Aster USDF (USDF) is the fully collateralized, yield-bearing stablecoin of the Aster platform, a next-generation decentralized perpetual futures exchange designed for all users. Born from the 2024 merger of Astherus and APX Finance, Aster is more than a rebrand—it’s a bold vision to transform perpetual futures trading and asset utilization in the decentralized ecosystem. USDF, pegged 1:1 to USDT, is crafted to deliver passive returns. This article explores Aster and its stablecoin USDF, detailing their functionality, mechanics, and opportunities.

What is Aster USDF (USDF)?

Aster is a DeFi platform uniting security, performance, and community-driven design. By merging Astherus’ robust yield-generating products with APX’s advanced perpetual trading infrastructure, Aster creates a seamless ecosystem for traders and yield-seekers. With one-click trading, smart automation, and deep on-chain liquidity, Aster redefines DeFi as simple, efficient, and user-focused. USDF, Aster’s stablecoin, is convertible 1:1 with USDT and generates returns through delta-neutral strategies.

Aster offers three trading modes:

-

Pro Mode: Order book-based perpetual futures trading with deep liquidity, minimal fees, and advanced tools.

-

1001x Mode: One-click, MEV-resistant perpetual trading using on-chain liquidity.

-

Spot Mode: Spot trading with low fees and deep liquidity.

Through Aster Earn, the platform supports Astherus’ popular yield products, including the BNB liquid staking derivative asBNB and the yield-bearing stablecoin USDF. Aster’s roadmap includes zero-knowledge proofs, a dedicated Layer 1 blockchain, and an intent-based system for automated cross-chain trading.

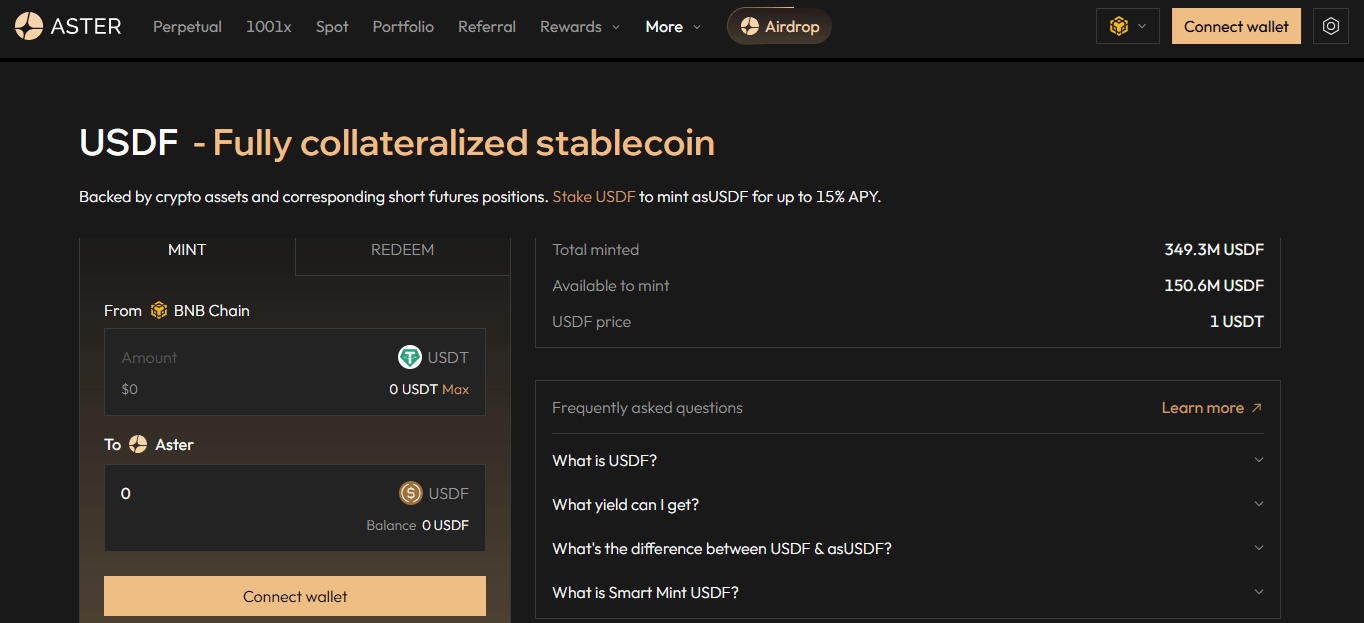

USDF is minted with USDT and supports staked USDF (asUSDF) for yield generation. Holding USDF grants a 20x Au Points multiplier for $AST airdrop rewards.

Purpose of Aster USDF (USDF)

Aster aims to lead the perpetual futures exchange market. Since 2024, decentralized perpetual exchanges have processed hundreds of billions in monthly trading volume (DefiLlama). With high leverage, privacy, and dual-mode trading, Aster targets a significant share of this multi-billion-dollar market. USDF serves as a stable value store and yield generator at the core of this ecosystem, using delta-neutral strategies to shield against market volatility.

