- They receive a liquid token (e.g., LCRO, LATOM, LTIA, LETH) with auto-compounding rewards.

- When unstaking, users get an NFT representing their stake, which can be sold or held until the original token is redeemed.

Governance

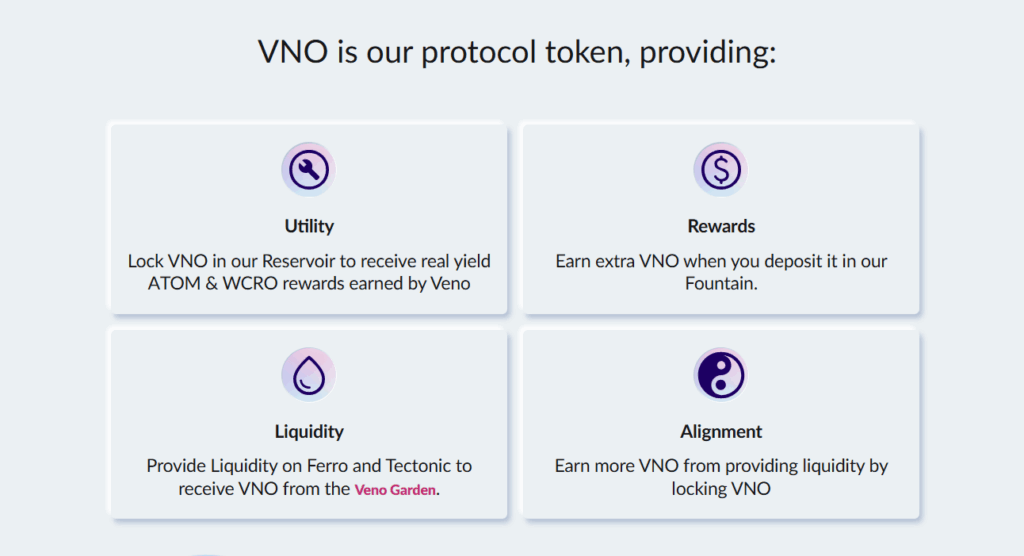

- Veno’s governance token is VNO. Users can:

- Stake VNO in vaults like Reservoir and Fountain for extra rewards,

- Participate in voting and incentive mechanisms,

- Benefit from the Buyback & Burn program to reduce supply.

Roadmap Highlights

- 2024 Q3: LETH launch on zkSync Era

- 2024 Q4: vETH, vUSD, zkCRO yield products

- 2025: More cross-chain integrations, new liquid staking tokens, ecosystem expansion

