Statis Euro (EURS) is a stablecoin solution that connects traditional banking with blockchain ecosystems. EURS, designed as an on-chain representation of the euro, combines the stability of traditional finance with the transparency, immutability, and transactional efficiency of blockchain. Supported by liquidity assurance mechanisms, this token represents the euro in the digital asset world. In this article, we will explore what EURS is, how it works, and the opportunities it offers in detail.

What is Statis Euro (EURS)?

Statis Euro (EURS), as part of the STASIS ecosystem, implements frameworks that merge the benefits of digital assets with the best features of traditional finance. The EURS token serves as the on-chain reflection of the euro and is backed by liquidity assurance mechanisms. Users can generate EURS using securities instead of currencies and vice versa. This allows users to obtain EURS by selling securities to STASIS’s liquidity-providing partners, bypassing bank-level transactions.

STASIS brings a liquidity cushion to markets; EURS’s market depth is significantly broader than that of standard crypto assets. While cryptocurrencies are limited by their circulating supply and free float, STASIS can tokenize any amount of capital. The platform utilizes the Ethereum blockchain, recognized by the professional community as the most reliable network, with the cost of compromising a transaction estimated at billions of euros.

STASIS is a Europe-based fintech company offering Web3 tools for institutional and retail clients. EURS is robust internet money for the EU and beyond, recognized as the most transparent euro-based stablecoin. Backed 1:1 by liquid financial instruments, it reinforces investor trust with four verification streams.

Legal Framework and Compliance: STASIS operates under EU and Swiss legal frameworks with a 6-year successful track record. Strict regulatory compliance since inception and treasury management tools enable service in 175 countries, fostering seamless connections between customers and businesses to promote financial freedom and crypto inclusion.

Blockchain Interoperability: STASIS infrastructure supports fiat on-/off-ramping on six popular blockchains—Ethereum, Polygon, XDC, XRPL, Algorand, and Stellar—bridging assets to enhance financial efficiency, secure the best rates for targeted crypto, and leverage arbitrage opportunities across the Web3 sector.

Purpose of Statis Euro (EURS)

STASIS offers the euro stablecoin EURS as an alternative to USD stablecoins in the digital asset space. Founded in 2018, the STASIS Foundation, based in the Isle of Man, employs a collateralized debt obligation (CDO) system to back stablecoins with fiat reserves. It ensures stability through transparent and auditable processes, used for online payments, remittances, and trading on crypto exchanges.

The name STASIS, derived from physics, refers to balance or stasis, maintaining the value of tokenized assets amidst shifting regulatory and economic environments. Its business model includes fees (stablecoin buying/selling), custom solutions (for financial institutions), white-label solutions (technology licensing), and reserve management (yield from custodians). These revenues support platform development and maintenance.

Reserve Management: Managed by STASIS Malta, reserves are held in 100% liquid euro balances or cash during positive interest rate periods. The transparency page provides reserve details and daily account statements.

Headquarters: STASIS is headquartered in Malta, a small Mediterranean island nation known as a blockchain-friendly jurisdiction, attracting crypto companies. Its EU location facilitates access to the European market. The team, composed of European employees spread globally, reflects Web3’s decentralized spirit and European values.

How Statis Euro (EURS) Works

EURS is the digital equivalent of the euro, backed 1:1 by euro reserves. It operates on five blockchains—Ethereum, Polygon, Algorand, XRPL, XDC—and two bridges, Arbitrum and Gnosis Chain. Circulating EURS is viewable on-chain via the official website or external sources, with four transparency levels: daily statements, quarterly verifications, annual audits, and on-demand verifications.

Obtaining EURS: Available through STASIS’s proprietary on-ramp solution or secondary markets (CEX/DEX). Sales occur on popular crypto exchanges.

EURS Usage:

- Store of value (pegged to the euro, an alternative to volatile cryptocurrencies).

- Payments and remittances (fast, low-cost cross-border transactions).

- Hedging against market volatility (euro-pegged stability).

- Trading on crypto exchanges (paired with Bitcoin, Ethereum, etc.).

- DeFi (staking, liquidity provision, lending, farming—crypto analogs of traditional deposits).

EURS Listings: Listed on dozens of CEX/DEX platforms, including CryptoMarket, HitBTC, Changelly, MtPelerin, Stablehouse, Curve, AAVE, CEX.IO, Geco.One, and others. The updated list is available on the website’s “Network” section and social media.

CBDC (Digital Euro) Impact: A digital euro could compete with EURS (ECB-backed, potentially more trusted). However, it may increase demand for digital assets, familiarizing people with euro-backed digital currencies. Private stablecoins like EURS may gain trust compared to CBDC’s stricter regulations.