USDF stands out among centralized (USDT, USDC) and decentralized (USDe, DAI) stablecoins:

-

USDT/USDC: Tether’s USDT, with over $80 billion in market cap, reported $13 billion in 2024 profits and $7 billion in excess reserves. Circle’s USDC, with a $30 billion market cap, processed $1 trillion in monthly volume in November 2024. Both face centralized risks like counterparty, transparency, and regulatory issues.

-

USDe/DAI: Ethena’s USDe offers up to 18% APY via synthetic assets and delta-neutral hedging but struggles with negative fee rates in bear markets. MakerDAO’s DAI, over-collateralized by crypto like Ethereum, supports yield through governance. Both thrive with DeFi demand.

-

USDF’s Edge: USDF blends decentralized mechanics with high yields. Resilient in bear markets via strategies like DAI lending, its USDT backing and regulatory compliance appeal to institutional investors.

How Does Aster USDF (USDF) Work?

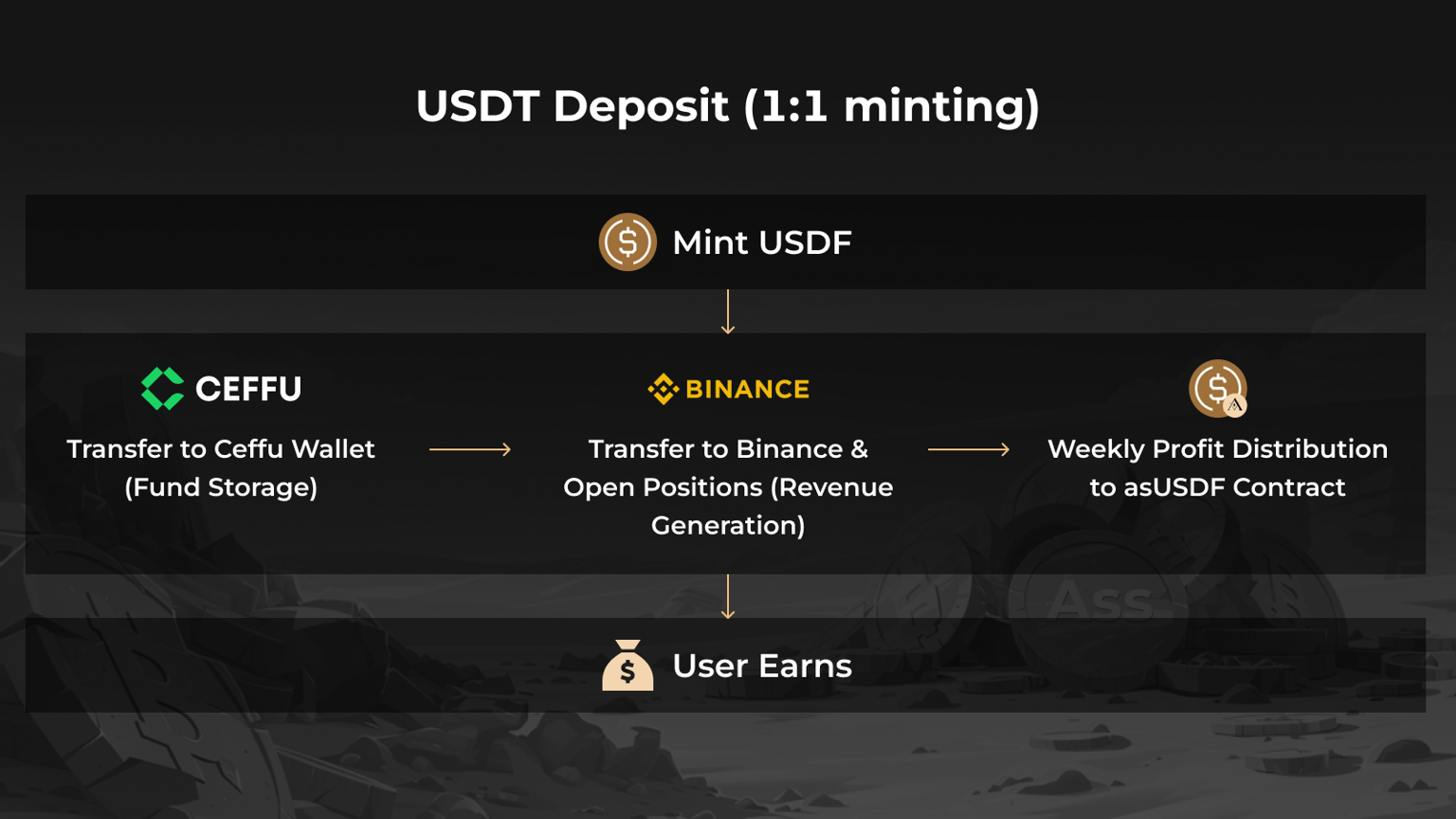

USDF is a USDT-minted stablecoin generating yield through delta-neutral strategies. Its process includes:

-

Minting USDF: USDF is minted 1:1 with USDT (e.g., 100 USDT = 100 USDF).

