Bitcoin is climbing toward a $125,000 peak as exchange balances fall to a six-year low. $14 billion worth of BTC leaving centralized exchanges signals investors are leaning toward long-term holding strategies.

Bitcoin Hits Record on Coinbase

On Sunday morning, Bitcoin surpassed $125,700 on according to TradingView, setting a new record. The previous peak was $124,500 on August 14. BTC had dropped 13.5% by September 1 but showed a strong recovery last week. Nova Dius CEO Nate Geraci commented:

“Bitcoin has reached an all-time high, and most people still don’t fully understand what Bitcoin is.”

Analyst Rekt Capital added:

“If Bitcoin convincingly breaks $126,500, the price could accelerate much higher.”

Exchange Bitcoin Reserves at Six-Year Low

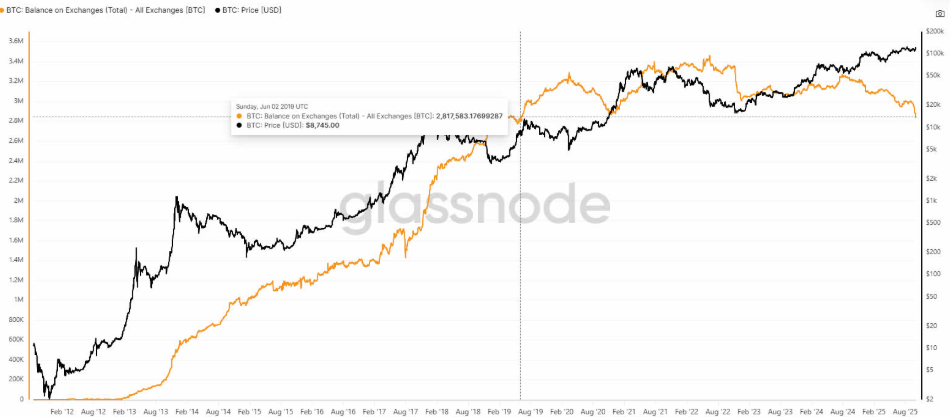

Glassnode reports that total BTC held on centralized exchanges fell to 2.83 million on Saturday, the lowest in six years. CryptoQuant shows total exchange reserves at 2.45 million BTC, a seven-year low.

Over the past two weeks, more than 114,000 BTC have left exchanges, valued at over $14 billion. This indicates holders plan to keep their coins long-term rather than sell. VanEck Digital Assets Research Head Matthew Sigel noted, “The outflow of Bitcoin from exchanges signals significant scarcity,” urging investors to remain cautious.

Institutional Funds and Long-Term Goals

Most of the BTC leaving exchanges is going to institutional funds, digital asset treasuries, or individual wallets. This reduces available supply in the market and can drive prices higher. Bitcoin’s long-term rally is supported by declining exchange reserves and rising institutional demand. Analysts note this trend could also affect altcoins and other crypto assets.

Factors Supporting Bitcoin’s Rally:

- Over 114,000 BTC leaving centralized exchanges

- Rising interest from institutional investors

- Long-term holding strategies

- Reduced available supply

- New price peak above $125K

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.