Corn (CORN) is a brand aimed at making Web3 more engaging, accessible, and fun. Comprising applications, protocols, games, and cultural projects, each Corn endeavor has its own purpose, united by a single goal: proving the fun nature of crypto. At its core is the Corn Token ($CORN), which connects the brand and its efforts, rewarding participation and creating a culture-driven economy. Let’s explore what Corn is and its uses in detail.

What is Corn (CORN)?

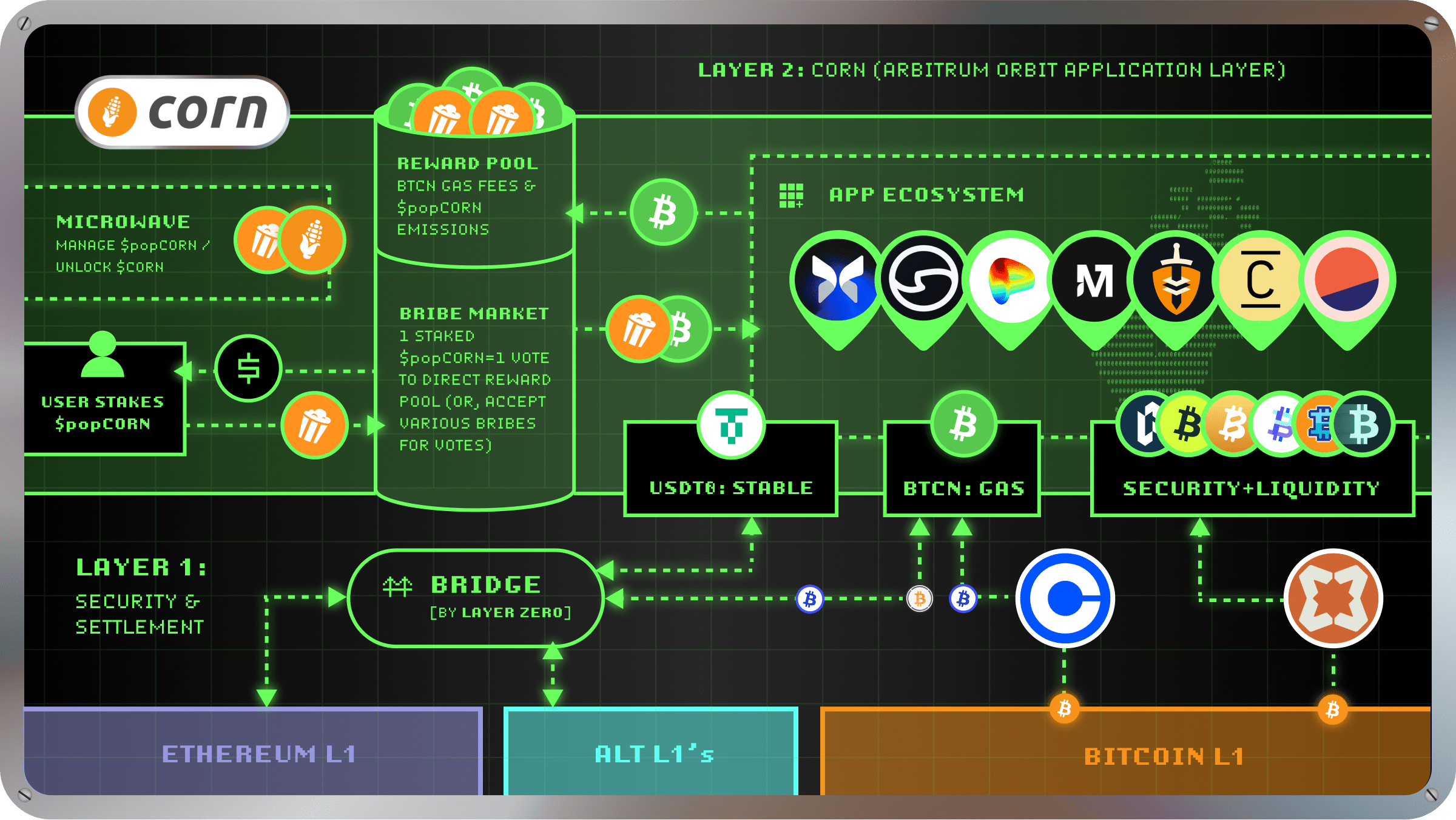

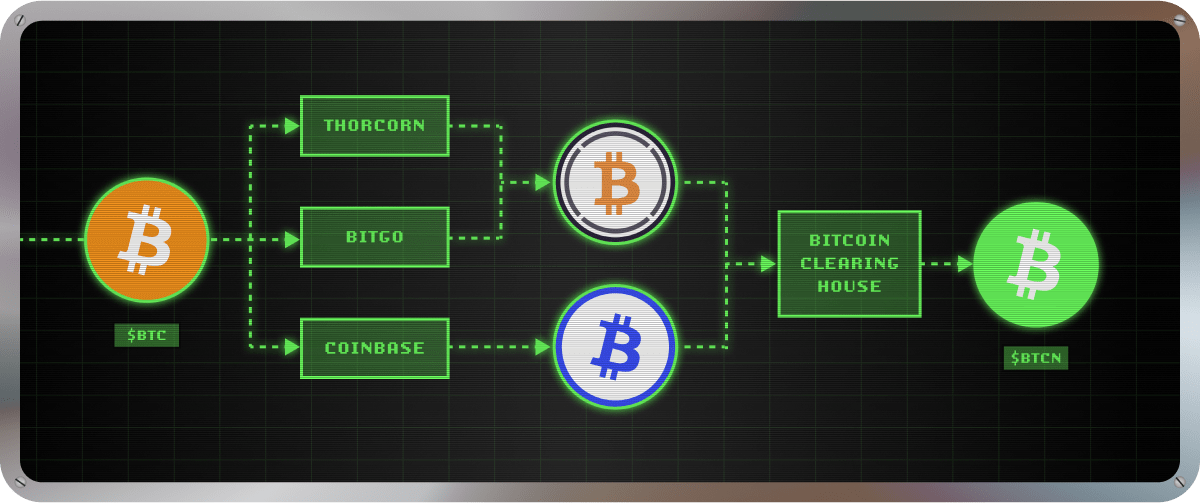

Project is a brand that blends financial innovation with culture, with each project emphasizing crypto’s fun side. The Corn Token ($CORN), using the LayerZero OFT standard, enables seamless cross-chain transfers between Corn Network, Ethereum Mainnet, and Solana (88+ LayerZero-supported chains). Bridging burns tokens on the source chain and mints them on the destination chain, preserving total supply. Corn Network is Bitcoin’s Utility Layer, making Bitcoin accessible for optimized yield opportunities. $BTCN (Bitcorn), a 1:1 BTC-backed hybrid token, bridges Bitcoin to Ethereum and EVM for DeFi use. The Bitcoin Clearing House on Ethereum Mainnet manages $BTCN mint/redemption, starting with $cbBTC and $wBTC, with custody by Coinbase and BitGo.

Purpose of Corn

The project aims to unlock Bitcoin’s dormant liquidity to grow BTCFi. Despite Bitcoin being the most trusted currency, its programmability is limited; $BTCN brings Bitcoin to EVM, enhancing its DeFi utility. The popCORN System allows $CORN stakers to direct yield to whitelisted applications, inspired by Curve Finance’s ve model, aligning users, developers, and liquidity providers for the long term. It builds a sustainable ecosystem instead of short-term incentives, making Bitcoin the most liquid DeFi asset.

How Does It Work?

Project operates with $CORN and $BTCN; the Bitcoin Clearing House manages $BTCN mint/redemption, and LayerZero enables bridging. $BTCN is backed 1:1 by $cbBTC and $wBTC; mint caps are managed by the Risk Council (initially 1000 BTC each).

