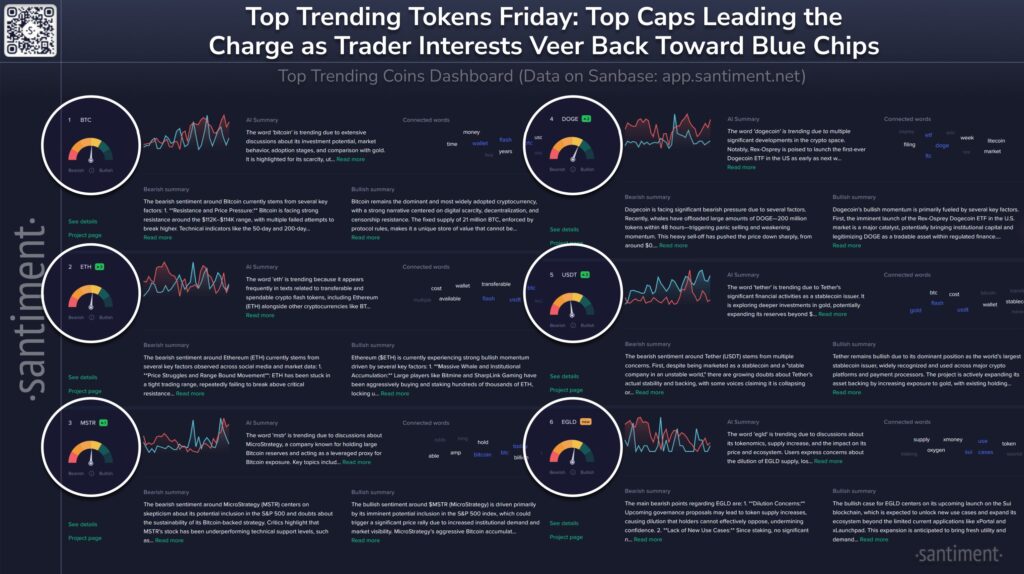

Santiment revealed which coins investors and social media users discussed the most at the end of the week. Panel data focused on social media and trading activity of BTC, ETH, DOGE, USDT, MSTR, and BUSD. Investors concentrated discussions on the coins with the highest market capitalization.

Bitcoin and Ethereum at the Center of Discussions

Investors emphasized Bitcoin’s scarcity and its role as a digital money network. BTC price drew attention by breaking a strong resistance level between $16,500–$16,900. Technical indicators suggest potential breakout above the 100 and 200-day moving averages. According to Santiment, investors also discussed Bitcoin’s value-creating aspects beyond store of value, self-custody, and running nodes. The term “btc” frequently appeared in discussions about liquidity and flash crypto offerings. Related words: money, value, adoption, hedge, gold, store of value.

For Ethereum, investors discussed multi-wallet support and easy transfers using the term “eth.” The “Shanghai” upgrade, staking, and decreasing supply (deflation) boosted ETH price. Whale and large player movements strengthened market sentiment. Santiment also highlighted Ethereum’s central role in the crypto-finance ecosystem through flash tokens and investment opportunities. Related words: move, disinflation, trading, future, value.

MicroStrategy, Tether, and Stablecoin Updates

Dogecoin trended on social media with news of the first U.S. Dogecoin ETF and Thumzup’s purchase of 3,500 devices. Additionally, the first Dogecoin satellite launched via SpaceX Falcon 9 attracted attention. These developments increased community support and institutional interest, bringing DOGE to the forefront on social media. The price remains around $0.21 with modest growth expected. Related words: week, trading, Elon Musk, exchange, Falcon.

MicroStrategy shares drew investor attention with Bitcoin reserves and potential S&P 500 inclusion. Comparisons with ETFs were highlighted. Discussions focused on the company’s low-performing technical support level and strategic position. Santiment also emphasized MSTR’s volatility and relationship with institutional investors. Related words: Bitcoin, buying, holdings, MSTR, coin.

Tether increased its gold holdings to over $8.7 billion. Investments span gold mining, refining, trading, and royalties. The CEO referred to gold as “natural bitcoin.” Santiment also noted new token listings on platforms like BitMart, enhancing Tether’s market influence. Large USDT transfers from exchanges to private wallets may signal future price movements. Related words: BTC, gold, fund, trade.

BUSD faced pressure due to SEC unregistered securities claims and CEO statements. De-pegging and supply concerns negatively affected BUSD social media trends. Related words: supply, wrong, token, custody.

MultiversX became a discussion topic due to increased token supply and declining use cases. Some projects are migrating to alternative chains like SUI. Santiment highlighted xPortal and xMoney infrastructure initiatives generating community optimism, and potential buyback mechanisms could support the price.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.