In the last few hours, whale movements in the crypto market have been particularly noteworthy. Large investors are executing multi-million-dollar transactions, causing significant fluctuations in the altcoin market and directly influencing investor behavior. Such transactions can lead to sudden price changes, especially in low-liquidity tokens, while even larger and more popular assets see increased market sensitivity.

PEPE and LINEA Transactions

A notable whale in recent transactions spent 262.84 ETH (approximately $1.07 million) to purchase 561,923 EIGEN at $1.90 each. The same whale also added 4.26 million LINEA tokens to their portfolio for 30 ETH (around $121,000).

The current portfolio distribution is as follows:

- 34 trillion PEPE ($12.31 million)

- 73 million ENA ($11.29 million)

- 26,500 AAVE ($7.08 million)

- 685,980 PENDLE ($3.14 million)

- 78 million LINEA ($1.41 million)

Experts note that such large purchases can trigger price fluctuations in the altcoin market and cause sudden spikes in low-liquidity tokens. These moves also reflect the whale’s portfolio diversification strategy and long-term investment plans.

BTC Transfer by the Royal Government of Bhutan

Another major transfer was carried out by the Royal Government of Bhutan. The institution moved 2,011.23 BTC (approximately $229.69 million) to new wallets. Analysts indicate that such massive transactions are usually conducted for exchange deposits or liquidity management purposes. This move could increase short-term volatility in the Bitcoin market and attract investor attention.

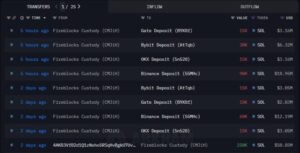

SOL and ASTER Whale Movements

- Whale “CMJi” deposited assets worth 250,000 SOL (approximately $51.89 million) to major centralized exchanges such as Gate, Bybit, OKX, and Binance over the past two days. Such transactions can create short-term price pressure in the SOL market and particularly influence investor price expectations.

- Whale 0x9137 used 34 million USDT to purchase 1.76 million ASTER tokens at $1.93 each. The same amount of ASTER was then added along with 3.43 million USDT to a liquidity pool. These transactions strengthen liquidity in the ASTER ecosystem, increase the token’s trading volume, and contribute to market depth.

- Five months ago, whale 0xE37F sold 1,857 ETH at $2,251 each. Approximately 50 minutes ago, the same whale purchased 1,501 ETH at $4,114 each. This transaction is considered an important indicator for Ethereum’s price trend and whale behavior. Large purchases are generally perceived as a signal of market confidence and can encourage other investors to take positions.

Market Commentary

The recent surge in whale activity indicates increased liquidity and volatility in the crypto market. Large investors can influence the market by diversifying their portfolios and managing liquidity. Significant transactions in tokens such as PEPE, LINEA, ASTER, and ETH can trigger short-term price movements while also shaping investor confidence in the long term.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.