Attention in the crypto market has once again shifted to Solana (SOL). The popular altcoin is in the spotlight among investors and analysts ahead of the upcoming Alpenglow upgrade. Recently, Bitwise CIO Matt Hougan stated that Solana could become Wall Street’s most preferred network for stablecoins and tokenization.

“Solana Is the New Wall Street”

Bitwise’s Chief Investment Officer Matt Hougan made notable comments during a discussion with Akshay Rajan from the Solana Foundation. According to Hougan, financial institutions have begun to seriously evaluate stablecoins and tokenization technologies.

Despite Ethereum’s (ETH) dominance in the sector, Hougan emphasized that Solana’s transaction speed and low fees make it a more attractive alternative for Wall Street institutions.

Solana’s Growing Stablecoin Ecosystem

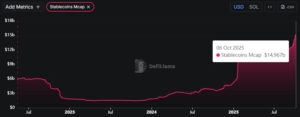

Data shows that the stablecoin supply on the Solana network has reached $14.9 billion, giving Solana a 4.7% market share in the stablecoin sector. However, Ethereum still leads with $172.5 billion in on-chain stablecoin value, maintaining a 59% market share. Still, experts suggest that the trend is beginning to shift. Hougan highlighted that thanks to faster transaction capacity and lower costs, networks like Solana are becoming appealing hubs for new projects.

The Solana team is continuing its preparations for Alpenglow, a major upgrade designed to enhance the network’s performance. Industry experts describe this upgrade as “the most comprehensive development in Solana’s history.” The update will enable institutional investors to conduct tokenization and DeFi transactions with greater speed and efficiency.

Solana ETF Decision Approaching

The Solana ETF application submitted by Bitwise to the U.S. Securities and Exchange Commission (SEC) is also on the agenda. Investors expect the final decision to be announced on October 16. If approved, the ETF could position Solana as “the most significant digital asset after Ethereum” in the eyes of institutional investors. This development could significantly boost Solana’s market capitalization and trading volume.

Statements from Bitwise executives reveal that Solana is emerging as a growing force not only among individual investors but also within the institutional finance world. Considering the Alpenglow upgrade, the expanding stablecoin ecosystem, and the potential ETF approval, the coming weeks are expected to be highly critical for Solana.

Crypto experts predict that Solana could become a serious competitor to Ethereum in the near future and may soon rise as “Wall Street’s new star” in terms of institutional adoption.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.