idLiqwid Finance (LQ) is a decentralized liquidity protocol built on the Cardano blockchain. It allows users to lend and borrow ADA, Cardano Native Tokens (CNTs), and stablecoins. The protocol is developed with Plutus smart contracts, which are audited and secure.

Users can earn interest by supplying assets to liquidity pools or take instant loans by providing collateral without fixed repayment schedules.

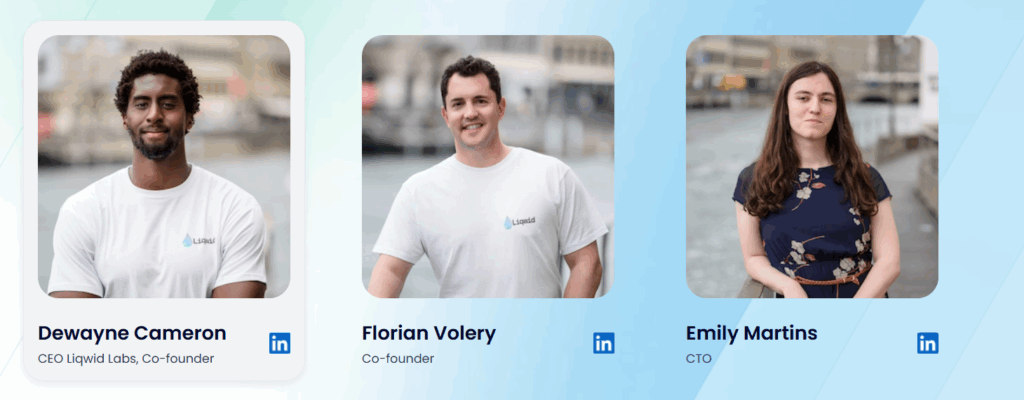

Team and Founders

Liqwid Finance is an open-source, noncustodial, algorithmic interest rate protocol designed for lenders, borrowers, and developers.

- Dewayne Cameron – CEO: Strategic direction and vision management

- Florian Volery: Protocol functionality and user experience

- Joshua Akpan: Protocol development and ecosystem alignment

- Tashoma Vilini: Protocol growth and DeFi-focused solutions

- Expertise: Haskell and TypeScript for reliable, smooth protocol development

Investors and Key Partners

- IOG (Input Output Global): Technical advisory and Plutus integration

- Minswap & SundaeSwap: DEX integrations for smooth asset flow

- WingRiders & Genius Yield: Cross-liquidity bridges within Cardano DeFi

- CASL (Cardano Staking ETP): Listed on SIX Swiss Exchange to increase accessibility

Project Concept

- Transform traditional finance lending models into decentralized, secure structures

