As of September 29, 2025, crypto investors have observed rising interest in spot Ethereum and Bitcoin ETFs. This trend not only reflects the growing popularity of digital assets but also highlights the increasing role of crypto ETFs in portfolio diversification strategies. Daily reports indicate that both Ethereum and Bitcoin ETFs are being actively chosen by investors, underscoring their critical role in shaping market dynamics.

Spot Ethereum ETFs

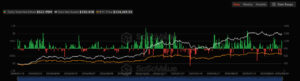

On September 29, spot Ethereum ETFs recorded a total net inflow of $546.96 million. This figure demonstrates that demand for Ethereum investments remains strong. Experts emphasize that the surge particularly reinforces confidence in Ethereum’s smart contract and DeFi ecosystem.

Spot Bitcoin ETFs

During the same period, spot Bitcoin ETFs recorded $521.95 million in net inflows. The sustained demand for Bitcoin ETFs highlights Bitcoin’s continued role as a core asset in investment portfolios, reinforcing its status as “digital gold.”

However, BlackRock’s IBIT stood out as the only product among these ETFs to record net outflows. Analysts attribute this to short-term portfolio adjustments rather than a shift in market sentiment, noting that the overall bullish trend in the market remains intact.

Market Commentary

Experts note that the rising net inflows reflect growing confidence in the long-term reliability of both Ethereum and Bitcoin. The strong demand for spot ETFs signals investors’ increasing interest in gaining direct exposure to digital assets.

The surge in Ethereum ETFs, in particular, underscores renewed trust in Ethereum’s smart contract ecosystem. Meanwhile, consistent net inflows into Bitcoin ETFs highlight Bitcoin’s continued role as a core asset in investment portfolios maintaining its reputation as digital gold.

Analysts emphasize that the outflows from BlackRock’s IBIT are likely due to short-term portfolio adjustments and do not alter the overall bullish market trend.

Overall, the steady inflows into spot Ethereum and Bitcoin ETFs demonstrate a resurgence of investor confidence in the crypto market and a growing appetite for ETF products.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.