In the decentralized finance (DeFi) space, perpetual futures (perps) trading has become a powerful tool for crypto traders. Lighter is a fully decentralized order book exchange running on the Arbitrum One Layer 2 network. By offering permissionless trading with zero slippage and built-in protection against MEV (Miner Extractable Value), it addresses common issues seen in traditional DEXs—such as latency, high gas fees, and lack of transparency. Leveraging cryptographic technologies, Lighter delivers both fairness and security, aiming to provide an alternative experience to centralized exchanges. In this article, we’ll dive into what Lighter is, how it works, and how to use it step by step.

What is Lighter?

Lighter is a decentralized perpetual derivatives trading platform built on Arbitrum One. Currently in its testnet phase, it aims to reshape how perps trading is done in DeFi by combining the speed and user-friendly features of centralized exchanges with the transparency and trustlessness of decentralization. Using innovations like SNARK-based verifiable matching and proof-of-liquidation, Lighter ensures fairness and reliability at every stage of trading.

Key Features of Lighter

Lighter differentiates itself from other DeFi platforms with several unique mechanisms:

-

Verifiable Matching:

Its matching engine operates on the Price-Time Priority rule, ensuring that orders are matched fairly by price and then by time. With the use of zero-knowledge proofs (SNARKs), traders can cryptographically verify that no manipulation occurs. -

Transparent Liquidation:

Instead of relying on opaque centralized oracles, Lighter verifies every liquidation through Liquidation Proofs, eliminating risks of favoritism or fraudulent activity—especially during high volatility. -

Anti-Self-Trading Mechanism:

The platform prevents wash trading and artificial volume creation, keeping trading activity authentic and manipulation-free. -

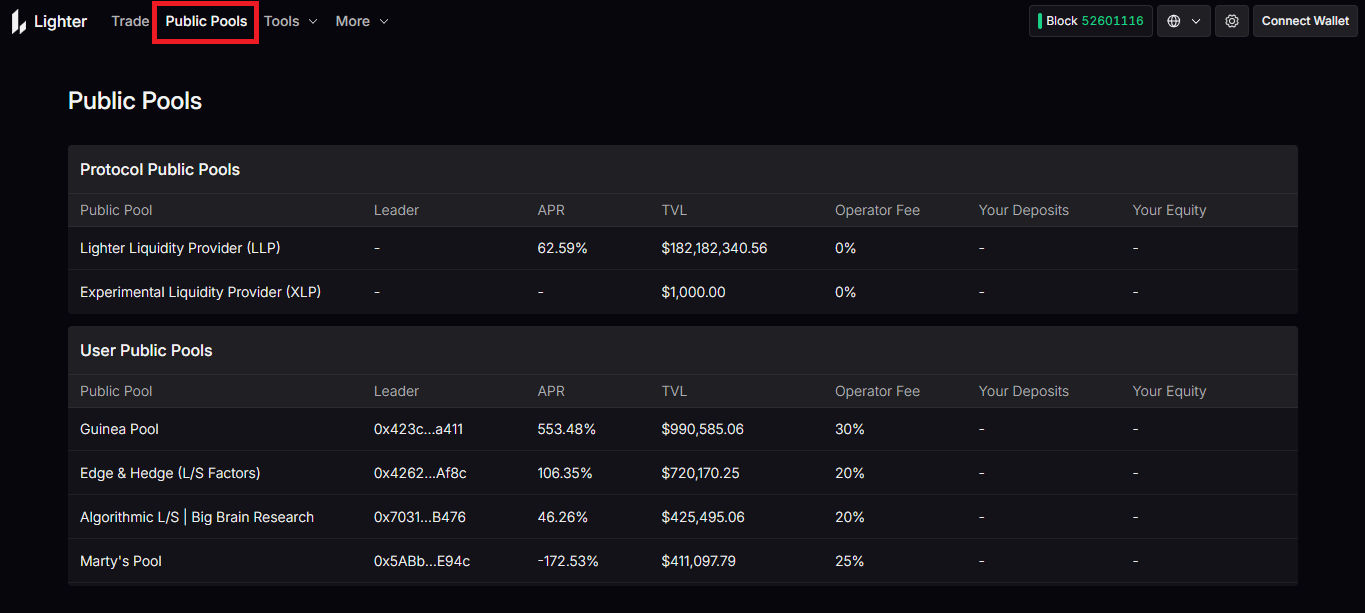

Public Pools:

Retail investors can allocate funds into pools managed by professional traders (Operators). Profits are distributed proportionally to contributions, creating a community-driven revenue-sharing model. -

Points Program:

Testnet participants can earn points by trading, reporting bugs, or providing feedback. These points will be redeemable for rewards after the mainnet launch.

Lighter’s Modular Ecosystem

Lighter’s infrastructure ensures efficiency and safety with the following components:

-

Matching Engine: Handles transparent order execution.

