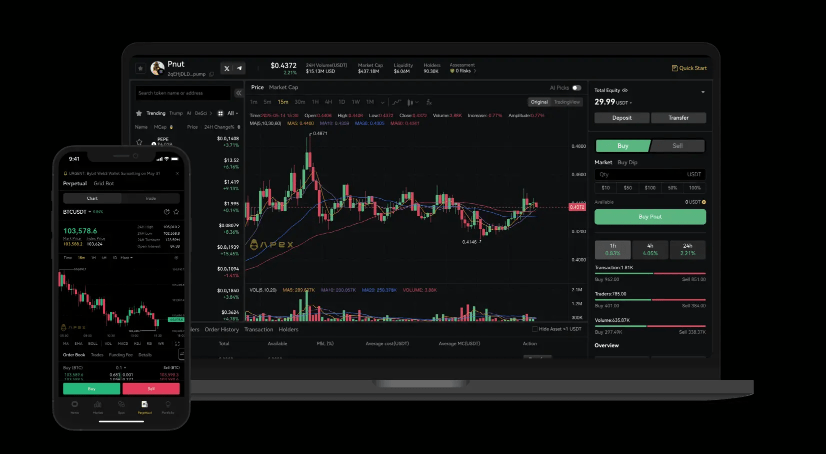

ApeX Protocol, established in 2022, is a permissionless and non-custodial decentralized exchange (DEX) platform. Its initial product, ApeX Pro, enables decentralized derivatives trading with USDC and USDT cross-margined perpetual contracts across over 45 trading pairs, offering up to 50x leverage. Its latest offering, ApeX Omni, is a modular, intent-centric, and chain-agnostic DEX that aims to redefine decentralized trading through a multichain liquidity aggregation framework. Delivering on promises of speed, efficiency, and security, ApeX seeks to transform trading for crypto professionals, enthusiasts, and newcomers alike. This article explores what ApeX Protocol is and how it functions in detail.

What is ApeX Protocol (APEX)?

ApeX Protocol is a DEX platform built on innovation and user empowerment, designed to provide a seamless, efficient, and secure trading experience in the crypto market. ApeX Omni (v2) enhances trading with multichain liquidity, a user-first design, and top-tier security through zero-knowledge proofs, making it safer and more efficient. Key features include:

-

Multichain Liquidity Aggregation: Combines liquidity from various blockchains, eliminating the need for cross-chain bridges and reducing associated risks and fees.

-

Intent-Centric Approach: Mimics the convenience of centralized exchanges, offering a chain-agnostic trading experience.

-

Modular Infrastructure: A flexible, scalable framework enables rapid product launches and adaptation to market demands.

-

Self-Custody and Security: Ensures users retain full control over their assets, with zero-knowledge proofs guaranteeing transaction security and privacy.

-

Comprehensive Product Suite: Offers perpetual contracts, spot trading, yield-generating vaults, and prediction markets.

With ApeX Omni, the protocol reshapes decentralized trading and enhances user experience through social rewards via ApeX Social.

Purpose of ApeX Protocol (APEX)

ApeX Protocol aims to revolutionize decentralized trading with innovative technology and user-focused products. It delivers speed, efficiency, and security, combining the advantages of centralized exchanges with a decentralized structure. ApeX Omni provides broad asset access through multichain liquidity, low fees, and high transaction speeds. It empowers users with full control over their assets while enhancing security through zero-knowledge proofs, strengthening the DeFi ecosystem for both crypto professionals and beginners.

How Does ApeX Protocol (APEX) Work?

ApeX Protocol operates as a multichain trading platform via ApeX Omni, with a modular, intent-centric architecture optimized for user needs.

Core Products:

-

Perpetual Contracts:

-

USDT-collateralized, up to 100x leverage, low slippage, and high liquidity.

-

Zero gas fees, 5 BPS taker and 2 BPS maker fees.

-

10,000 TPS transaction speed.

-

Cross-margin: Trade multiple markets with a single margin account for capital efficiency.

-

P&L Calculation: Linear in USDT, reducing position risk.

-

-

Spot Trading:

-

Unified cross-chain trading with USDT swaps (Solana, Base, BNB Chain, Ethereum).

-

0.5% low fees, anti-MEV protection, and unified liquidity pools.

-

-

Yield Vaults: Generate returns through automated user- or protocol-created strategies.

-

Prediction Markets:

-

Event-based trading with up to 20x leverage, using Polymarket price references.

-

Binary outcome markets (e.g., “Will BTC reach 120,000 USDT by July 20, 2025?”).

-

Contract prices reflect event probability (0.001–0.999 USD).