Token Utility

- Staking Incentives: Earn extra rewards via Reservoir/Fountain

- Governance: Participate in votes

- Liquidity Incentives: Additional APY in pools

- Buyback & Burn Program: Deflationary mechanism

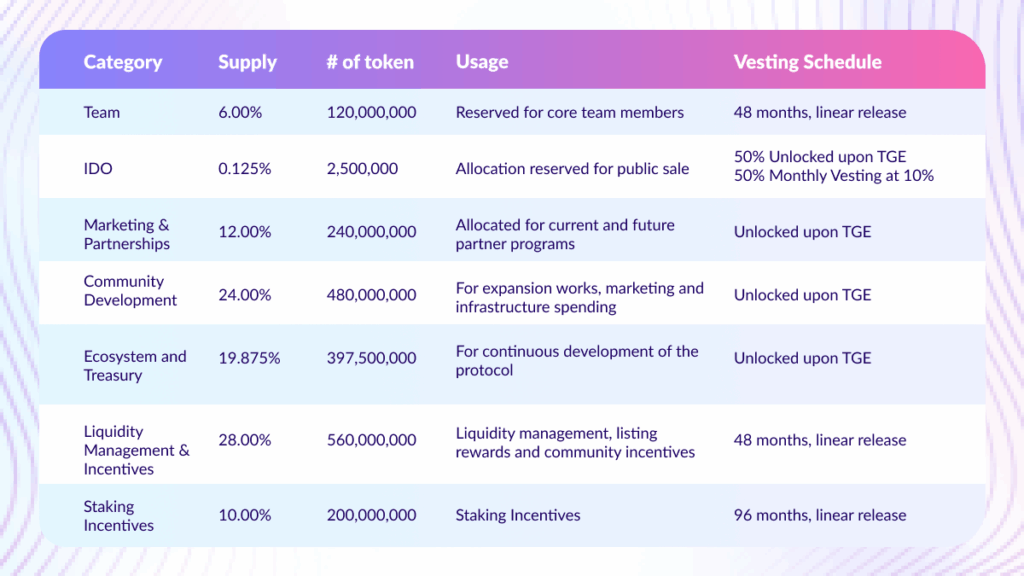

Token Details

- Token Name: Veno Finance (VNO)

- Total Supply: 2,000,000,000 VNO

- Circulating Supply: 474.51M VNO

- Max Supply: 2B VNO

Token Distribution

- Ecosystem Reserve: 20% (60,000,000 VNO)

- Listing Reserve: 40% (120,000,000 VNO)

- Staking Incentives: 25% (75,000,000 VNO)

- Liquidity Management & Incentives: 15% (45,000,000 VNO)

Ecosystem & Integrations

- Cronos ID integration

- Swap & farming via Ferro Protocol

- NFT liquidity on Minted Network

- Liquidity provision on zkSync Era via SyncSwap and Maverick

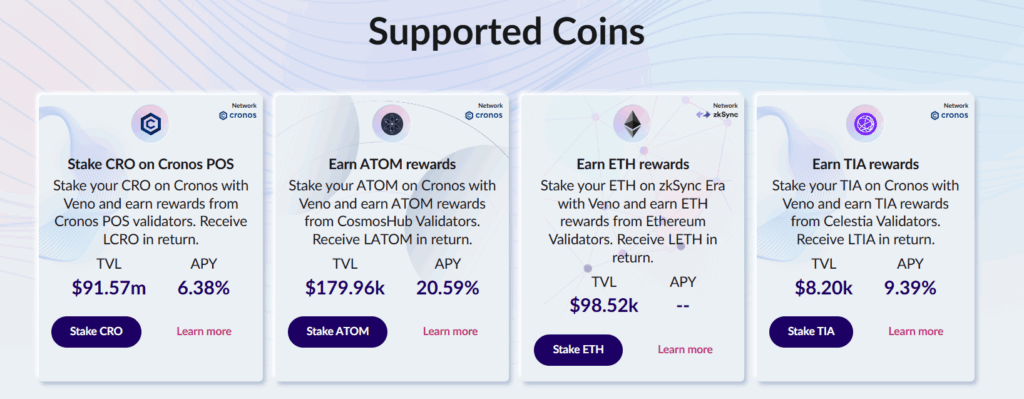

Supported Assets & Yields

- CRO (Cronos PoS): TVL $91.57M, APY 6.38% → LCRO

- ATOM (Cronos): TVL $179.96K, APY 20.59% → LATOM

- ETH (zkSync Era): TVL $98.52K → LETH

- TIA (Cronos): TVL $8.20K, APY 9.39% → LTIA

Key Features

- Liquid staking NFTs for liquidity during waiting periods

- Auto-compounding for optimized passive income

- Deflationary Buyback & Burn program

- Low fees (0.2% unstake) and high security

- Multi-chain support (Cronos + zkSync Era)

