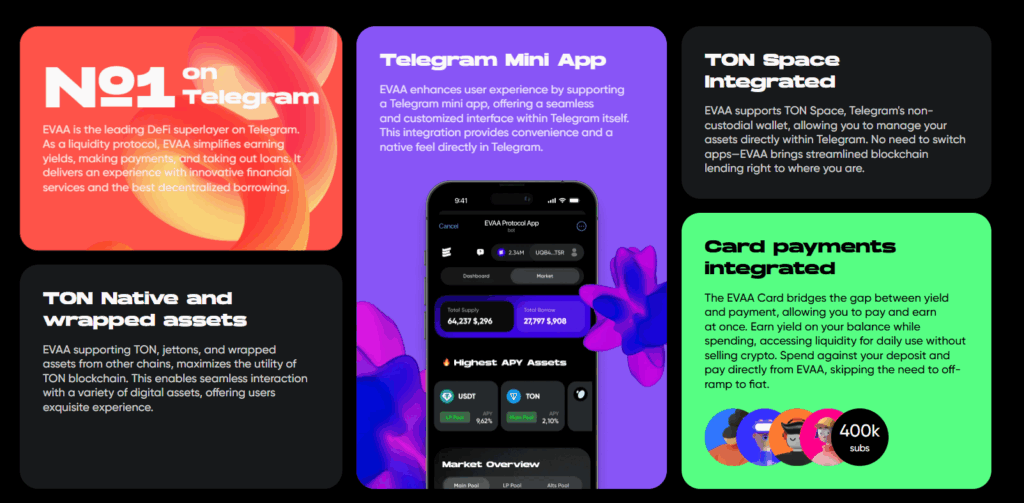

EVAA Protocol is the first lending protocol operating on Telegram. It is a DeFi solution designed to help users manage assets, borrow funds, and make payments seamlessly. Built on the TON ecosystem, EVAA is accessible via the Telegram Mini App (@EvaaAppBot) and web application.

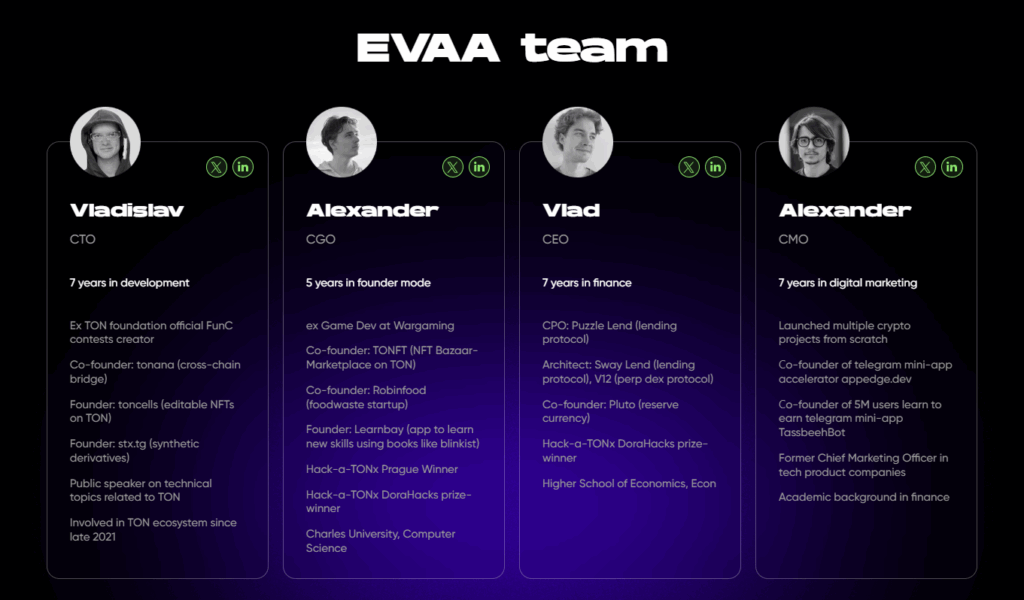

Founders and Team

The EVAA team consists of four experienced members in finance, blockchain development, and marketing:

- Vlad (CEO): 3 years in DeFi, developed two successful lending protocols, 4 years in traditional finance risk management.

- Vladislav (CTO): Former TON Foundation member, 7 years in software development, 4 years in DeFi application development.

- Alexander (CGO): 5 years in entrepreneurship and game development.

- Alexander (CMO): 7 years in crypto product marketing, co-founder of a Telegram mini-app accelerator.

