Ripple (XRP) is the name of the company and is an open-source protocol designed to make transactions fast and cheap. Traditional banking systems often suffer from slow, costly, and opaque cross-border transactions. While blockchain technology offers a faster and more reliable solution, decentralized networks like Bitcoin and Ethereum don’t align with banks’ need for control. Ripple addresses this gap by leveraging blockchain to streamline banking processes, reduce costs, and maintain institutional oversight. This article explores what Ripple is, how it operates, and the opportunities it provides.

What is Ripple (XRP)?

Ripple is a for-profit technology company that harnesses blockchain to enable financial institutions to conduct cross-border transactions quickly, affordably, and securely. It develops products like RippleNet, XRP Ledger, and the Interledger Protocol (ILP) to create a global payment network. The native cryptocurrency, XRP, serves as a settlement layer, facilitating efficient transactions within the network.

XRP acts as a bridge currency, enabling rapid and cost-effective exchanges between different currencies. Its smallest unit, a “drop,” equals 0.000001 XRP. XRP has a capped supply of 100 billion tokens, all pre-mined at inception, with a deflationary mechanism where a small amount of XRP is burned per transaction, gradually reducing the supply. Approximately 45 billion XRP are in circulation, with the remainder held in escrow by Ripple Labs. Up to 1 billion XRP can be released monthly for development and sales, with unused portions returned to escrow.

Purpose of Ripple (XRP)

Ripple tackles the inefficiencies of cross-border payments in traditional banking, where transactions via the SWIFT network involve multiple intermediary banks, leading to delays of days or weeks due to time zones, system differences, and currency exchanges. Each intermediary adds fees, increasing costs. Ripple offers a blockchain-based global ledger as an alternative, processing up to 1,500 transactions per second (TPS) and settling in 3-5 seconds—a vast improvement over SWIFT’s lengthy timelines.

By complying with anti-money laundering (AML) regulations and preventing fraud, Ripple gains the trust of financial institutions. Major players like American Express and IndusInd Bank use Ripple for international transactions. RippleNet unified its original offerings—xCurrent (interbank communication), xRapid (now On-Demand Liquidity, using XRP for liquidity), and xVia (API access)—in 2019, maintaining core functionalities under a single brand.

How Does Ripple (XRP) Work?

Unlike Bitcoin’s Proof of Work (PoW) or Ethereum’s Proof of Stake (PoS), Ripple employs the Unique Node Lists (UNL) consensus mechanism. In UNL, nodes only consider votes from their trusted node list, enabling faster consensus with fewer nodes compared to Bitcoin or Ethereum. Transactions are validated by comparing them to the latest XRP Ledger, requiring majority approval from validators.

-

RippleNet: A decentralized payment platform connecting financial institutions and payment providers, using XRP as a bridge currency to accelerate and reduce the cost of cross-border transactions. Its consensus algorithm ensures multi-node validation.

-

XRP Ledger: An open-source distributed ledger recording all transactions in real time, maintaining account balances and transaction history. It supports smart contracts and decentralized applications (dApps).

-

Smart Contracts and dApps: Ripple enables financial institutions to offer services like escrow and digital wallets.

-

Transaction Fees: Small amounts of XRP are burned per transaction to prevent spam, reducing the total supply without being collected.

Ripple (XRP) Use Cases

Ripple is designed to transform cross-border financial transactions:

-

Cross-Border Payments: XRP facilitates fast, low-cost transfers as a bridge currency.

-

Remittances: Individuals can send money internationally to family or friends efficiently.

-

E-commerce: Online merchants can accept XRP for secure, rapid payments.

-

Liquidity Management: Financial institutions reduce liquidity costs for cross-border payments using XRP.

-

Smart Contracts and dApps: Supports innovative financial services.

Usage Steps:

-

Acquire XRP: Create an account on a crypto exchange, deposit funds, and purchase XRP.

-

Store XRP: Transfer XRP to a secure digital wallet.

-

Send/Receive XRP: Send XRP by entering the recipient’s wallet address or share your address to receive XRP.

-

Payments/Transfers: Use XRP for merchant payments or peer-to-peer transfers.

Advantages of Ripple (XRP)

-

Speed: Transactions settle in 3-5 seconds, far faster than Bitcoin’s minutes to hours.

-

Scalability: Handles 1,500 TPS, comparable to VISA’s 1,700 TPS, surpassing Ethereum’s 30 TPS.