- Provide peer-to-peer lending on Cardano without intermediaries

- Increase capital efficiency with pooled liquidity models

- Allow users to borrow or withdraw funds anytime

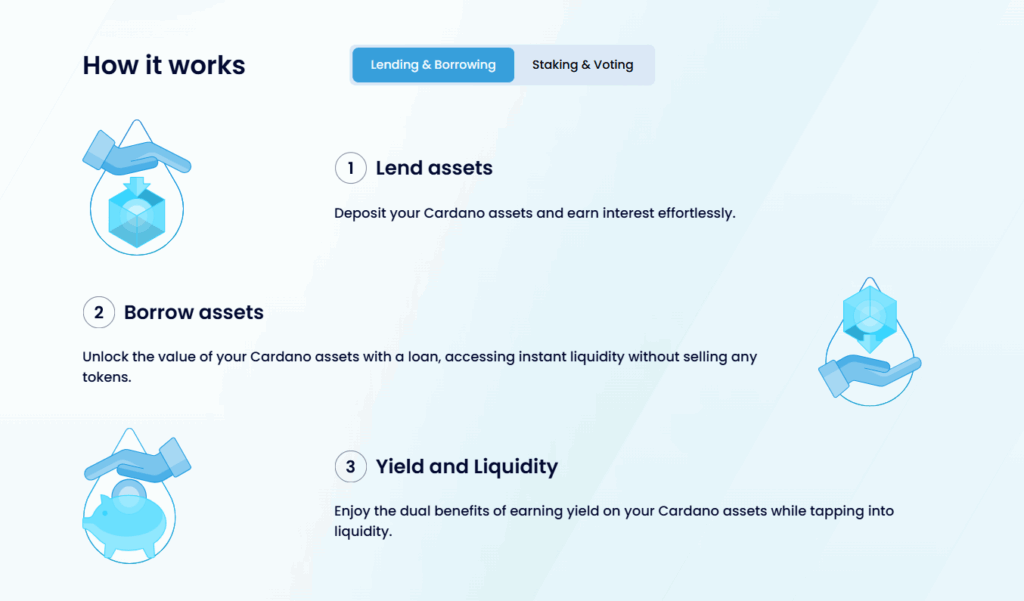

How It Works

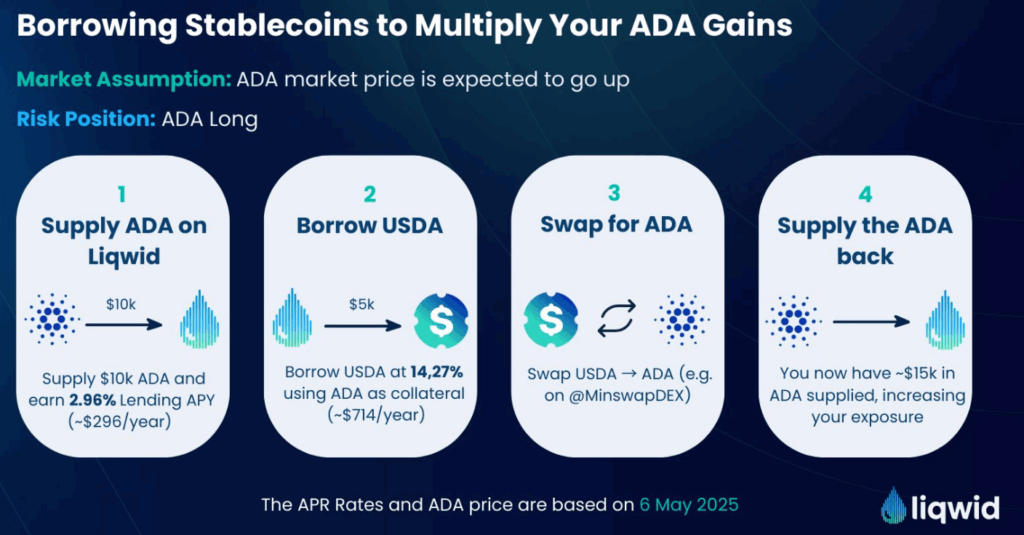

- Asset Supply: Deposit ADA and tokens in pools to earn interest

- Borrowing: Take instant loans using collateral without selling assets

- Yield & Liquidity: Earn interest while maintaining liquidity access

- qTokens: Interest-bearing representative tokens (qADA, qUSDC, etc.)

- Liqwid v2: 10x faster transactions and on-chain risk management

Governance (Liqwid DAO)