-

Smart Contracts: Manage margin, PnL, liquidations, and order flow.

-

Margin System: Divided into Initial Margin (IMR), Maintenance Margin (MMR), and Close-out Margin (CMR).

-

Insurance Fund: Covers negative balances.

-

Public Pools: Professionally managed community liquidity.

-

Sub-Accounts & API Keys: Support multi-strategy trading and automated bots.

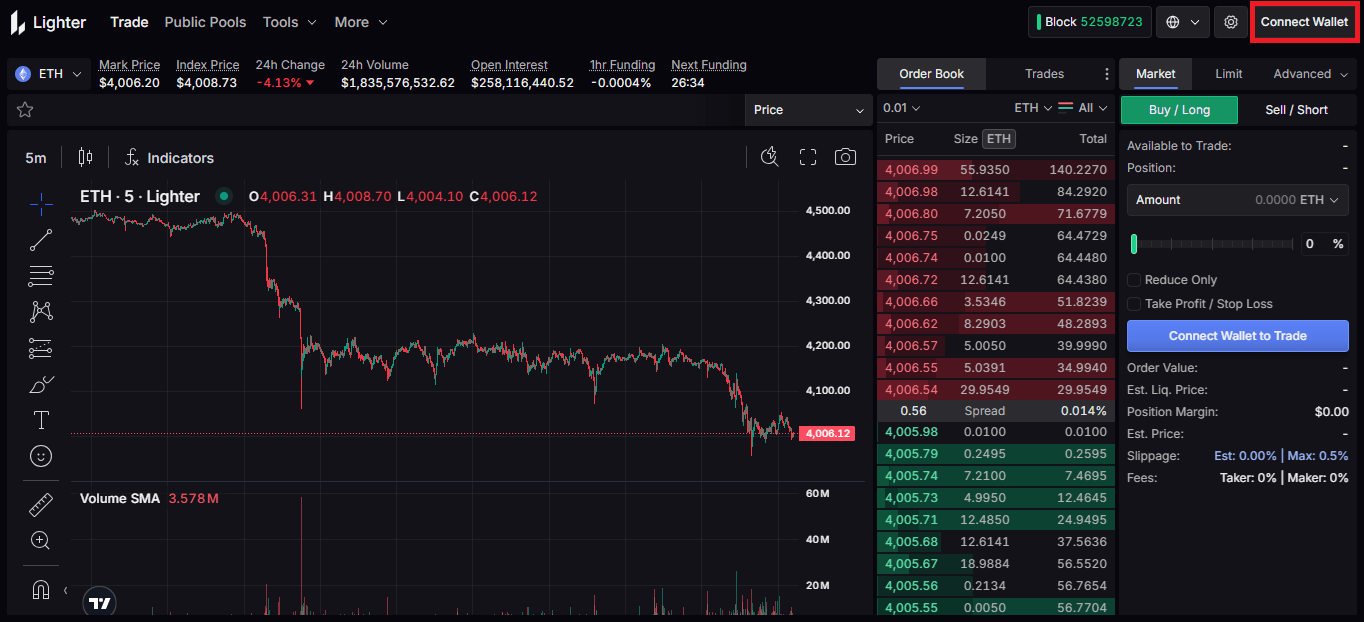

How Lighter Works

At its core, Lighter runs on an order book system. Market makers profit from bid-ask spreads, while takers execute trades with zero slippage. Thanks to Arbitrum Layer 2, traders benefit from lower costs and faster transactions compared to Ethereum mainnet.

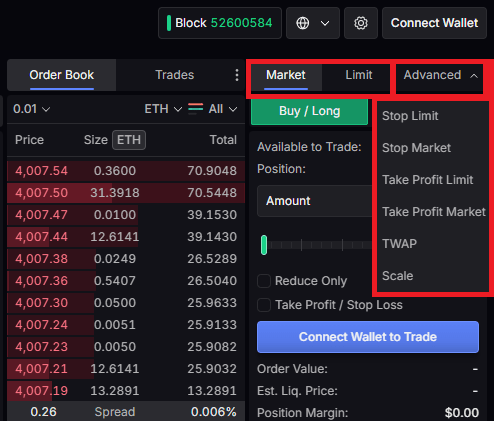

Order Placement

-

Traders can submit Market, Limit, Stop-loss, Take-profit, or TWAP orders.

-

Options include Reduce-only, Post-only, and Time-in-force (e.g., GTC, IOC).

-

The matching engine executes based on price-time priority, with SNARK verification for fairness.

Mark Price and Valuation

Position value is determined by:

-

Index Price (spot market reference),

-

Funding Premium,

-

Impact Price (liquidity depth from the order book).

The Mark Price is used for PnL, margin requirements, and liquidation triggers.

Margin & Liquidation Management

-

IMR: Minimum margin to open new positions.

-

MMR: Triggers partial liquidation if breached.