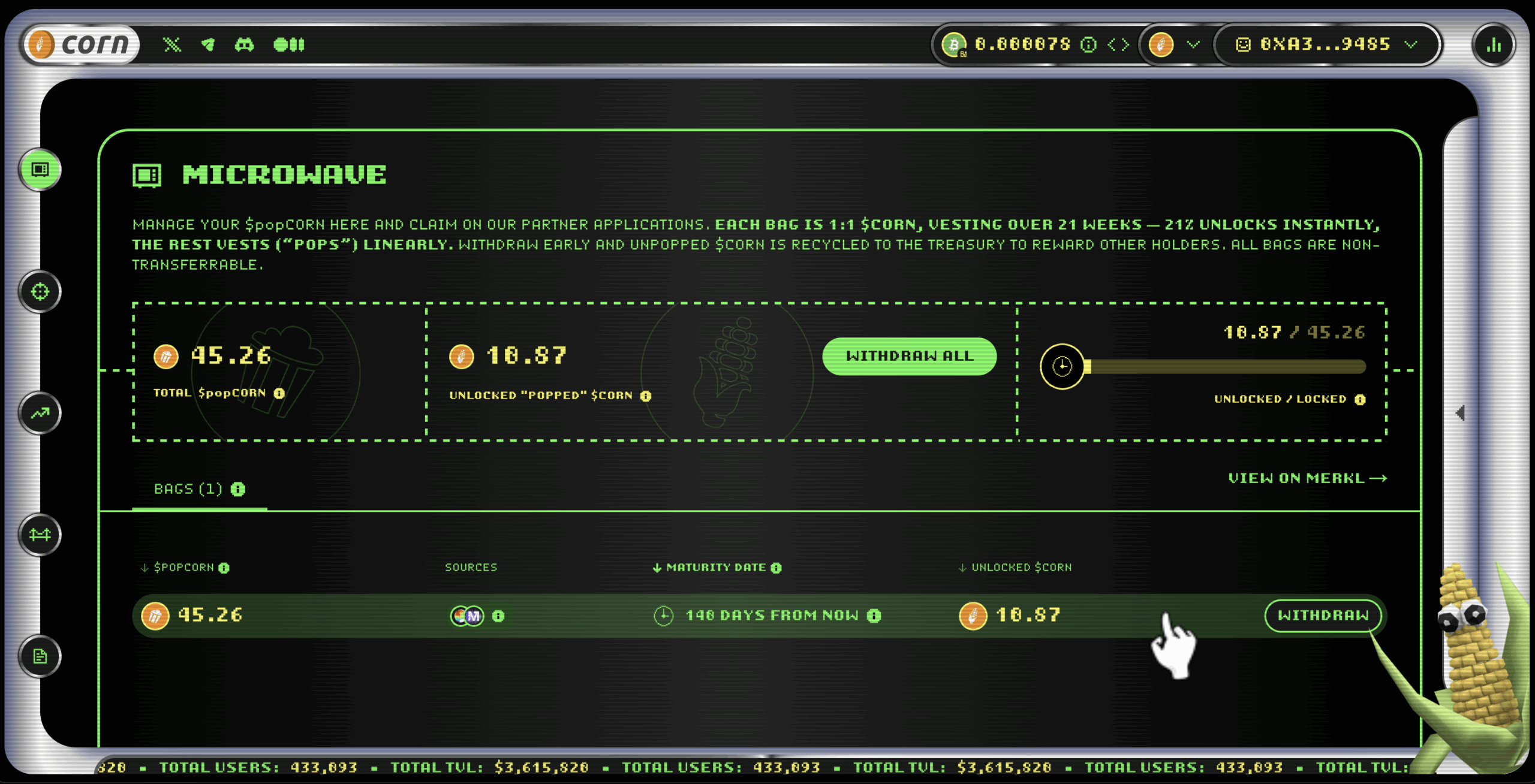

popCORN System:

- $CORN stakers vote or delegate yield ($BTCN and $CORN) to whitelisted protocols.

