Ethereum (ETH), the second-largest asset in the crypto market, continues to capture investors’ attention with its short-term price movements. As of today, although ETH is trading in the $4,000–$4,010 range, it has dropped to as low as $3,966, falling below the critical $4,000 support level for the first time in 48 days. This decline clearly highlights the short-term volatility and the increasing pressure in the markets.

Liquidation Waves in Ethereum Over the Last 24 Hours

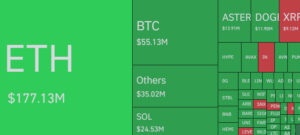

The rapid price movements in the crypto market have triggered significant liquidations in the derivatives market. Ethereum investors faced approximately $177 million worth of position liquidations within the past 24 hours.

This situation has also brought increased selling pressure and investor fear in both the spot and futures markets. Leveraged positions, in particular, are highly sensitive to price fluctuations, and such liquidations often create a chain reaction, leading to even greater volatility.

Market Factors and Short-Term Pressures

There are several short- and medium-term factors behind Ethereum’s recent decline:

- Global financial uncertainties: The U.S. Federal Reserve’s cautious stance on interest rate policy is affecting capital flows into risk assets.

- Leveraged positions: Many investors had entered the market with high leverage; the price drop triggered forced liquidations, amplifying market pressure.

- Retail investor trends: Some investors shifted their focus toward altcoin projects promising short-term gains, temporarily reducing demand for Ethereum.

- Ethereum ETF outflows: Today marks the third consecutive day of net outflows from U.S. spot Ethereum ETFs, totaling $79.36 million. This indicates a short-term decline in institutional investor confidence and adds further selling pressure to the market.

Blockchain data shows that large ETH holders continue accumulating assets despite short-term price fluctuations. This reflects long-term investors’ confidence in Ethereum’s fundamental value and suggests that short-term declines may not be permanent.

Technical Outlook and Support Levels

- The current price is hovering around $4,000–$4,010, with an intraday low of $3,966.

- Key support levels stand at $4,000, $3,800, and $3,600.

- If the price can quickly reclaim the $4,400–$4,500 range, bullish momentum may once again shift in favor of buyers.

- Market sentiment remains cautious, with the Fear and Greed Index reflecting investor concerns. Meanwhile, blockchain data shows that large investors continue withdrawing Ethereum from exchanges, signaling sustained long-term confidence and accumulation.

Short-term indicators suggest that market pressure persists. However, staying above the 200-day moving average supports Ethereum’s long-term bullish outlook. Continued outflows of ETH from exchanges by major holders are being interpreted as a positive sign for potential future price increases.

The Future of Ethereum

The Ethereum ecosystem continues to expand through DeFi and Web3 applications. Ongoing improvements in network scalability and efficiency demonstrate strong long-term fundamentals. While the recent liquidations and short-term volatility over the past 24 hours are notable for investors, Ethereum’s market leadership and institutional interest continue to reinforce its long-term investment narrative.

In the coming days, whether ETH manages to hold the $4,000 support level and how investors interpret this critical zone will be key in determining market direction. With volatility remaining high, traders are carefully managing their strategies in both the spot and derivatives markets.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.