Velora is the most advanced intent-based trading protocol in DeFi, designed for high-performance trading and composable finance. Formerly known as ParaSwap, the project provides secure, optimized, and intelligent trading solutions for both retail and institutional traders.

By aggregating fragmented liquidity pools, Velora enables gasless, MEV-protected, and chain-abstracted cross-chain swaps. Building on the ParaSwap legacy, it has processed over 30M transactions and $120B in trading volume. Its mission is to expand DeFi adoption while maintaining a decentralized CEX-like user experience.

From ParaSwap to Velora: A Next-Gen Crosschain DeFi Protocol

ParaSwap has evolved into Velora, a fully intent-based crosschain DeFi trading protocol. Previously, ParaSwap focused on aggregating DEXs to deliver the fastest and most cost-efficient swaps. To date, it has:

- Facilitated over $100B in total trading volume ($12B in the last 90 days)

- Supported Ethereum, Base, Arbitrum, Polygon, Avalanche, BSC, Optimism, Gnosis, and Polygon zkEVM

- Integrated more than 100 liquidity sources

Team and Founders

Velora is developed by the ParaSwap team with extensive DeFi expertise. While most founders remain anonymous, the project’s creator is identified as Mounir Benchemled (@mounibec). The project was founded in 2019 in Paris, France.

Investors and Partnerships

- Velora raised ~$5.7M from early-stage VC funds, including Zyfi, BlackDragon, Cabrit Capital, Cumberland, Extra Watts, and Founderheads (28 total investors).

- Institutional partners include asset managers, lenders, banks, brokers/bots, market makers, and custodians. Velora’s ecosystem has 170+ protocol integrations across multiple chains.

- Highlighted partnerships: Binance Wallet (VLR TGE listing, Sep 16, 2025), Stargate Finance, Arbitrum DRIP, Chainza (agent rewards).

Vision and Purpose

Velora aims to eliminate fragmented liquidity and chain complexity with its intent-based architecture. User intents (cross-chain swaps, limit orders) are executed through the Delta engine and solver agents. The protocol ensures gasless, MEV-protected, and chain-abstracted trading.

Through agent competition, Velora guarantees best pricing, making DeFi accessible to both retail and institutional users.

How Velora Works

- Velora operates on the Portikus infrastructure and Delta engine using an agent-based model:

- Chain Abstraction: Instant cross-chain swaps via multi-bridge routing (ERC20/USDC with Stargate)

- Super Hooks: Merges swap and cross-chain actions into a single process with programmable modules

- Advanced Limit Orders: Auto-fill with price competition among solver agents

- Onchain RFQ: Real-time quotes from KYC-verified market makers

- Velora integrates 160+ protocols, aggregates liquidity across L1/L2 chains, and its smart contracts are independently audited.

Governance

Velora’s governance model empowers VLR token holders to shape the platform’s future. Users can stake tokens for rewards and participate in DAO decisions, maintaining decentralized ownership.

- VLR Token: Staking (sePS2 boosted pool) and DAO voting

- Revenue Sharing: Stakers earn 80% of protocol revenue

- Migration: 1:1 PSP -VLR migration into a unified staking/governance model

Roadmap

- TGE: Sep 16, 2025 – Binance Alpha listing & airdrop

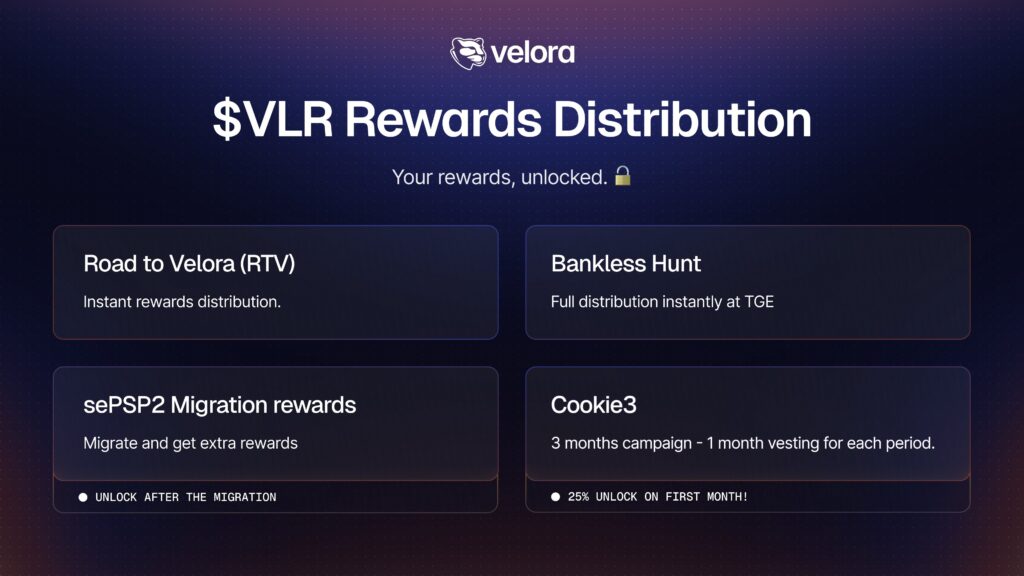

- Campaigns: Road to Velora, Bankless Hunt, Cookie3, Migration Rewards

- Future: Multi-bridge expansion, Superchain integrations, new chains (BNB Chain), solver optimization, institutional APIs, yield optimizer

VLR Token

VLR is Velora’s native token used for staking, governance, liquidity, and supporting intent-based execution in cross-chain transactions.

Use Cases

- Staking: Boosted pools and revenue rewards

- Governance: DAO voting & protocol upgrades

- Migration Incentives: Early adopters receive extra rewards

- Ecosystem Rewards: Referrals and agent competition bonuses

Token Information

- Name: VLR

- Type: ERC-20 (Base network)

- Total Supply: 2,000,000,000 VLR

- Max Supply: 2,000,000,000 VLR

- Circulating Supply (self-reported): 1,900,000,000 VLR

- Price: $0 pre-TGE (Sep 15, 2025); trading on Binance Alpha from Sep 16

Token Distribution

- 10% Migration & ecosystem incentives

- Staking & governance revenue share

- Team/partnership vesting: 1–3 months

- Migration campaigns: 2–3 months

Ecosystem

- 12 active chains: Ethereum, BSC, Avalanche, Polygon, Gnosis, Arbitrum, Optimism, Base, Sonic, Unichain

- 170+ protocol integrations

- 30M+ transactions, $120B+ volume

Key Features

- Crosschain swaps (multi-bridge)

- Limit Orders & Super Hooks

- Delta: MEV-protected, gasless, agent-based execution

- Onchain RFQ, Yield Optimizer, Advanced Charts

- Referral & Agent of the Month rewards

- Audited smart contracts; tracked via DeFiLlama fees/revenue

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.