Crypto asset manager Grayscale has taken a major step by staking $150 million worth of Ethereum (ETH). The move came just one day after the company introduced staking functionality for its exchange-traded products (ETPs), marking a new milestone in the U.S. crypto investment landscape.

A First for the U.S.: Staking-Enabled Crypto ETP

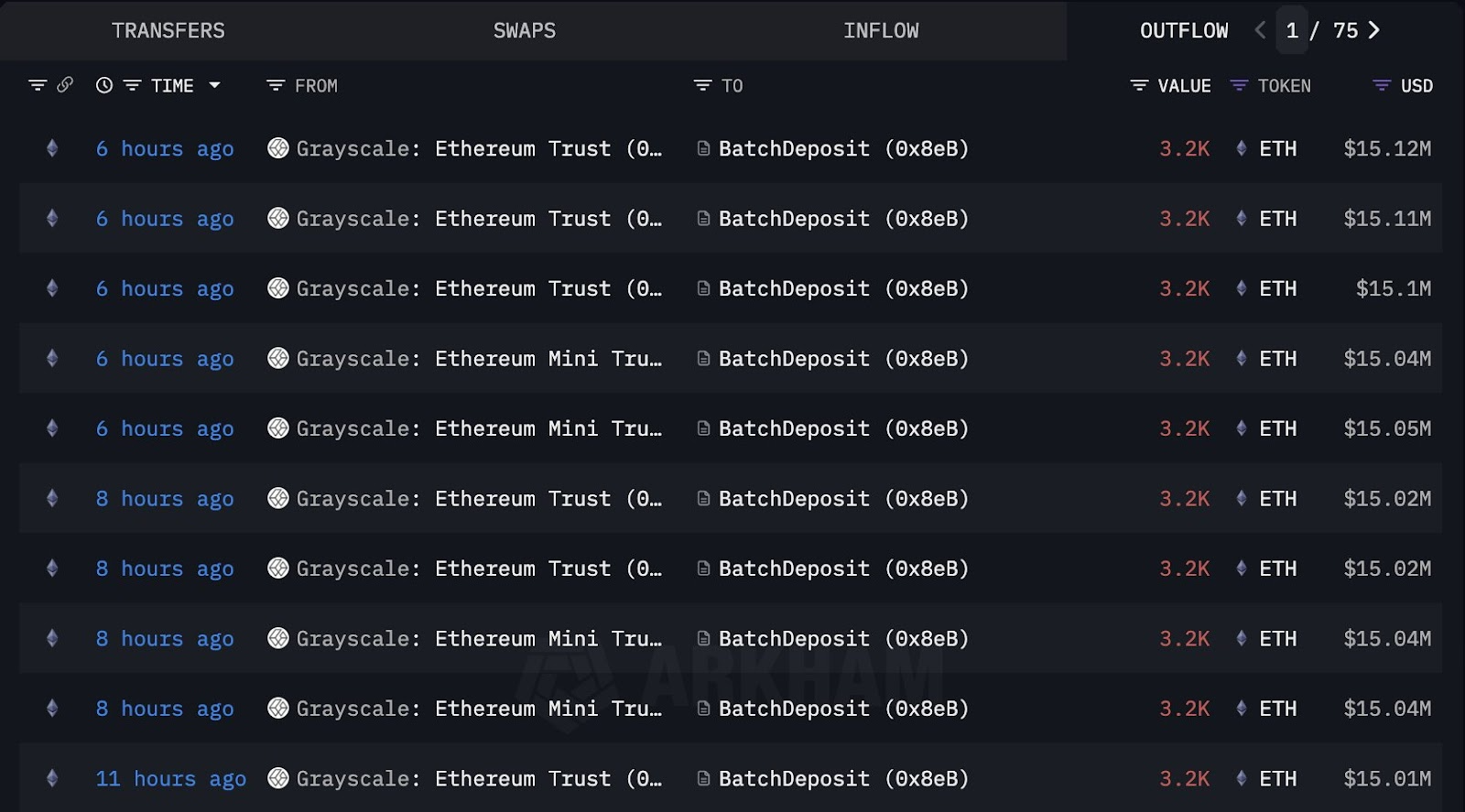

According to blockchain data, Grayscale staked 32,000 ETH, valued at roughly $150 million. This transaction occurred only a day after the firm rolled out staking features within its Ethereum ETPs.

With this launch, Grayscale became the first U.S.-based crypto fund issuer to offer passive income opportunities via staking. As outlined in the company’s ETP Staking Policy, the rewards generated will be treated as assets of the fund itself.

Shareholders will receive the majority of staking proceeds after sponsor and custodian fees are deducted:

-

Ethereum Trust (ETHE) investors will collect about 77% of net rewards.

-

Ethereum Mini Trust (ETH) investors will earn roughly 94% of rewards.

ETP vs. ETF: What’s the Difference?

Both the Grayscale Ethereum Trust (ETHE) and Ethereum Mini Trust (ETH) are structured as ETPs under the Securities Act of 1933. This sets them apart from traditional ETFs, which fall under the Investment Company Act of 1940.

This regulatory distinction means ETPs operate differently in terms of structure, governance, and investment flexibility compared to ETFs overseen by the 1940 framework.

A Busy October Ahead for the SEC

While Grayscale’s move establishes the first staking ETP in the U.S., October could be pivotal for crypto investment products. The U.S. Securities and Exchange Commission (SEC) faces decisions on 16 pending crypto ETP filings this month.

Two of these proposals specifically involve staking:

-

21Shares Core Ethereum ETF (TETH) is set for review on October 23.

-

BlackRock’s iShares Ethereum Trust (ETHA) amendment, seeking to add staking rewards, is expected on October 30.

Solana Staking ETFs and Other Developments

Earlier this year, the REX-Osprey Solana Staking ETF launched under the 1940 Act, becoming the first Solana staking fund with regulatory approval. This structure allows funds to hold spot assets directly and distribute staking rewards to investors.

Meanwhile, Grayscale’s Solana Trust (GSOL) has already enabled staking and is awaiting approval to uplist as an ETP.

Government Shutdown Clouds the Outlook

The ongoing U.S. government shutdown may slow regulatory progress. The SEC has announced it will be operating with “extremely limited staff,” which could delay responses to pending crypto ETP applications.

Yet uncertainty appears to be boosting investor appetite. Last week, crypto ETPs recorded all-time-high inflows of $5.95 billion, highlighting growing demand for decentralized assets amid market volatility and regulatory delays.

Also, feel free to share your thoughts on the topic in the comments. Besides, don’t forget to follow us on Telegram, YouTube, and Twitter for more analysis and updates.