-

-

ApeX Social: Offers airdrops, NFTs, trading bonuses, and real-world rewards (e.g., Apple Vision Pro, Saga phone).

Cross-Collateral:

-

Supports USDC, WBTC, WETH, ETH, cmETH, mETH, cbBTC, and USDe.

-

Enables flexible, efficient trading with automatic asset conversion.

-

Diversified collateral reduces risk tied to a single asset’s volatility.

Grid Bot:

-

Automated “buy low, sell high” or “sell high, buy low” strategies.

-

Long, short, or neutral modes; neutral bots excel in sideways markets.

-

-0.002% maker fee: Earns rewards per trade, credited daily to position margin.

Fee Structure:

-

Taker: 5 BPS, maker: 2 BPS.

-

Beta period discounts: 2.5 BPS taker, 0 maker for <500,000 USDT volume; 5 BPS taker, 0 maker for >500,000 USDT.

-

No gas fees; fees apply only to filled orders.

-

Funding fees: Hourly, exchanged between long and short positions to align market and spot prices.

Order Types:

-

Limit Order: Executed at a specified or better price, no fill guarantee.

-

Market Order: Filled instantly at the best available price.

-

Conditional Orders: Market or limit orders with trigger price conditions.

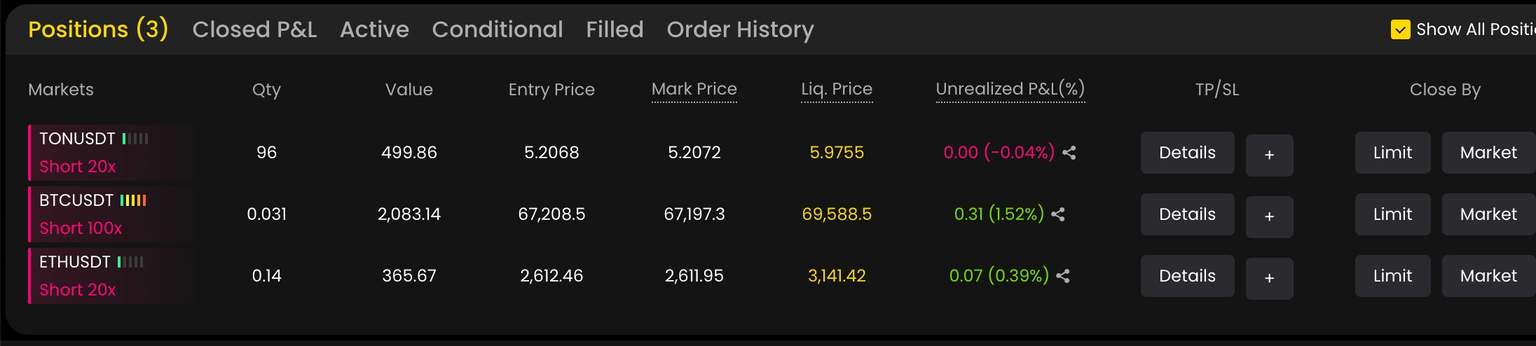

Leverage and Open Interest:

-

Up to 100x leverage, adjustable by users.

-

Open interest reflects total unsettled derivative contracts at day’s end.

Liquidation and ADL:

-

Maintenance margin is required to keep positions open; a 100% margin ratio triggers liquidation.

-

Auto-Deleveraging (ADL): Ranks high-profit positions to balance losses during volatility.

ApeX Protocol (APEX) Use Cases

ApeX caters to diverse user needs:

-

Perpetual Trading: High-leverage, low-fee derivatives trading.

-

Spot Trading: Multichain, low-fee token swaps.

-

Prediction Markets: Event-based speculation with 20x leverage.

-

Yield Vaults: Passive income through automated strategies.

-

ApeX Social: Engagement incentives with crypto and real-world rewards.

-

Tokenized U.S. Stocks: Trade AAPL, TSLA, NVDA, etc., with USDT.

Usage Steps:

-

Connect a wallet to ApeX Omni, deposit USDT or supported assets.

-

Trade in perpetual, spot, or prediction markets.

-

Apply automated strategies with Grid Bot.

-

Earn yields with USD0++ or vaults, participate in $APEX rewards.

