As of September 9, 2025, Bitcoin and Ethereum ETFs have shown notable market activity. Additionally, high Call/Put ratios in Bitcoin options indicate investors’ bullish expectations, while Ethereum ETFs recorded $44.16 million in daily net inflows, reflecting active market participation. These data confirm strong institutional demand for both major crypto assets.

Bitcoin Options ETFs: Bullish Sentiment Strengthens

- Total Bitcoin Options Volume: Daily net open interest (Delta) in Bitcoin options reached $441.46 million, with total nominal open interest at $28.39 billion. Total traded value (nominal) was $2.63 billion, and Delta-based value stood at $685.35 million.

- Call/Put Ratios: The Call/Put ratio for OI (nominal) was 1.95 and (Delta) 3.17; for traded value-based options, ratios were 7.13 and 5.98, indicating investors’ focus on a bullish market trend.

Highlighted Funds:

- BlackRock’s IBIT fund stood out with $28.41 million in nominal open interest and $2.62 billion in traded nominal value.

- Grayscale’s GBTC fund recorded $373.03 million in open interest and $7.70 million in traded nominal value.

- Bitcoin ETF Flows: Mixed Fund Movements

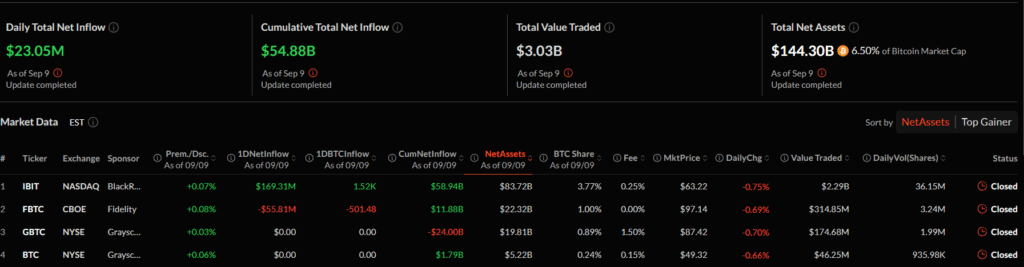

On September 9, Bitcoin ETFs saw $23.05 million in daily net inflows, bringing cumulative net inflows to $54.88 billion. Total trading volume reached $3.03 billion, and total net assets were $144.30 billion, equivalent to 6.50% of Bitcoin’s market cap.

Fund-specific movements:

- BlackRock (IBIT): $169.31 million daily net inflow; cumulative net inflow $58.94 billion.

- Fidelity (FBTC): -$55.81 million daily net outflow; cumulative net inflow $11.88 billion.

- Grayscale (GBTC): No daily movement; cumulative net outflow -$24.00 billion.

Ethereum ETF Flows: $44 Million Net Inflow

Daily Net Inflow: Ethereum ETFs recorded $44.16 million in net inflows on September 9, with cumulative net inflows reaching $12.67 billion.

Total Trading Volume and Net Assets: Total traded value was $1.28 billion, and total net assets amounted to $27.39 billion, representing 5.27% of Ethereum’s market cap.

ETF Fund Status:

- BlackRock ETHA leads with $15.78 billion in net assets.

- Fidelity FETH reached $3.16 billion in net assets.

- Grayscale ETHE recorded $4.53 billion in net assets with a cumulative net outflow of $4.60 billion.

Bitcoin and Ethereum ETF data clearly demonstrate sustained institutional interest in crypto markets. Meanwhile, strong Call/Put ratios in Bitcoin options and high net inflows into Ethereum ETFs suggest potential market volatility in the near term.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.