Tradoor (TRADOOR) is the industry’s pioneering Normal Distribution-Based Automated Market Maker (NDMM) exchange, leveraging advanced mathematical models and robust safety measures to enable confident trading. Built on The Open Network (TON) blockchain, Tradoor harnesses fast finality, sub-cent gas fees, and high scalability to deliver a seamless experience. It offers up to 100x leverage on Bitcoin and Ethereum perpetual contracts, with a scientifically designed pricing system that safeguards traders, liquidity providers (LPs), and the protocol from unexpected market volatility. Accessible across multiple platforms, Tradoor integrates with Telegram Wallet, providing easy onboarding for over 700 million users.

What is Tradoor (TRADOOR)?

Tradoor aims to provide a secure, fast, and cost-efficient trading platform in the decentralized finance (DeFi) space. Utilizing TON’s blockchain capabilities, it offers an accessible DeFi application for mass adoption. As the first TON protocol to combine swaps, perpetuals, and options, Tradoor stands out with zero-slippage transactions, rapid confirmations, and minimal gas fees. Its innovative “Price Lock” mechanism ensures no slippage, while the AI-enhanced “Liquidity Shield” isolates toxic flow, delivering fair pricing and high order success rates. The NDMM pricing system protects traders, LPs, and the protocol, establishing Tradoor as a reliable derivatives platform in the Web3 ecosystem.

NDMM Pricing Mechanism

Tradoor’s Normal Distribution-Based Automated Market Maker (NDMM) system ensures that liquidity providers (LPs) act as counterparties in all transactions, maintaining consistent pricing when traders open, close, or liquidate positions. The Deviation Rate (DR) is calculated based on the difference between long and short position values, reflecting the net exposure of the liquidity pool. The Premium Rate (PR) is derived from the DR, with a zero DR resulting in a zero PR, ensuring fairness. Built on a risk-neutral approach with a normal distribution assumption, this mechanism keeps pricing transparent and equitable. The Funding Rate, calculated hourly, helps maintain market balance.

Auto Deleveraging (ADL)

Tradoor’s Auto Deleveraging (ADL) system protects the protocol from counterparty risk during extreme market conditions. If large-scale position closures cause net exposure to exceed the liquidity pool, ADL activates to forcibly reduce excess positions. The ADL ranking prioritizes contracts with the highest exposure and considers profit/loss ratios. For profitable users, the position profit rate is multiplied by the leverage ratio; for losing users, it’s divided by the leverage ratio. ADL continues until all contract exposures reach zero, with the execution price set at the trigger-time contract price. This ensures the protocol’s insolvency resistance.

Tradoor Liquidity Provider (TLP)

The Tradoor Liquidity Provider (TLP) absorbs all losses from liquidity risk exposure until depleted, generating income from transaction and liquidation fees, funding fees, and traders’ profits or losses. The TLP’s profit/loss rate is calculated by dividing its net value by the number of shares. Subscriptions are non-leveraged, with a 10-day lockup period. If the TLP is profitable, investments and shares align 1:1; in a loss scenario, a loss subscription incentive is calculated. Redemptions vary based on profit or loss status, optimized by configurable incentive coefficients. This structure supports LPs while ensuring protocol stability.

What are $DOOR Points?

$DOOR is Tradoor’s native points and rewards system, designed to incentivize active participation and foster ecosystem growth. Users can earn $DOOR by trading, referring friends, completing tasks, or engaging with “Sausage the Bull” on Tradoor’s reward platform. These points enhance user engagement and support the platform’s community-driven approach, encouraging users to contribute to Tradoor’s development and success.

Tradoor Tokenomics

The project has not yet released its Tokenomics information.

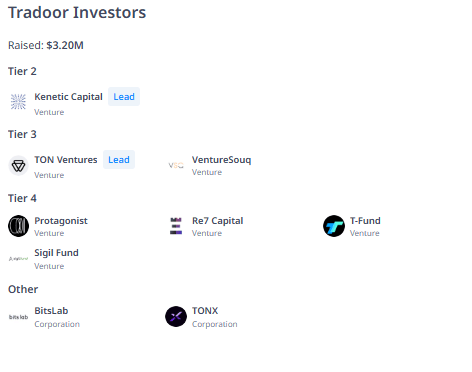

Tradoor (TRADOOR) Investors

Tradoor has raised $3.2 million, backed by investors including Kenetic Capital, TON Ventures, VentureSouq, Protagonist, Re7 Capital, T-Fund, Sigil Fund, BitsLab, and TONX. Additionally, Tradoor was part of the inaugural TON Accelerator, further strengthening its position in the ecosystem.

Tradoor Team

Founded in 2023, Tradoor is led by a skilled team from Asia and Western Europe:

-

Lev Vladykin: Head of Partnerships

-

Wei Wei Lim: Creative Marketing Executive

Tradoor leverages TON’s blockchain to deliver a fast, affordable, and self-custodial trading tool that combines swaps, perpetuals, and options. With innovative features like Price Lock and Liquidity Shield, it addresses traders’ needs for cost, speed, and reliability. As the leading derivatives platform on TON, Tradoor shapes the future of decentralized finance in Web3.

Official Links

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.