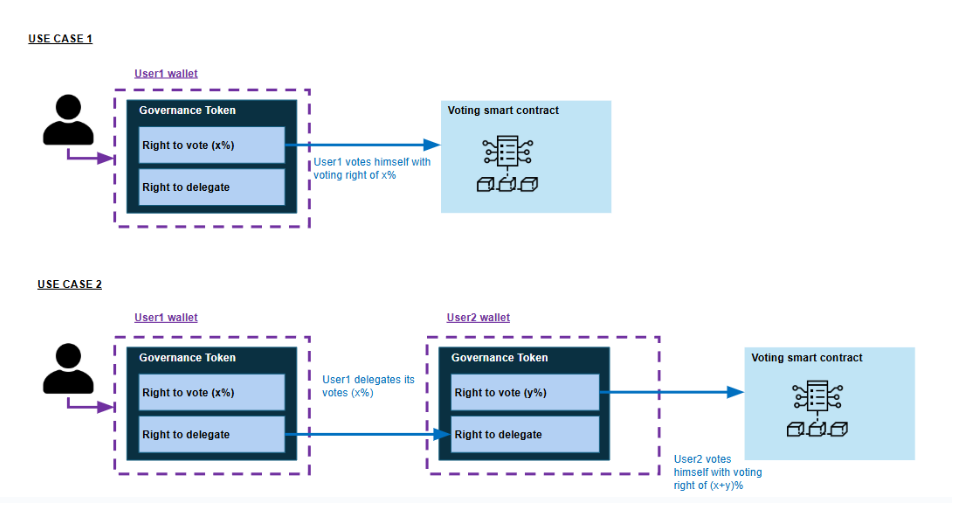

- LQ token holders vote on proposals or delegate voting rights

- DAO manages parameter changes, new markets, and treasury usage

- 1 LQ = 1 vote

- Staked LQ earns voting rights and a share of protocol revenue

Roadmap

- 2023 – v1 Launch: Mainnet deployment of Liqwid Protocol

- 2024 – v2 Update: 10x faster transactions, risk management tools, API upgrades

- 2025 – v3 (Planned): Cross-chain asset bridges, stablecoin integration, advanced oracle system, mobile app

Token Use Cases

- Governance voting and proposal submission

- Share in protocol revenue

- Staking rewards

- Incentives for liquidity providers

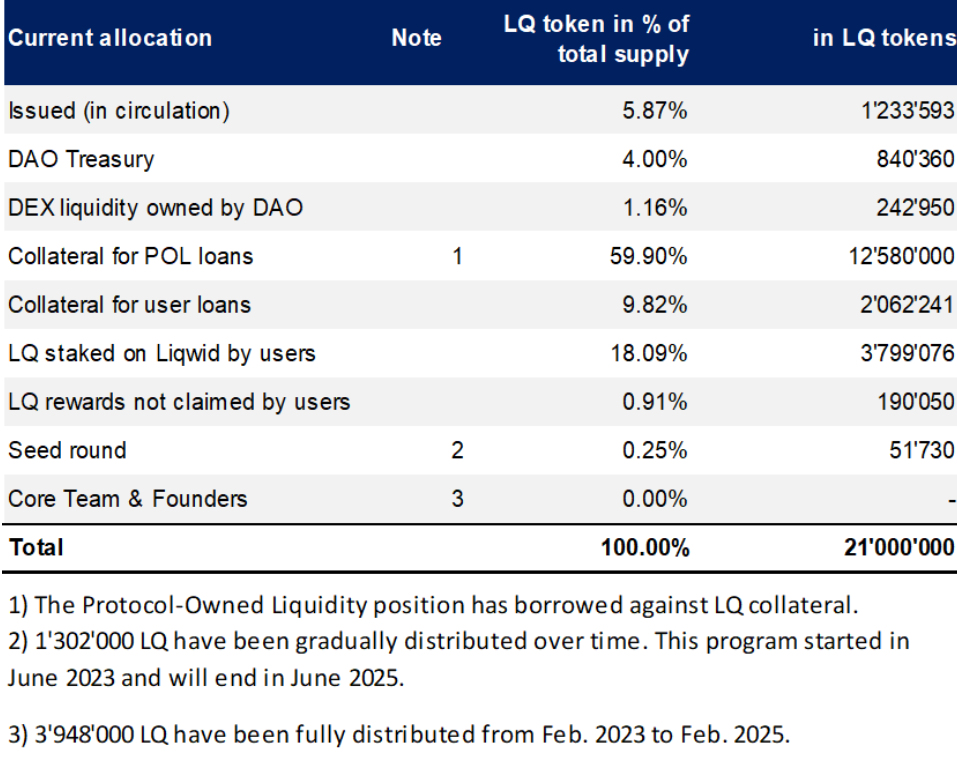

Liqwid Token Details

- Token Name: Liqwid DAO Token

- Symbol: LQ

- Total Supply: 21M LQ

- Max Supply: 21M LQ

- Circulating Supply: 20.14M LQ

- Blockchain: Cardano

Token Distribution

- Core Team, Founders & Advisors: 18.9%

- Seed Round Investors: 6.1% (linear vesting over 24 months, Feb 2023–Feb 2025)

- DAO Treasury & Community Incentives: 75% (community/protocol allocation, no vesting)

Ecosystem & Features

- Pooled Liquidity Model: High capital efficiency and flexible lending markets

- Risk Management: On-chain borrowing and supply limits

- qToken Mechanism: Assets continuously earn interest

- Automated Oracle System: Off-chain verified price updates

- Performance-Focused Architecture: Optimized API and transaction infrastructure in v2

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.