Investors and Partnerships

Seed Round:

- Animoca Ventures: Part of Animoca Brands; invests in gaming, metaverse, and DeFi projects.

- TON Ventures: Official investment arm of the TON ecosystem.

- Polymorphic Capital: Supports Web3 and early-stage DeFi projects.

- PAKA: Web3-focused investments since 2020.

- Mythos Ventures: Invests in decentralized, user-centric Web3 projects.

- Frens Syndicate x VC DAO: Community of Web3 founders and investors.

Pre-Seed Round: Supported by strategic Web3-focused investors including First EVAAngelist, TONStarter, TON Coin Fund ($250M portfolio), Existential Capital, and WAGMI Ventures.

Project Concept

EVAA brings DeFi to Telegram, allowing users to:

- Stake assets for yield.

- Borrow over-collateralized loans.

- Soon access card payments and non-collateralized loans.

How the Protocol Works

- Yield: Deposit assets to earn passive income.

- Borrowing: Use assets as collateral to borrow funds.

- Payments: Make fast crypto payments directly via Telegram.

- Upcoming Features: Card integration and unsecured loans.

- All actions are accessible via Telegram Mini App or web interface.

Governance

$EVAA token holders participate in protocol governance by voting on technical proposals and feature updates, promoting a community-driven and autonomous platform.

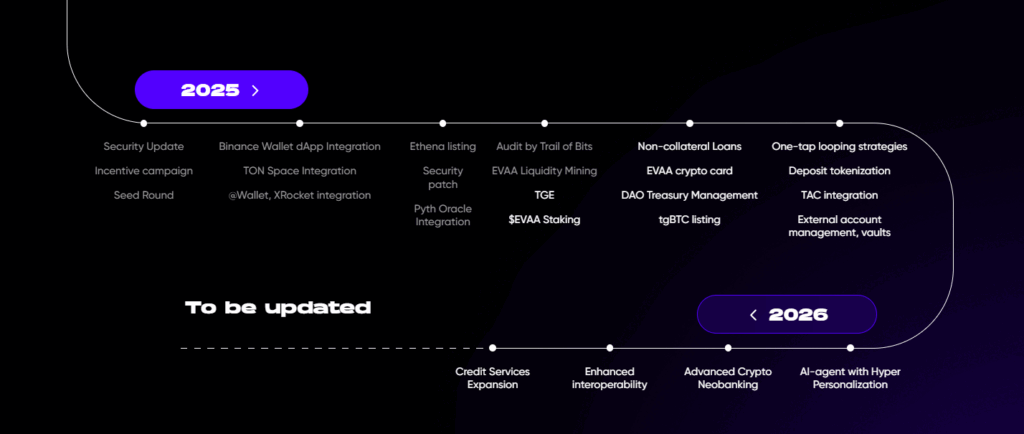

Roadmap

- 2023 – Launch: Foundations, testing, Hackathon awards, NFT releases.

- 2024 – Mainnet & Expansion: Public mainnet, SDK and EVAA XP launch, open-source smart contracts, exchange integrations, LP pools.

- 2025 – Growth & Tokenization: TGE, $EVAA staking, DAO governance, liquidity mining, unsecured loans, crypto card, further integrations.

- 2026+ – Advanced Finance & AI: Expanded credit services, neobank features, AI personalization, transforming EVAA into a community-managed DeFi superlayer.

- EVAA Protocol is listed on Binance Alpha and Binance Futures.