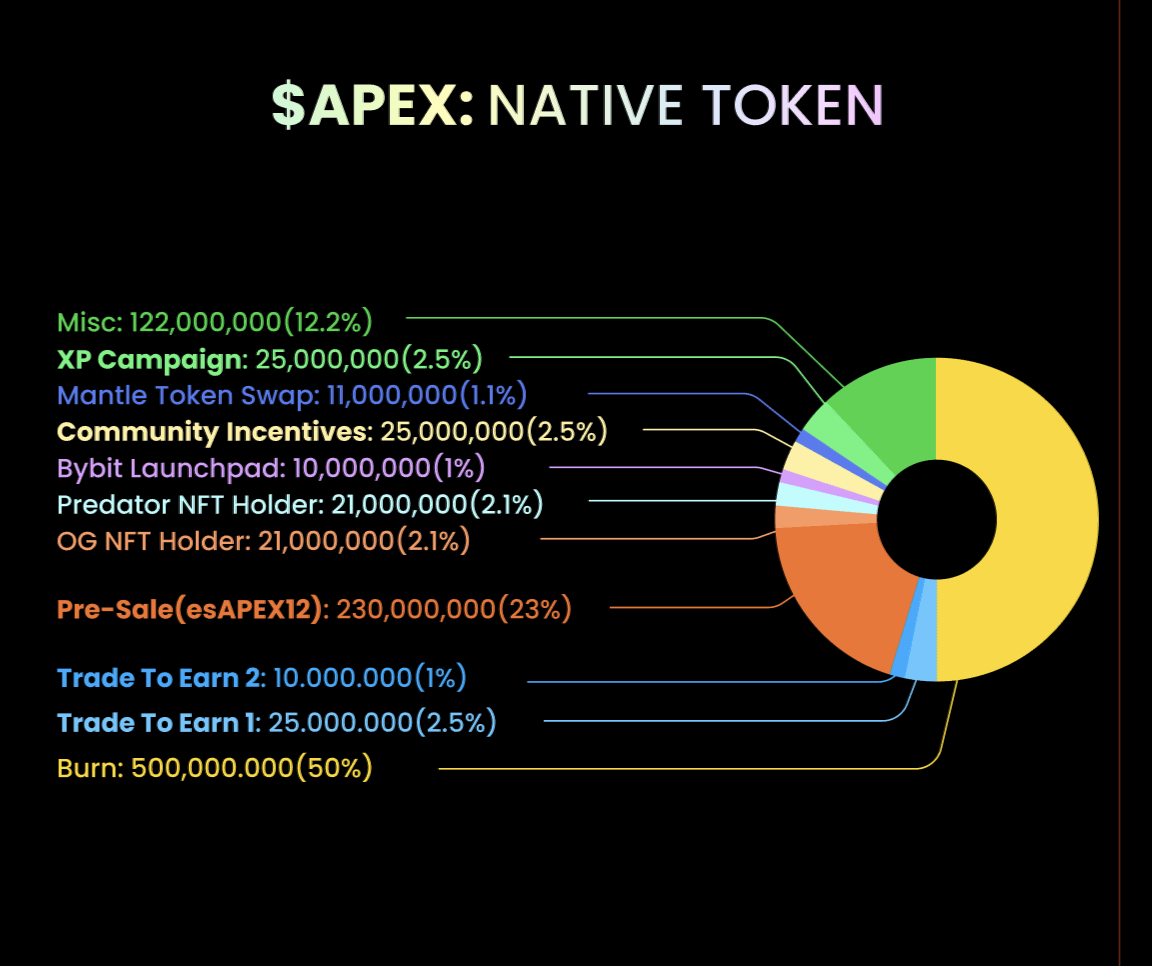

ApeX Protocol (APEX) Tokenomics

The $APEX token is central to the protocol:

-

Total Supply: 500 million (reduced from 1 billion in 2024).

-

Distribution:

-

23%: Core team and early investors (24-month lock, 24-month vesting).

-

77%: Participation rewards, ecosystem, and liquidity (100% unlocked at TGE, DAO locked for 36 months).

-

Trade to Earn: 25 million (Round 1), 10 million (Round 2), 25 million (XP Campaign).

-

-

Utility: Weekly staking rewards, governance (roadmap, settings).

-

esAPEX: Escrowed token, convertible to $APEX after 6-month vesting.

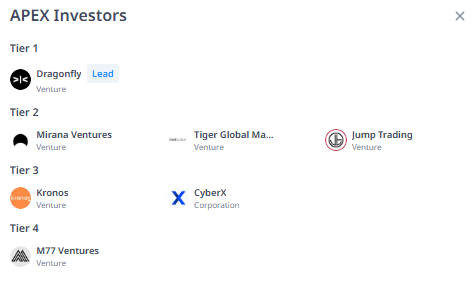

ApeX Protocol (APEX) Investors

-

Tier 1: Dragonfly.

-

Tier 2: Mirana Ventures, Tiger Global Management, Jump Trading.

-

Tier 3: Kronos, CyberX.

-

Tier 4: M77 Ventures.

ApeX Protocol (APEX) Team

-

Mariam Iashagashvili: Head of Marketing and Operations.

-

Aron Peak: Head of Product.

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.