- Protocols offer bribes for $CORN votes, attracting liquidity and users.

- $popCORN, the non-transferable version of $CORN; 21% instantly claimable, 79% vests linearly over 21 weeks.

$BTCN Bridging:

- LayerZero Bridge: Acquire $BTCN by bridging $cbBTC or $wBTC.

- Wrapped Bitcorn (wBTCN): ERC-20 wrapper for DeFi protocols.

Bitcoin Clearing House:

- 1:1 swaps, zero fees/slippage/limits.

- Risk Council manages cap increases and whitelist.

Corn Use Cases

The project offers Bitcoin holders the following opportunities:

- BTCFi: Use $BTCN for DeFi (lending, liquidity).

- Yield Distribution: $CORN stakers direct yield via popCORN.

- Cross-Chain: LayerZero enables Ethereum/Solana integration.

- Security: Babylon Bitcoin staking for a Bitcoin-backed network.

Usage Steps:

- Mint $BTCN (via Clearing House).

- Stake $CORN to earn popCORN.

- Vote or delegate yield to protocols.

- Convert $popCORN to $CORN via vesting.

Advantages of Corn

- Bitcoin-Focused: Makes Bitcoin liquid and secure in DeFi.

- Fairness: popCORN allows stakers to direct yield.

- Sustainability: Long-term alignment over short-term incentives.

- Security: Coinbase/BitGo custody, Arbitrum Orbit L2.

- Cross-Chain: LayerZero integration with 88+ chains.

