Movements of major investors in the crypto market are always closely watched. Most recently, BitMine made a significant move by purchasing 264,378 Ethereum (ETH). Following this acquisition, the company’s total ETH holdings reached 2.42 million Ethereum. This amount corresponds to more than 2% of the total supply, making BitMine a critical player in the Ethereum ecosystem.

BitMine’s Ethereum Move

This large-scale acquisition by BitMine not only strengthened the company’s balance sheet but also sent an important signal to the market. Crypto investors often view the actions of major companies as an indicator of the market’s future direction.

An Ethereum purchase of this magnitude shows that institutional confidence in Ethereum remains high. Considering ETH’s role in DeFi, staking, and future corporate integrations, it can be said that BitMine has taken a strategic position.

The Companies Holding the Most Ethereum? First is BitMine

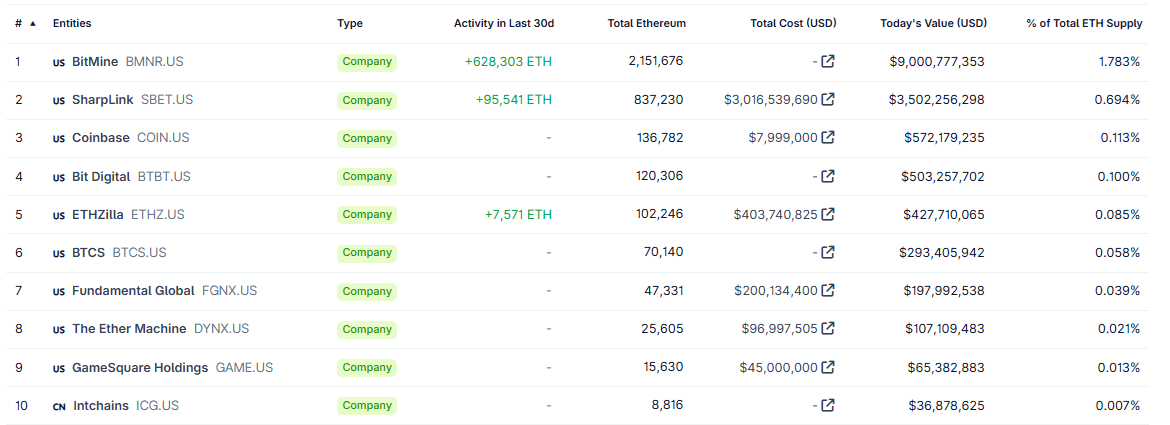

BitMine’s move has made it one of the largest institutional holders of Ethereum supply. Here are the top 10 companies holding the most ETH:

-

BitMine (USA) – 2,151,676 ETH (1.783% of Ethereum supply)

-

SharpLink (USA) – 837,230 ETH (0.694%)

-

Coinbase (USA) – 136,782 ETH (0.113%)

-

Bit Digital (USA) – 120,306 ETH (0.100%)

-

ETHZilla (USA) – 102,246 ETH (0.085%)

-

BTCS (USA) – 70,140 ETH (0.058%)

-

Fundamental Global (USA) – 47,331 ETH (0.039%)

-

The Ether Machine (USA) – 25,605 ETH (0.021%)

-

GameSquare Holdings (USA) – 15,630 ETH (0.013%)

-

Intchains (China) – 8,816 ETH (0.007%)

Institutional Power Balance in Ethereum

At the top of the list, BitMine has significantly outpaced its competitors with this latest acquisition. Compared to other leading players in the sector, such as SharpLink and Coinbase, BitMine’s Ethereum reserves have reached an impressive scale.

This picture demonstrates that institutional investors see Ethereum not only as a short-term investment tool but also as a long-term store of value and ecosystem investment.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.