Nine of Europe’s top banks have announced plans to launch a euro-denominated stablecoin. The consortium, which includes ING, Banca Sella, KBC, Danske Bank, and UniCredit, aims to leverage blockchain technology to reduce the cost of euro transfers.

This initiative could accelerate institutional crypto adoption in Europe and expand the use of euro-based digital assets. At the same time, banks intend to offer customers faster, safer, and lower-cost payment options.

Consortium and Licensing Process

The consortium of European banks is applying for a license as an e-money institution based in the Netherlands and supervised by the Dutch Central Bank.

This process will ensure the stablecoin operates within a legal framework and fully complies with the EU’s Markets in Crypto-Assets (MiCA) regulations. Consortium officials say this step will increase trust in financial transactions across Europe and strengthen the digital asset ecosystem.

“The launch of a euro-denominated stablecoin is an important step to reduce transaction costs and increase the use of digital assets among institutional investors,” said a consortium representative.

Euro-Backed Alternative to USD Coins

One of the main goals of the stablecoin is to provide Europe with a euro-backed alternative to U.S. dollar coins, strengthening the region’s strategic independence in payments. Europe’s cross-border payments market is substantial, expected to exceed $250 billion in 2025 and reach $320 billion by 2030.

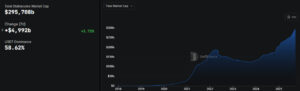

While stablecoins are rapidly growing, with a market size of $290 billion this year, euro-backed coins currently make up less than 1%. This highlights the clear gap the consortium aims to fill. Launching a euro-based stablecoin could provide strategic advantages for the European economy and enhance digital financial sovereignty.

Stablecoin Launch and Institutional Adoption

The stablecoin launch will be carried out in accordance with the EU MiCA framework, which comes into effect from December 2024. Euro-based stablecoin transactions are designed to meet the growing demand among institutional investors seeking an alternative to USD-pegged assets. In particular, European financial institutions plan to integrate digital assets into traditional banking products, offering more flexible and faster financial solutions.

Banca Sella has partnered with Fireblocks to launch an internal pilot project testing custody services for stablecoins. These initiatives demonstrate that banks are committed to developing innovative financial products and increasing engagement with digital assets.

Future Expectations

The launch of a euro-denominated stablecoin is expected to accelerate the adoption of blockchain-based financial solutions in Europe. Banks’ investment in digital assets may drive higher institutional demand and reduce costs in financial transactions.

In the coming years, euro-backed stablecoins could become a widely used payment method, especially for cross-border and corporate transactions. These developments signal a faster digital transformation in the European banking sector and broader adoption of blockchain-based innovations.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.