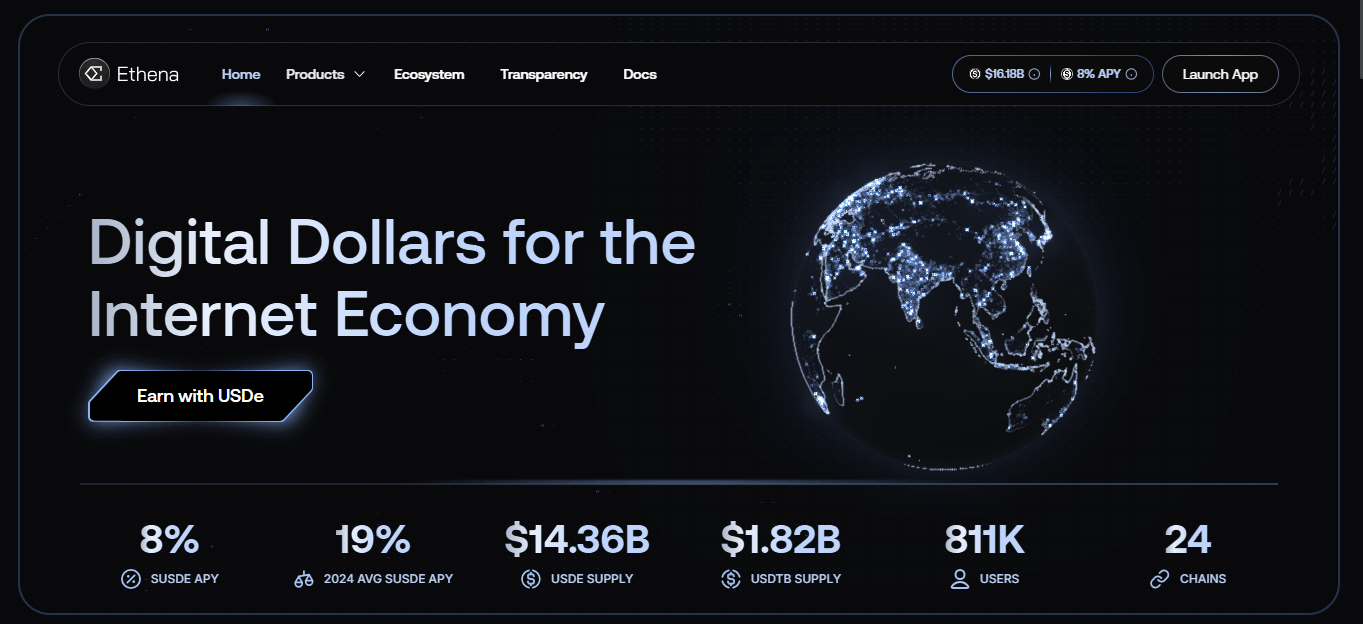

Ethena (ENA) is a synthetic dollar protocol built on Ethereum. It offers a crypto-native money solution, USDe, alongside a globally accessible dollar savings asset, sUSDe. It manages delta-hedging of Bitcoin, Ethereum, and other spot assets using perpetual and deliverable futures contracts while holding liquid stablecoins (USDC, USDT). USDe is fully backed (subject to potential loss of backing as discussed in the Risks section) and freely composable across CeFi and DeFi. In this article, we will explore what Ethena is, how it works, and the opportunities it provides in detail.

What is Ethena (ENA)?

Ethena provides a crypto-native, scalable money solution with its synthetic dollar, USDe, backed by spot assets through delta-hedging with perpetual futures contracts and liquid stablecoins (USDC, USDT). USDe maintains a relatively stable value with reference to spot crypto assets and futures positions; liquid stablecoins enhance delta-hedging efficiency and offer protection in bear markets. sUSDe is the reward-accruing version of USDe, sharing protocol revenue through staking.