-

Ceffu Wallet Transfer: USDT is moved to Aster’s Ceffu wallet, a secure custodial solution preparing funds for yield strategies.

-

Binance Position Opening: Funds are deployed on Binance for low-risk delta-neutral strategies, leveraging its liquidity and efficiency.

-

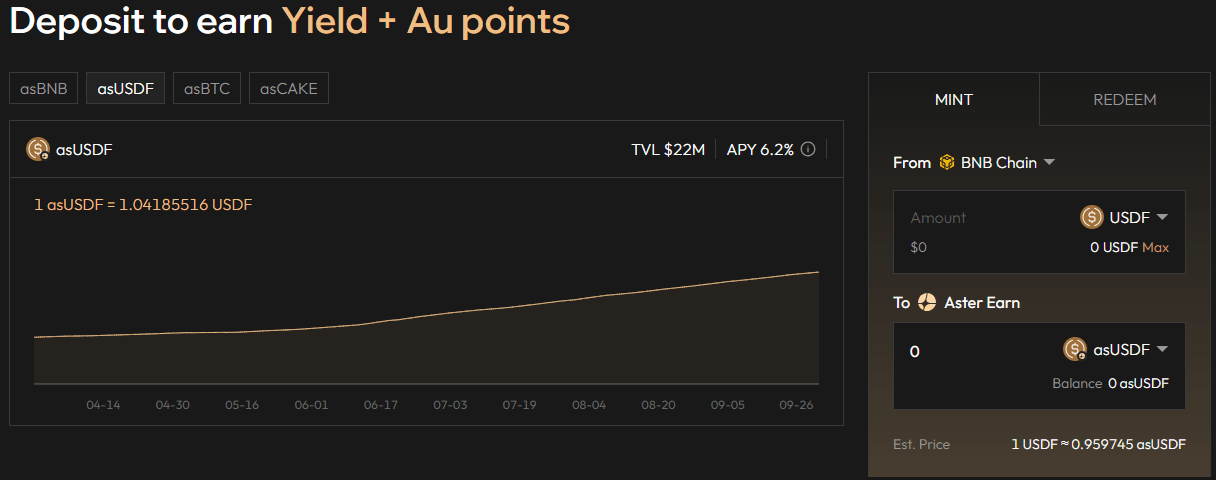

Weekly Profit Distribution: Profits from Binance strategies are calculated weekly and distributed to the asUSDF contract, the staked form of USDF, for yield.

Delta-Neutral Strategy: Balances long and short positions to remain market-neutral. For example, spot (long) and perpetual futures (short) positions on Bitcoin generate income from trading fees and interest rate differentials, ensuring stable returns regardless of price movements.

Peg Maintenance:

-

1:1 Redemption: USDF is always redeemable 1:1 for USDT.

-

Arbitrage Opportunities: If USDF’s price deviates (e.g., 1.02 USDT on PancakeSwap), users can redeem 1:1 for arbitrage profits (e.g., 2%), stabilizing the peg.

-

Delta-Neutral Contribution: Long and short positions manage USDT volatility, supporting the 1:1 peg.

Fund Custody and Risk Management: USDF and USDT are held by Ceffu, which uses multi-party computation (MPC), multi-signature wallets, and ISO 27001/SOC 2 compliance for secure custody. Ceffu’s MirrorX enables delta-neutral positions on Binance while keeping assets in custody, with off-exchange settlement reducing counterparty risk.

Aster USDF (USDF) Use Cases

-

Passive Yield: Minting USDF earns a 20x Au Points multiplier for $AST airdrops. Staking asUSDF yields APY from delta-neutral strategies.

-

Trading: USDF serves as a stable value store in Aster’s Pro, 1001x, and Spot modes.

-

DeFi Integration: Usable in liquidity pools and lending protocols.

-

Arbitrage: Offers profit opportunities from price deviations.

Usage Steps:

-

Mint USDF: Mint USDF 1:1 with USDT on Aster.

-

Stake: Stake USDF on Aster Earn for asUSDF, earning yield and Au Points.

-

Redeem/Swap: Convert USDF to USDT on Aster (0.1% fee) or swap on PancakeSwap (variable fee).

-

Trade: Use USDF for trading on Aster’s platform.

Advantages of Aster USDF (USDF)

-

Yield Potential: Passive income via delta-neutral APY and Au Points.

-

Bear Market Resilience: Strategies like DAI lending ensure stable returns during negative fee periods.

-

Security: Ceffu’s institutional-grade custody and regular audits.

-

Low Fees: Free minting, 0.1% redemption fee on Aster, variable on PancakeSwap.

-

Institutional Appeal: Decentralized mechanics and USDT compliance attract institutions.

Aster USDF (USDF) Team

Aster was formed by the merger of Astherus and APX Finance, led by a team of experts in yield products and perpetual futures trading.

Official Links

Also, click to review our stock market guide article titled “What is Aster DEX? How to Use It?”

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.