-

Low Cost: Transaction fees are minimal compared to traditional banking.

-

Security: Robust cryptographic protocols prevent double-spending and fraud.

-

Flexibility: Fewer nodes allow easier transaction corrections, beneficial for banks addressing errors or fraud.

-

Open Source: Developers can review and contribute to the codebase.

Tokenomics of Ripple (XRP)

XRP’s total supply is capped at 100 billion, all pre-mined. Around 45 billion XRP are in circulation, with the rest in Ripple Labs’ escrow accounts. Up to 1 billion XRP can be released monthly, with unused portions returned to escrow. Transaction fees burn small amounts of XRP, reducing supply. XRP serves as a bridge currency for currency exchanges and spam prevention.

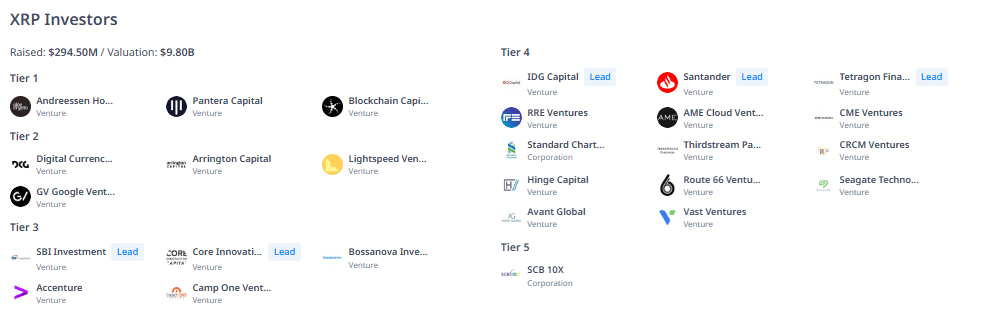

Investors in Ripple (XRP)

Ripple raised $294.5 million with a $9.8 billion valuation. Investors include:

- Tier 1: Andreessen Horowitz (a16z crypto), Pantera Capital, Blockchain Capital.

- Tier 2: Digital Currency Group (DCG), Arrington Capital, Lightspeed Venture Partners, GV Google Ventures.

- Tier 3: SBI Investment, Core Innovation Capital, Bossanova Investimentos, Accenture, Camp One Ventures.

- Tier 4: IDG Capital, Santander, Tetragon Financial Group, RRE Ventures, AME Cloud Ventures, CME Ventures, Standard Chartered Bank, Thirdstream Partners, CRCM Ventures, Hinge Capital, Route 66 Ventures, Seagate Technology, Avant Global, Vast Ventures.

- Tier 5: SCB 10X.

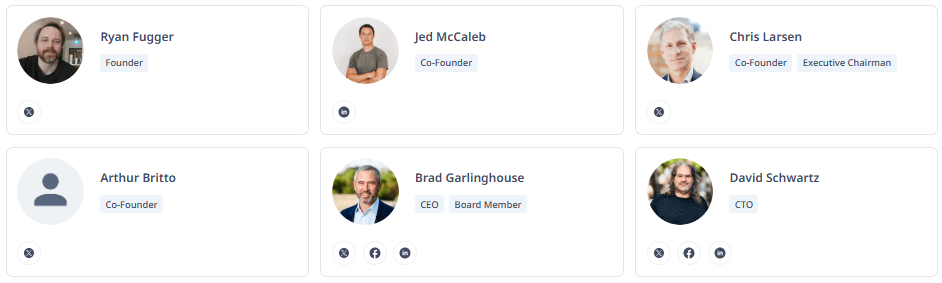

Ripple (XRP) Team

Founded in 2004 by Ryan Fugger as RipplePay, Ripple Labs was established in 2011 by Jed McCaleb and Chris Larsen. Launched as NewCoin in 2012, it became OpenCoin, then Ripple Labs in 2013, and Ripple in 2015. Team: Ryan Fugger (Founder), Jed McCaleb (Co-Founder), Chris Larsen (Co-Founder, Executive Chairman), Arthur Britto (Co-Founder), Brad Garlinghouse (CEO), David Schwartz (CTO), Stuart Alderoty (CLO), Monica Long (President), Anja Manuel, Craig Phillips, Sandie O’Connor, Rosie Rios, Michael Warren, Asheesh Birla, Warren Jenson, Masashi Okuyama (Board Members).

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.