As of September 26, 2025, spot ETF data closely tracked by crypto markets signaled a deepening of the recent decline in investor confidence. The fact that significant outflows occurred on the same day from ETFs focused on Bitcoin and Ethereum, the two largest digital assets in the market, revealed that both institutional and retail investors are reducing their risk appetite.

This underscores how crypto assets are becoming increasingly influenced by uncertainties in traditional markets and macroeconomic developments, pushing investors to seek short-term protection against volatility.

Spot Bitcoin ETFs

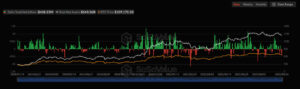

On September 26, spot Bitcoin ETFs recorded a total net outflow of $418.25 million. What stood out was that none of the 12 Bitcoin ETFs traded on the market saw any inflows. This indicates that both institutional and retail investors turned cautious simultaneously, showing a significant decline in risk appetite. According to experts, this development reflects how both global market uncertainties and crypto-specific regulatory debates are shaping investment decisions.

Spot Ethereum ETFs

A similar picture emerged on the Ethereum side. On September 26, spot Ethereum ETFs recorded a total net outflow of $248.31 million. This marked the fifth consecutive day of outflows from the funds. Analysts note that this trend has shaken short-term confidence in the Ethereum ecosystem, with investors adopting more defensive positions in response to volatility.

Market Impact and Investor Sentiment

- Flight to safety: The simultaneous outflows from Bitcoin and Ethereum ETFs indicate that investors are seeking safe-haven assets.

- Macro factors: Interest rate policies, global liquidity conditions, and regulatory developments around U.S. crypto ETFs stand out as the main drivers behind the outflows.

- Cautious stance of institutional investors: The uncertain environment is prompting large investors to act more prudently.

- Short-term volatility: Declining demand may amplify short-term price fluctuations.

- Medium-term liquidity pressure: Continued outflows from funds could constrain overall market liquidity in the crypto space.

Assessment

The latest data, showing significant outflows from both Bitcoin and Ethereum ETFs on the same day, signals a break in investor confidence. This underscores weakening market sentiment and a declining appetite for risk. In the coming days, ETF inflow and outflow data will remain a critical indicator for gauging investor behavior and the direction of prices.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.