Crypto investors have been eagerly awaiting the approval of one of the spot altcoin ETFs, which was scheduled for today. However, the U.S. Securities and Exchange Commission (SEC) has yet to announce its decision, leaving uncertainty in the market. This delay is causing particular concern among Litecoin ETF investors. So, what is behind the delay, and what does it mean for investors? Experts have weighed in on the process and its possible implications.

Delay in Litecoin Spot ETF Approval

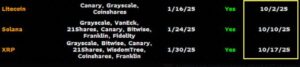

Bloomberg analyst James Seyffart Noted that the previously set deadline for the Litecoin ETF application may no longer be valid. Normally, Canary’s 19b-4 filing was expected to be finalized today. However, the SEC now requires submissions under the newly adopted “general listing standards” for all products. This means that the previously determined date is no longer a clear reference point for investors.

Seyffart emphasized that the partial shutdown of the U.S. government has added serious uncertainty to the process.

“No one really knows exactly what is happening right now. However, we still believe these products will be launched in the near future,” he said, making it clear that approval has not been completely ruled out.

This statement offers both reassurance to investors and signals that short-term volatility risks may continue. Analysts note that the SEC’s compliance with new standards and bureaucratic delays could make ETF approval processes take longer than usual.

Uncertainty in SEC Staffing and Approval Processes

Crypto journalist Eleanor Terrett

Stated that the government shutdown could directly affect the approval process for the Litecoin ETF. She highlighted that the SEC must approve the S-1 filings, but the agency is operating with limited staff, making it unclear which personnel are active and what priorities are being set.

Terrett also noted that she reached out to the SEC for comment, but spokespersons were unable to respond to many press inquiries due to the shutdown. Since 19b-4 filings are now being withdrawn, the old deadlines technically no longer hold significance.

This situation increases uncertainty for crypto investors. In particular, institutional investors may delay their strategic decisions due to such postponements. However, experts stress that the SEC has not completely suspended the process and intends to make decisions in line with the new standards.

Expert Opinions and Market Impact

Crypto analysts argue that the delay will not completely diminish investor interest. On the contrary, the likelihood of ETF approvals being issued in the short term is fueling expectations among investors and even increasing volatility in some altcoins.

Analysts explain that the SEC’s new listing standards and the slowdown caused by the government shutdown are influencing the decision-making process, but final approval remains possible. In other words, investors should not treat such delays as a reason to panic but rather as part of the normal regulatory procedure.

Additionally, this situation underscores the long-term importance of launching spot ETFs. Once approved, they could significantly boost liquidity and institutional interest, especially for altcoins.

Key Takeaways for Investors

- Delays create short-term uncertainty, but investors should remain patient.

- Once ETF approval is granted, altcoins could see substantial liquidity and price movements, particularly with increased institutional participation.

- Regulatory uncertainties should be factored into investment strategies as a driver of volatility in the crypto market.

According to experts, investors should carefully monitor the process instead of panicking and focus on seizing opportunities once ETF approvals are granted. Delays are seen as a natural part of the market and a necessary step to ensure compliance with regulatory standards.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.