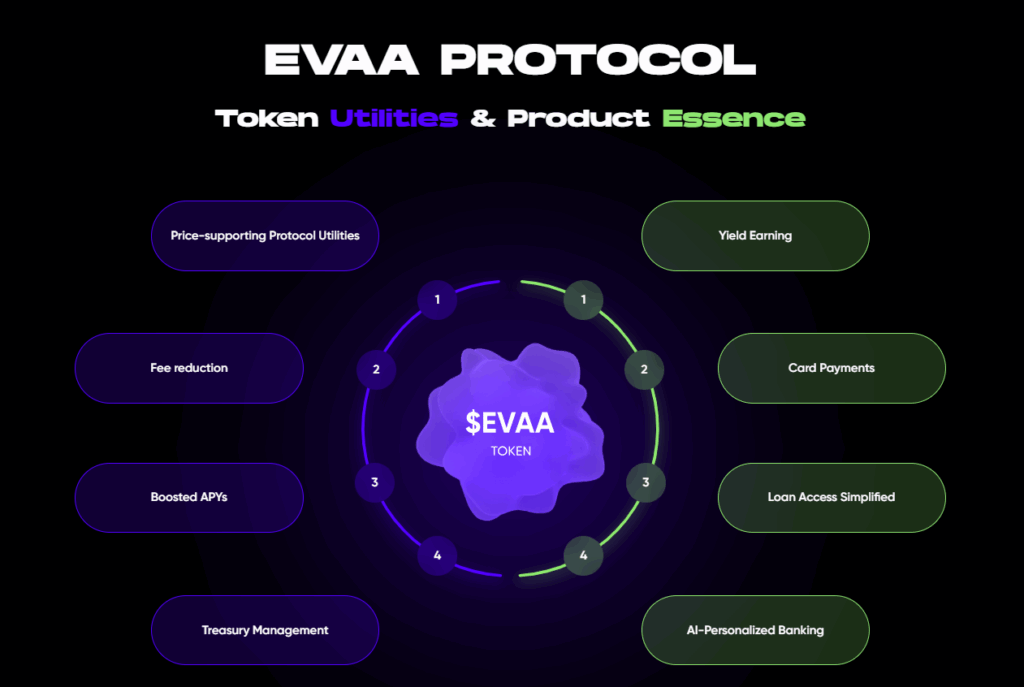

EVAA Token Use Cases

- Governance: Participate in voting.

- Yield Incentives: Rewards for staking and liquidity provision.

- Ecosystem Incentives: Support new Telegram features.

- Deflationary Mechanism: Controlled supply to reduce price pressure.

EVAA Token Details

- Token Name: EVAA Token

- Symbol: $EVAA

- Type: Deflationary utility token

- Chain: TON

- Initial Circulating Supply (TGE): 13.38%

- Immediate Unlock: 1.71%

- Total Supply: 50,000,000 $EVAA

- Max Supply: 50,000,000 $EVAA

- Circulating Supply: 6,610,000 $EVAA

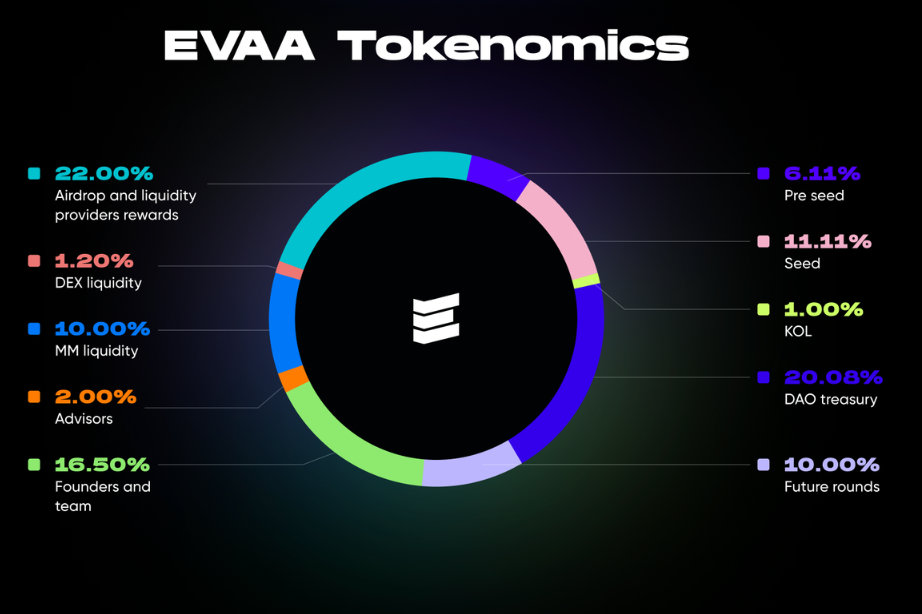

Token Distribution

- Airdrop & Liquidity Rewards: 22%

- DAO Treasury: 20.08%

- Founders & Team: 16.5%

- Pre-seed & Seed Investors: 17.22%

- Others: Ecosystem development

EVAA Ecosystem

- Telegram Mini App: Borrow and lend easily.

- Web App: Desktop interface.

- DeFi Superlayer: Combines yield, lending, and payments.

- TVL: $30M+ (peak $118M).

- User Base: 310,000+ wallets.

- Transaction Volume: $1.4B+

Key Features

- First lending protocol on Telegram.

- Easy integration for DeFi and daily payments.

- Security backed by major investors and audit firms.

- Rapidly growing user base and transaction volume.

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.