The Polkadot community is showing strong support for a proposal to introduce pUSD, an algorithmic stablecoin fully collateralized by DOT tokens. If approved, this initiative could mark a significant milestone for the ecosystem, aiming to reduce reliance on external stablecoins.

A New Stablecoin Proposal

Over the weekend, Bryan Chen, co-founder and CTO of Acala, unveiled a proposal to develop a Polkadot-native stablecoin. The asset would be DOT-backed, algorithmic in design, and launched under the ticker pUSD.

According to Chen’s outline, the stablecoin would leverage Honzon, Acala’s decentralized stablecoin and collateralized debt position protocol. This framework is designed to lower Polkadot’s dependence on centralized stablecoins like Tether (USDT) and Circle’s USDC.

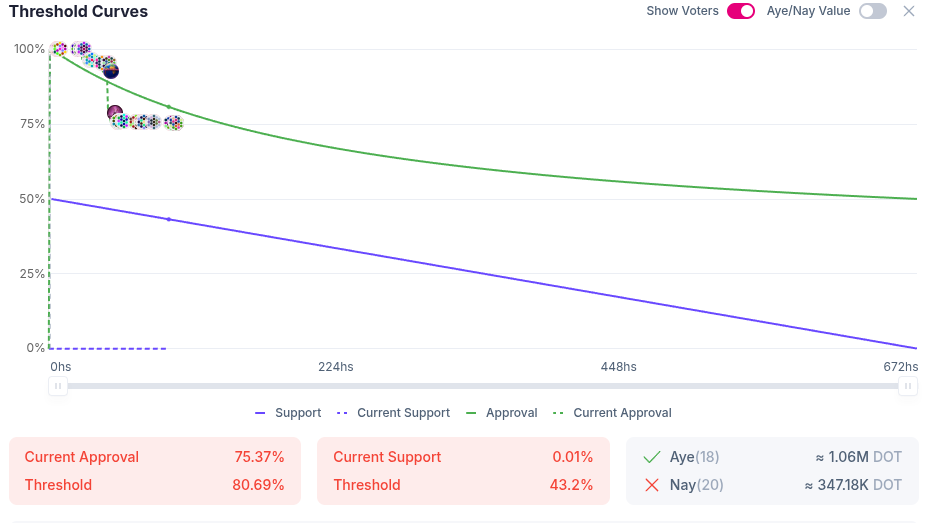

So far, more than three-quarters of the votes have been cast in favor of the idea. With over 24 days left before the vote concludes, around 1.4 million DOT — valued at roughly $5.6 million at $3.90 per token — has already been committed.

How Would pUSD Function?

The proposed pUSD would operate as an overcollateralized debt token backed by DOT. Additionally, a savings module is being considered, which would allow holders to lock their tokens and earn interest through stability fees.

Chen emphasized that the main goal is to enhance Polkadot’s financial infrastructure:

“Polkadot Hub should have a native DOT-backed stablecoin because people need it. Without it, we risk losing liquidity, utility, and security.”

Unlike centralized models, algorithmic stablecoins aim to maintain a fiat peg using on-chain assets and smart contracts, with economic incentives built into the system to stabilize the price.

The Debate Around Algorithmic Stablecoins

Algorithmic stablecoins remain a controversial topic, especially after the dramatic collapse of TerraUSD (UST), which took down its entire ecosystem. Despite this setback, such assets continue to attract interest due to their greater decentralization compared to centralized alternatives.

This model offers a more permissionless and less controllable design. Some industry voices even warn that algorithmic stablecoins could pave the way for so-called “dark stablecoins”, which might evade regulatory oversight and sanctions.

Additionally, please don’t forget to follow us on our Telegram ,YouTube and Twitter channels.