Avalon Labs is a BTC-Fi (Bitcoin finance) ecosystem aiming to transform Bitcoin (BTC) from a passive store of value into an active player in on-chain finance. At its core, Avalon features the BTC-backed CDP stablecoin USDa, a CeDeFi liquidity model, and the governance token AVL.

Overview

Avalon Labs is designed to help Bitcoin holders unlock liquidity, borrow, and earn yield without selling their BTC. Its foundation includes BTC-collateralized yield-bearing CDPs (USDa), CeDeFi lending (blending CeFi liquidity with DeFi models), DeFi lending pools, and complementary services.

Investors & Partners

Avalon Finance is backed by top investors and partners including YZi Labs, Framework, Kenetic, Mirana, SNZ Holding, Matrixport, Antalpha, UTXO, CEiC, Summer Ventures, Comma 3 Ventures, Geekcartel, ViaBTC, Trinito, Presto, Marblex, Paka, DOMO (BRC20 creators), Taiko, and the BNB Chain MVB incubation program.

Key highlights:

- Institutional partners like YZi Labs and BNB Chain MVB program.

- Token listings on Bybit, Binance Alpha, and Bithumb.

- Notable co-founder: Venus Li.

Vision

Avalon’s vision is to evolve Bitcoin beyond “digital gold” into a yield-generating, credit-enabling asset active in lending markets. With BTC-backed stablecoins, CeDeFi liquidity, and multi-chain lending, Avalon seeks to integrate BTC into everyday and institutional finance.

How It Works (Products)

USDa (CeDeFi CDP): A BTC-collateralized yield-bearing stablecoin, claimed as the world’s first and largest BTC-CDP.

- USDaLend: Borrowing and lending protocols based on USDa.

- CeDeFi Lending: Hybrid model merging DeFi with institutional CeFi liquidity providers.

- DeFi Lending (Isolated Pools): Risk-controlled lending pools, supporting collateral types like LSDFi.

- Flow: Users lock BTC → mint USDa or borrow → use in Avalon products (USDaLend, DeFi lending).

Governance — AVL & sAVL

- AVL: Governance token, total supply 1B, used for incentives, fee reductions, and governance.

- sAVL (staked AVL): Earned by staking AVL; grants governance rights, emission shaping, and fee rebates.

Roadmap Highlights

- TVL milestones ($500M → $800M → $1B+).

- Launch of USDa.

- Fixed-rate borrowing.

- Multi-chain expansion.

- AVL token listings (from Feb 2025).

Token Utility

AVL and sAVL provide:

- Governance power.

- Access to ecosystem benefits (AVL Lend, fee rebates).

- Yield rewards through staking.

- Borrowing cost reductions.

Tokenomics

- Total Supply: 162.25M AVL

- Circulating Supply: 161.68M AVL

- Max Supply: 1B AVL

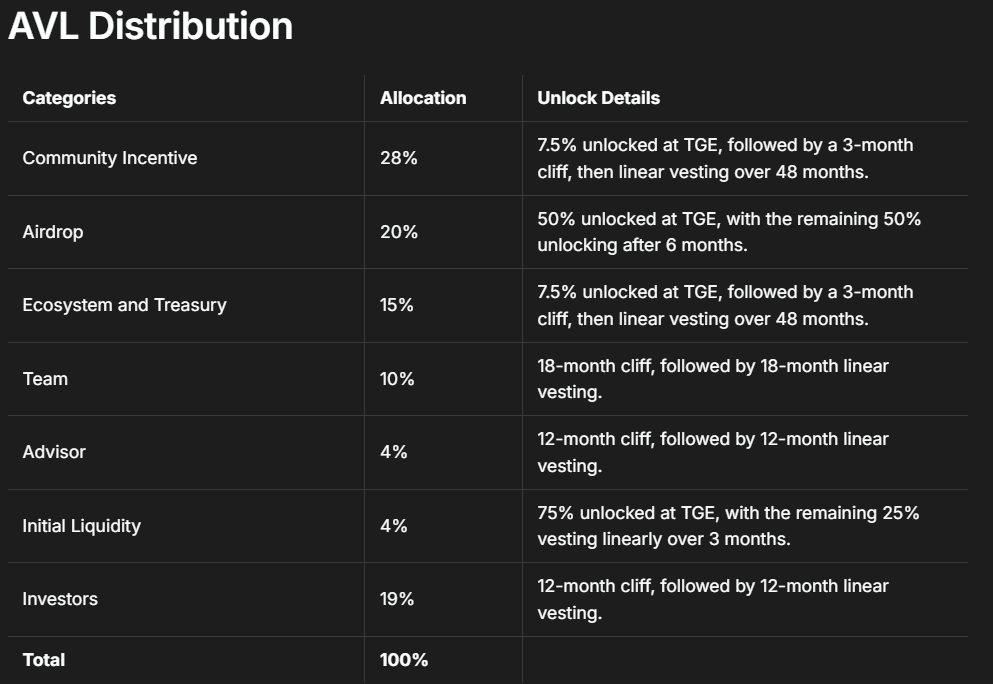

Distribution

- Community Incentive: 28% (48m vesting)

- Airdrop: 20% (50% TGE, rest 6m)

- Ecosystem & Treasury: 15% (48m vesting)

- Team: 10% (18m cliff, 18m linear)

- Advisors: 4% (12m cliff, 12m vesting)

- Initial Liquidity: 4% (75% TGE, 3m vesting)

- Investors: 19% (12m cliff, 12m vesting)

Ecosystem Components

- USDa: BTC-backed stablecoin

- USDaLend: Lending protocols

- CeDeFi Lending: Hybrid liquidity model

- DeFi Lending / Isolated Pools: Risk-managed lending

- AVL & sAVL: Governance, staking, rewards

- Explorer, docs, and audit reports

Key Features & Advantages

- BTC-backed CDP (USDa): Yield-bearing stablecoin on Bitcoin.

- CeDeFi hybrid model: CeFi liquidity + DeFi innovation.

- Fast TVL growth & multi-chain expansion.

- Audits & Security: Contracts audited by SlowMist, BlockSec, Salus.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.