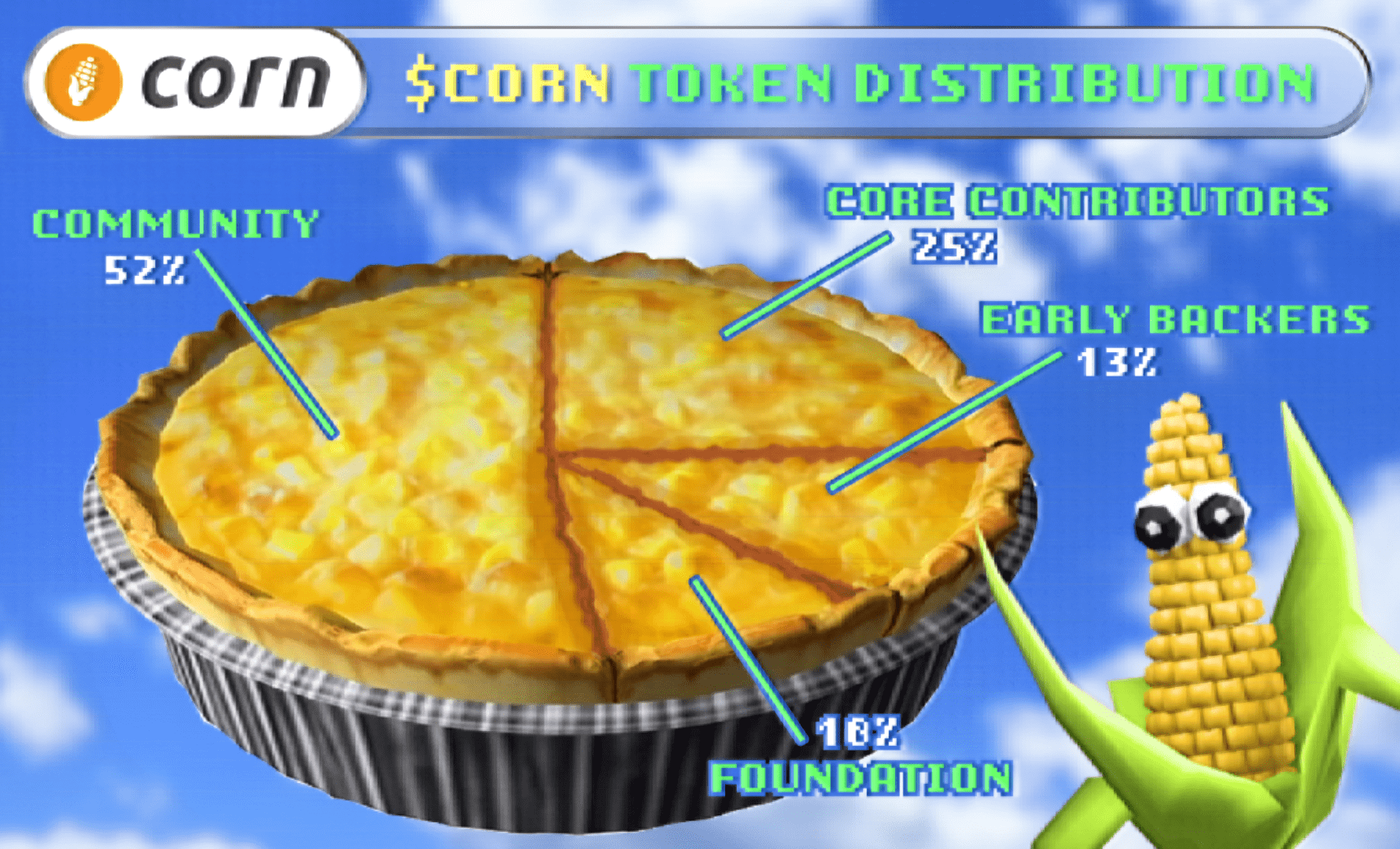

Corn (CORN) Tokenomics

Total Supply: 2.1 billion $CORN.

Distribution:

- Community: 52% (Initial Token Distribution 10%, User Emissions 33.3%, Ecosystem Builders 5%, Community Fundraise 3.7%).

- Early Backers: 13%

- Core Contributors: 25%

- Foundation: 10%

Initial Circulating Supply: 525M $CORN at TGE (25%, community and ecosystem-focused).

Lock/Vesting:

- Community: Kernels S1/S2 fully claimable at TGE; Yap to Eat claimable within 14 days with EVM wallet linking.

- Others: 1-year lock, 12-month linear unlock; cannot participate in staking.

- Future Inflation: 3%/year for ecosystem support.

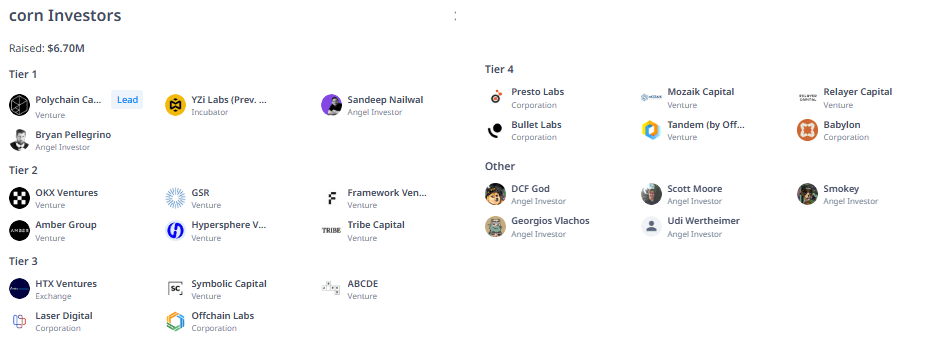

Corn Investors

Corn raised $6.7 million. Tier 1: Polychain Capital, YZi Labs, Sandeep Nailwal, Bryan Pellegrino. Tier 2: OKX Ventures, GSR, Framework Ventures, Amber Group, Hypersphere Ventures, Tribe Capital. Tier 3: HTX Ventures, Symbolic Capital, ABCDE, Laser Digital, Offchain Labs. Tier 4: Presto Labs, Mozaik Capital, Relayer Capital, Bullet Labs, Tandem (Offchain Labs), Babylon. Others: DCF God, Scott Moore, Smokey, Georgios Vlachos, Udi Wertheimer.

Corn Team

The Corn team is led by Zak Cole (Co-Founder) and Chris Spadafora (Co-Founder).

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.