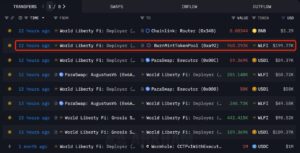

The World Liberty Financial (WLFI) team recently carried out a notable transaction in the crypto market. The team conducted a $1.06 million buyback, acquiring 6.04 million WLFI tokens from the market. Following this, they burned 7.89 million WLFI tokens across the Binance Smart Chain and Ethereum networks, reducing the circulating supply.

This move eliminated approximately 0.029% of the total circulating supply, creating a meaningful scarcity effect in WLFI’s tokenomics. The initiative aims to strengthen investor confidence in the market and support the token’s value over the long term.

Market Impact of the Transaction

The buyback and burn process caused a noticeable increase in WLFI’s price. Before the buyback and burn, the token was trading around $0.114, but these actions pushed the price upward. According to CoinGecko data, the 24-hour trading volume reached approximately $428.2 million, with WLFI/USDT being the most active pair, highlighting high market volatility and strong investor interest. (At the time of writing, the price is $0.20.)

On-chain analyses reveal that last week, subgroups of addresses holding 1M–10M WLFI saw a growth of 26.72 million tokens, indicating increased stability among token holders.

What is World Liberty Financial (WLFI)?

World Liberty Financial (WLFI) gained attention in the crypto space following Donald Trump and his family’s entry into the digital finance sector. Founded in 2024, this U.S.-based decentralized finance (DeFi) platform aims to give users full control over their funds, in contrast to traditional banking systems. Its primary goal is to strengthen the global position of the U.S. Dollar and make DeFi accessible to everyday Americans.

Ecosystem and Strategic Goals

WLFI operates across Ethereum, Binance Smart Chain, and Solana, using fees collected by the protocol for buybacks and burns, creating tokenomic incentives. This approach is designed to foster scarcity in the long term and support token value.

The protocol also offers lending and borrowing features, provides holders with discounts on shared fees, and plans regular burns as platform usage grows.

World Liberty Financial’s recent actions have increased on-chain activity and strengthened token holder confidence. These transactions highlight the sustainability of the WLFI ecosystem and its long-term growth strategy.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.