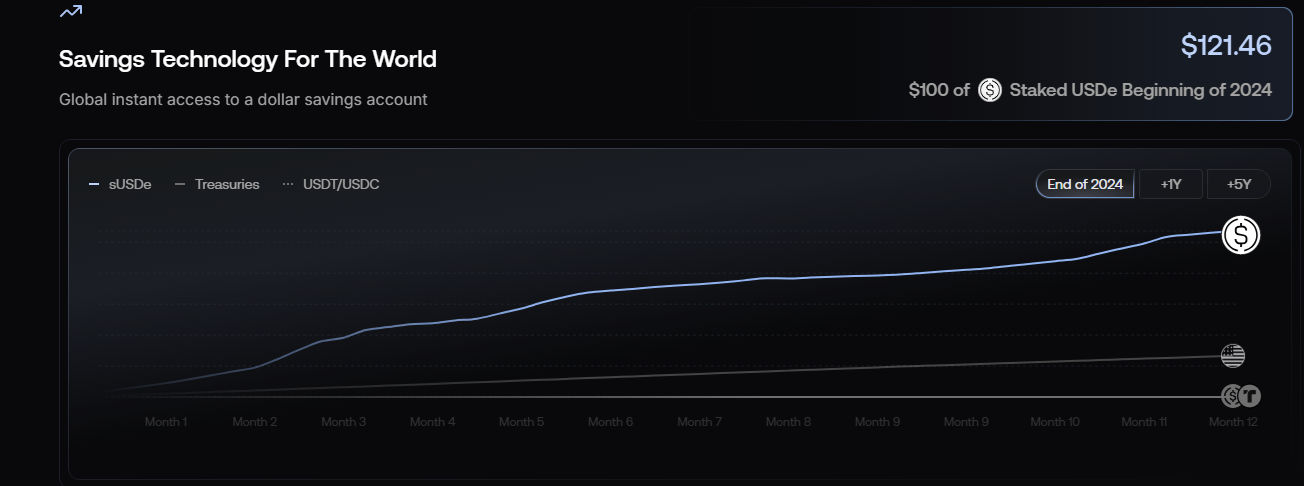

In 2024, BTC funding rates averaged 11%, ETH 12.6%; sUSDe APY averaged 19%. Ethena offers an alternative to USD stablecoins in the stablecoin market; in Q2 2024, stablecoins settled $8.5 trillion on-chain. Stablecoins account for 90% of spot/futures trading and over 70% of on-chain settlements, making them one of the largest crypto assets.

Centralized stablecoins (USDC, USDT) carry traditional finance risks; overcollateralized stablecoins are tied to Ethereum leverage demand; algorithmic stablecoins show mechanism fragility. Ethena creates a scalable dollar via derivatives, offering a $20 billion+ opportunity across DeFi, CeFi, and TradFi.

Ethena (ENA)’s Purpose

Ethena captures crypto’s largest opportunity with a crypto-native synthetic dollar and the first “internet bond,” inspired by Arthur Hayes’ “Dust on Crust” vision in March 2023. Stablecoins are crypto’s core instrument, with over 100 million users, proven product-market fit, the largest addressable market, and revenue potential. USDe reduces reliance on traditional banking rails, offering an alternative to fiat-backed centralized stablecoins.

Ethena integrates stablecoins across DeFi, CeFi, and TradFi, providing a reward-bearing dollar with sUSDe. Its network grows with members like Ethereal (perp/spot exchange), Strata (perp risk tranching), Terminal (spot exchange), Echelon (universal lending), and Derive (options/structured products); sENA accrues ecosystem token airdrops in a BNB-like model.

How Ethena (ENA) Works

USDe is backed by spot assets with on-chain custody and centralized liquidity venues, using delta-neutral hedging to manage spot asset risk with perpetual futures contracts. Example: A whitelisted user provides ~$100 USDT and receives ~100 USDe; the protocol opens a short perpetual position of the same notional value. Backing assets are transferred to “Off Exchange Settlement” solutions, flowing between custody and exchange only for funding or realized P&L.

Delta Neutrality: Backing asset price risk is hedged with a short position; changes in backing asset value are offset 1:1 by the hedge. USDe requires 1:1 collateralization.

Off Exchange Custody: Backing assets are held in institutional-grade solutions, minimizing exchange risk.

