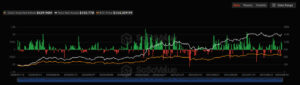

September 30 once again underscored the sustained confidence and interest of institutional investors in digital assets. Spot ETFs for both Bitcoin and Ethereum recorded net inflows worth hundreds of millions of dollars in a single day, delivering a remarkable performance.

This development reflects the strategic approach of traditional financial institutions and large funds toward crypto. While the crypto market has long been known for its volatility, steady inflows into spot ETFs indicate that investors no longer view these assets solely as short-term speculative tools, but also as long-term stores of value with significant growth potential.

Capital Continues Flowing Into Bitcoin ETFs

On September 30, spot Bitcoin ETFs recorded total net inflows of $429.96 million. Notably, none of the twelve Bitcoin ETFs trading in the market posted net outflows. This reinforces growing investor confidence in Bitcoin and highlights the strengthening interest from institutional players in BTC.

Analysts emphasize that such strong inflows carry the potential to directly influence Bitcoin’s price movements. In particular, the contributions of large U.S.-based funds are making the impact of spot ETFs on the market increasingly evident.

Strong Investor Interest in Ethereum ETFs

Alongside Bitcoin, spot Ethereum ETFs also recorded net inflows of $127.47 million on September 30. All nine Ethereum ETFs trading in the market ended the day positive, with no net outflows reported.

This development highlights Ethereum’s growing appeal, particularly among institutional investors. With ETH’s broad range of use cases — from smart contracts to decentralized finance (DeFi) applications — investments made through ETFs reflect long-term expectations and confidence in Ethereum’s future potential.

Overall Assessment

The fact that both Bitcoin and Ethereum ETFs recorded strong inflows on September 30 without any outflows is seen as evidence of the crypto market’s growing maturity and the rapidly increasing interest from traditional financial institutions. If this trend continues, the final quarter of the year could bring strong price movements for both BTC and ETH.