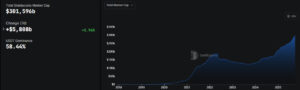

As recovery signals continue in the cryptocurrency markets, the stablecoin ecosystem has reached a historic peak. According to DeFiLlama data, the total market capitalization of all stablecoins has surpassed $300 billion for the first time, reaching $301 billion. This represents a 2% increase compared to last week and a 6.5% gain over the past 30 days.

Tether (USDT) Maintains Its Leadership

Tether (USDT), the leading stablecoin in the market, remains far ahead with a market capitalization of $176.3 billion and a 58% market share. USDT is widely used in crypto trading, DeFi protocols, and cross-border payments.

It is followed by Circle’s USDC, which has a market capitalization of $74 billion (24.5% market share), while Ethena’s USDe stands at $14.8 billion and MakerDAO’s DAI holds $5.0 billion in market value.

The Importance of Stablecoins

Stablecoins not only provide price stability but also serve as an indicator of capital flow in the crypto market. Their peg to fiat currencies like the US dollar helps mitigate price fluctuations of volatile assets such as Bitcoin and Ethereum. Analysts note:

This development shows that investors are seeking safe havens in the crypto market, and stablecoins are increasingly fulfilling this role. For institutional investors in particular, stablecoins are a critical tool not only for protection against high volatility but also for providing liquidity.

Market Performance and Institutional Interest

In Q3 2025, the stablecoin market recorded 20% growth. This growth is supported by renewed institutional interest and regulatory developments such as the US GENIUS Act. During the same period, Bitcoin and Ethereum also showed strong performance: Bitcoin rose 9.6% to $119,972, while Ethereum increased 13.3% to $4,498.57. These gains highlight the significant role stablecoins play in supporting market recovery.

The expansion of the stablecoin market indicates that the crypto ecosystem is maturing and investor confidence is returning. The increasing interest from institutional investors also reflects a growing demand for greater market transparency and regulatory clarity.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.