Protocol Rewards: sUSDe is obtained by staking USDe, earning from three sources: perpetual futures funding, system usage, and future integrations.

Staking USDe: Stake/unstake via UI; the transaction is signed, submitted to the blockchain, and upon confirmation, sUSDe/USDe is atomically swapped. Holding sUSDe is sufficient; rewards accrue in the staking contract, increasing sUSDe value. Unstaking has a 7-day cooldown; early sUSDe/USDe ratio is 1:1, increasing with rewards. Token vault mechanism (similar to Rocketpool’s rETH); staked amount may grow.

Staking ENA: Stake/unstake via UI; the transaction is signed, submitted to the blockchain, and upon confirmation, sENA/ENA is atomically swapped. Holding sENA is sufficient; rewards accrue in the staking contract, increasing sENA value. Unstaking has a 7-day cooldown + sENA unstake cooldown. In late 2024/early 2025, unclaimed Season 1 airdrop ENA was distributed; as of September 2025, no distributions are active or announced.

Position Locking: Lock/unlock via UI; the transaction is signed, submitted to the blockchain, and upon confirmation, the cooldown begins. After the cooldown, a “Withdraw” transaction is signed and confirmed to receive tokens. USDe has a 7-day cooldown, sENA has a 7-day cooldown + unstake cooldown, LP tokens have a 21-day cooldown (some LP tokens immediate).

ENA Governance: ENA governs the Ethena protocol and critical decisions; biannual Risk Committee elections and future additional committees. ENA holders delegate daily decisions to expert stakeholders; Snapshot forum and voting page. Risk Committee: Kairos Research, Llama Risk, Ethena Labs Research, Steakhouse Financial, Blockworks Advisory, Credio (Untangled). sENA holders vote on ENA tokenomics and ENA-specific proposals. The community voted on Ethereal, SOL backing, and Reserve Fund RWA allocations; BlackRock BUIDL received the highest allocation.

sENA Rewards: sENA is the liquid receipt token for locking ENA, composable in DeFi. It receives unclaimed Season 2 airdrop ENA, rewarding users aligned with long-term growth. It earns rewards from Ethereal and Ethena Network members; Ethereal commits 15% of future token supply to sENA. Rewards page for details.

Restaked ENA: Generalized restaking pools with Symbiotic; sENA provides economic security for USDe cross-chain transfers via LayerZero DVN messaging. First layer for Ethena Network and on-chain financial applications.

Ethena (ENA) Tokenomics

ENA is the Ethena protocol governance token. Total supply: 15 billion.

Allocation:

-

30% Core Contributors (1-year 25% cliff, 3-year linear monthly vesting; no unlock before cliff),

-

25% Investors (1-year 25% cliff, 3-year linear monthly vesting; no unlock before cliff),

-

25% Foundation (expanding USDe reach, development, risk assessments, audits),

-

20% Ecosystem Development and Airdrops (10% Season 1/2 airdrop, remainder for cross-chain initiatives, exchange partnerships; DAO multisig).

Core Contributors and Investors unlock began at ENA TGE on March 5, 2024.

Ethena (ENA) Investors

Ethena raised $136.5 million (valuation $300 million). Tier 1: Dragonfly, Polychain Capital, Pantera Capital, YZi Labs, Galaxy, Delphi Ventures. Tier 2: OKX Ventures, GSR, Hashed, CMT Digital, Mirana Ventures, Wintermute, Nascent, MEXC Ventures. Tier 3: Maelstrom, HTX Ventures, Foresight Ventures, Castle Island Ventures, Brevan Howard Digital, Strobe Ventures, Franklin Templeton Investments, Faction, Gemini, No Limit Holdings, Avon Ventures, Deribit. Tier 4: F-Prime Capital. Others: Anthony Sassano, Cobie, Nic Carter.

Ethena (ENA) Team

Ethena team: Guy Young (Founder), Zach Rosenberg (General Counsel), Conor Ryder (Head of Research), Elliot Parker (Head of PM), Brian Grosso (Head of Engineering), Seraphim Czecker (Head of Growth).

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.