The world’s largest asset management company, BlackRock, drew attention in 2024 with its Bitcoin spot ETF, IBIT. Outperforming its long-standing traditional investment funds, IBIT generated $245 million in net revenue for BlackRock.

This achievement highlights not only high returns in a short period but also the growing adoption of Bitcoin among institutional investors and the impact of spot ETFs in financial markets.

IBIT Spot ETF Outperforms Traditional Funds

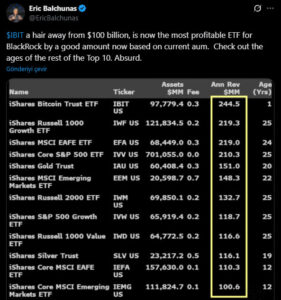

Managing over $10 trillion in assets, BlackRock’s Bitcoin spot ETF IBIT has made a mark alongside its traditional funds. According to Bloomberg ETF analyst Eric Balchunas, as of early 2025, IBIT has surpassed long-standing funds including:

- iShares Russell 1000 Growth ETF (IWF)

- iShares MSCI EAFE ETF (EFA)

IWF ETF, launched on May 22, 2000, invests in large and mid-cap growth-focused U.S. companies, with a total value of around $122 billion.

EFA ETF, launched on August 14, 2001, provides exposure to stocks in developed countries outside the U.S. and Canada, with a value of approximately $70 billion.

IBIT’s strong performance reflects the shift of institutional capital toward Bitcoin and the effectiveness of crypto spot ETFs in generating returns that rival or exceed traditional long-term funds.

IBIT’s Growth Speed Approaching $100 Billion

The IBIT ETF has drawn enormous interest in a short period, particularly when compared to traditional funds. In just 435 days, the Bitcoin spot ETF reached approximately $97.7 billion, and if the current pace continues, it will become the fastest fund ever to hit $100 billion.

For comparison, Vanguard’s S&P 500 Index Fund (VOO), managed by the world’s second-largest asset manager, took 2,011 days to reach $100 billion, and still holds the record in that regard.

Impact of Bitcoin ETFs on Institutional Demand

IBIT’s performance highlights:

- The growing institutional interest in Bitcoin

- The importance of spot ETFs in providing easier, regulated access to digital assets

Large investment firms like BlackRock moving into Bitcoin ETFs not only increase Bitcoin’s institutional adoption but also offer investors a safer, regulated investment vehicle.

Analysts note that IBIT’s rapid growth reflects:

- Rising confidence in digital assets

- Strengthened integration between traditional finance and the crypto world

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.