-

CMR: If equity falls below this level, full liquidation occurs. Remaining balances go to the Insurance Fund, with Auto-Deleveraging (ADL) kicking in if needed.

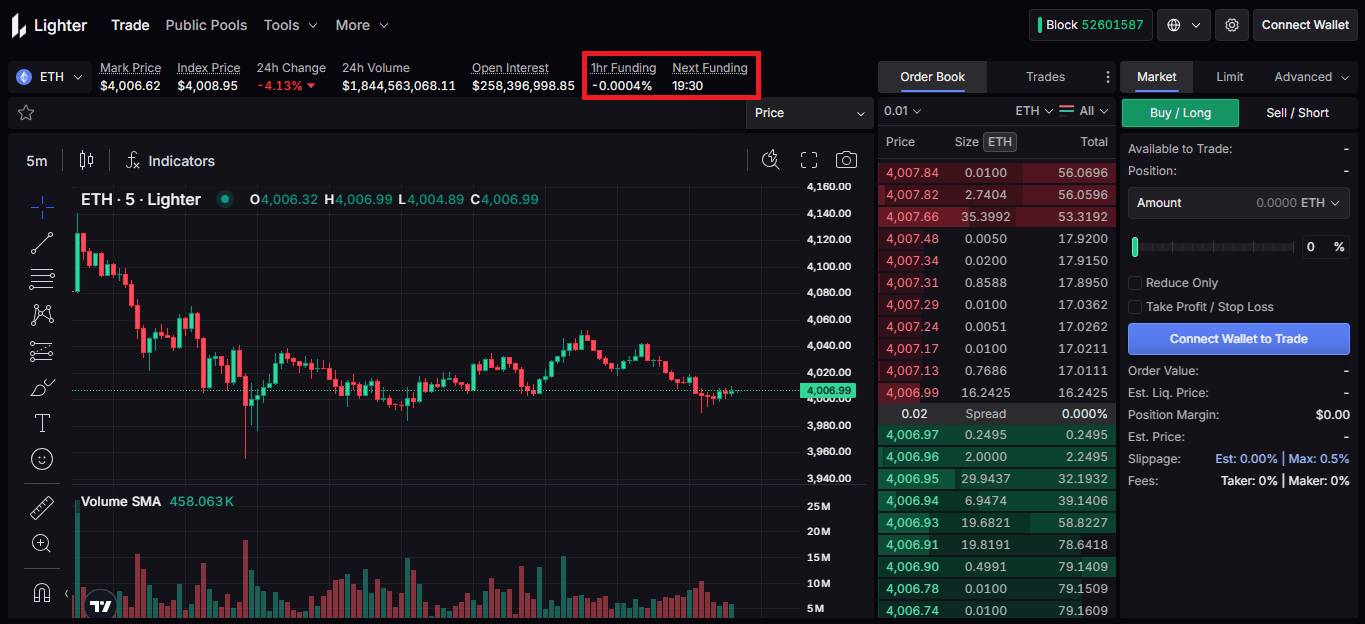

Funding Mechanism

Funding payments are exchanged hourly based on the difference between Mark and Index prices:

-

Positive rate → Longs pay Shorts.

-

Negative rate → Shorts pay Longs.

This balances the market and discourages extreme speculation.

PnL Calculation

-

Unrealized PnL = (Mark Price – Entry Price) × Position Size

-

Account Value = Margin + Unrealized PnL

-

Funding fees directly impact realized PnL.

Account & Pool Management

-

Sub-Accounts allow multiple strategies under one wallet.

-

API Keys enable automated trading setups.

-

Public Pools let users back professional operators and share profits proportionally.

How to Use Lighter (Step by Step)

To try Lighter during its testnet phase, you’ll need an Arbitrum One-compatible wallet (e.g., MetaMask). Here’s the process:

- Link your Arbitrum wallet to the Lighter dApp.

2.Set Up Accounts

- Create your trading account and optionally add Sub-Accounts for different strategies.

- Generate API Keys if you plan on running automated bots.

3.Place Orders

- Choose your order type (Market, Limit, Stop-loss, etc.).

- Configure advanced options (Reduce-only, Post-only, Time-in-force).

- Confirm, and the matching engine executes the trade with SNARK verification.

Manage Margin & Positions

- Monitor IMR, MMR, and CMR levels.

- Keep enough collateral to avoid liquidation risks.

- Track Mark Price to stay ahead of potential margin calls.

Join Public Pools

- Deposit funds into pools managed by Operators.

- Earn profits based on your contribution share.

Earn Points

- Trade, report bugs, and share feedback to accumulate points.

- Redeem them for rewards once the mainnet goes live.

Track Funding & PnL

- Check hourly funding payments.

- Monitor both realized and unrealized PnL in the dApp dashboard.

Official Links

Also, click to read our article titled “Top 5 Perp DEXs: 2025 Updated List!”

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.