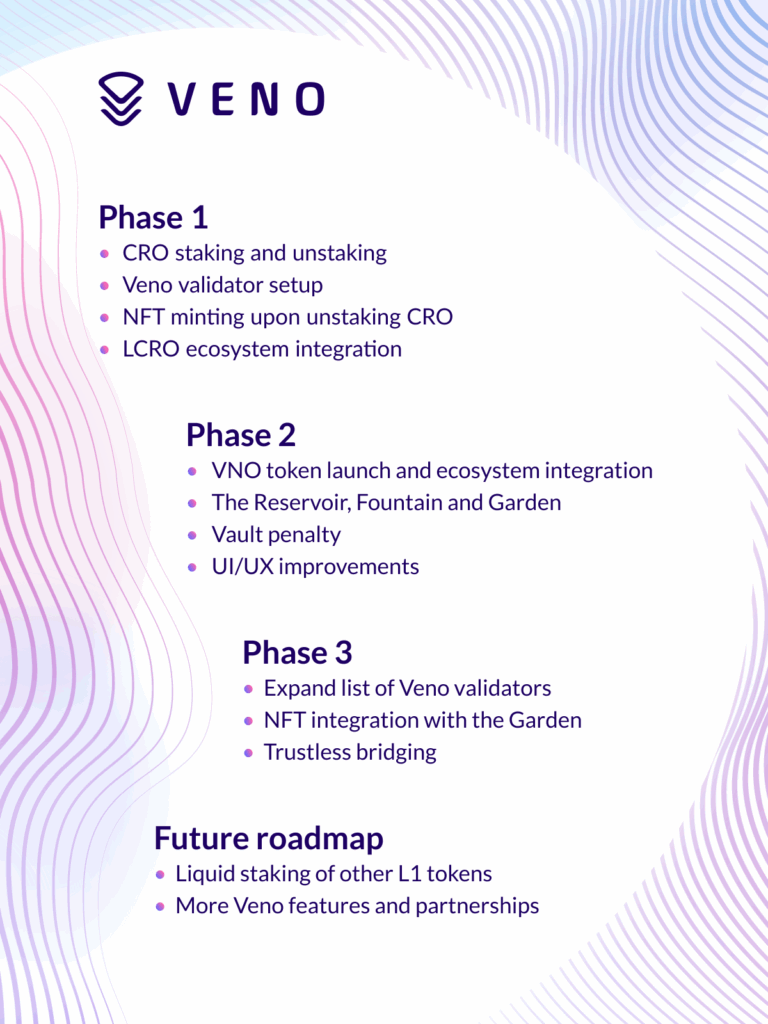

Roadmap Phases

- Phase 1: CRO staking/unstaking, LCRO integration, NFT liquidity

- Phase 2: VNO launch, Reservoir/Fountain/Garden, UI/UX improvements

- Phase 3: Validator expansion, NFT integration, cross-chain bridging

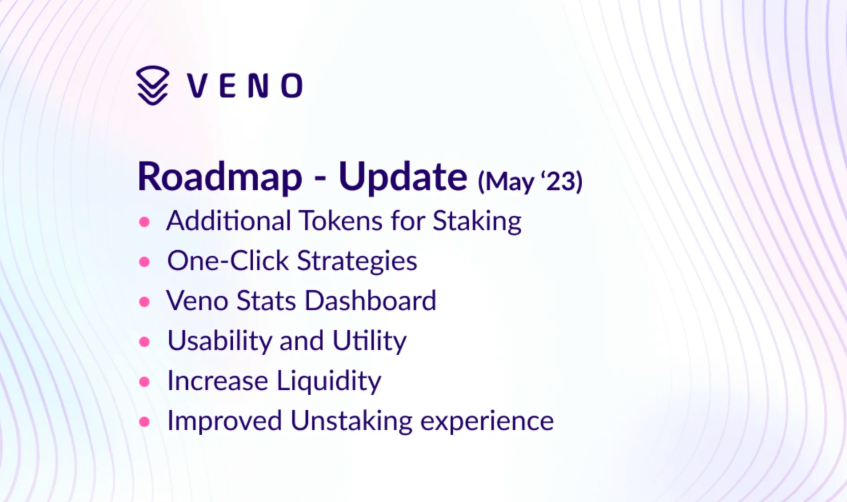

- Future: Additional token staking, one-click strategies, analytics dashboard, improved liquidity & unstake experience

Social & Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.