Supported Wallets: MetaMask, Exodus, Monolith, Argent, SafePal, Coinomi, and the native STASIS Wallet.

STASIS Stablecoin Wallet: While developing EURS, STASIS sought a simple, user-friendly wallet for digital asset transactions. Unable to find one meeting their standards, they built their own non-custodial STASIS Wallet.

Statis Euro (EURS) Use Cases

For Web2 & Web3 Companies: EURS is a neutral, transparent financial instrument with no conflict of interest with businesses, banks, or exchanges; it undergoes daily audits since inception and is 100% backed by liquid instruments.

Use Cases:

- DeFi Yield: Holding company funds in EURS instead of euros is more profitable, offering higher returns than traditional banking and instant liquidity for seamless transactions.

- Cross-Border Crypto Settlement: Global reach without intermediaries, instant settlement, and flexibility to convert EURS into any currency.

- Crypto Arbitrage: Leverage trading and investment opportunities with EURS on CEX/DEX, ensuring flexibility and profitability.

- Crypto Payments and Acquiring: Instant customer payments without reliance on bank acquiring, popular in online, crypto, NFT marketplaces, travel agencies, and card providers.

- Stablecoin-as-a-Service: White-label stablecoin solutions for fiat- or commodity-pegged branded digital currencies with extensive capabilities.

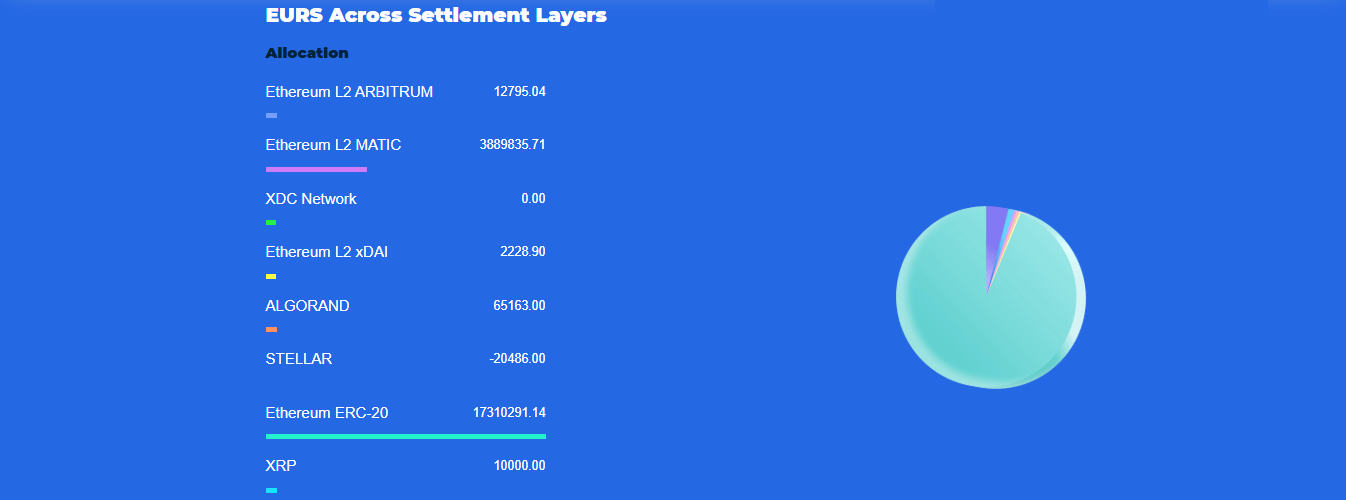

Statis Euro (EURS) Tokenomics

EURS is 100% backed by euro reserves:

- Circulating EURS Amount: 17,364,968 EURS.

- Distribution Across Settlement Layers:

- Ethereum L2 Arbitrum: 12,795.04

- Ethereum L2 Matic: 3,889,835.71

- XDC Network: 0.00

- Ethereum L2 xDAI: 2,228.90

- Algorand: 65,163.00

- Stellar: -20,486.00

- Ethereum ERC-20: 17,310,291.14

- XRP: 10,000.00

STASIS ensures EURS’s flexibility to avoid inefficiencies of single-layer solutions, unlocking the full potential of distributed ledger technologies.

Statis Euro (EURS) Partners

EURS partners include YouHodler, NexPay, Wirex, Propine, Klarpay, SCB, and HexTrust.

Statis Euro (EURS) Team

STASIS, a European fintech company founded in 2018, is managed by the STASIS Foundation based in the Isle of Man. The team, composed of European employees spread globally, embodies the Web3 spirit. Headquartered in Malta, a blockchain-friendly jurisdiction, it leverages its EU location to serve the European market.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.