Coral Finance is a DeFAI (DeFi + AI) application layer and marketplace for pre-market assets. Users can discover early-stage opportunities, alpha projects, “gems,” and pre-listing assets, trade them, and participate in their growth. Coral aims to fill a market gap by creating a pre-listing market with high growth potential before the Token Generation Event (TGE).

Vision: Build a hub where everyone can find alpha opportunities, earn yield, and provide liquidity for pre-market assets.

Project Concept & Purpose

- The main goal of Coral Finance is to establish an efficient market and liquidity center for pre-market assets. The project targets the following problems:

- Minimize liquidity acquisition costs for protocols

- Provide the best pricing

- Reduce credit risks in OTC trades

- Allow users to track high-potential pre-listing assets

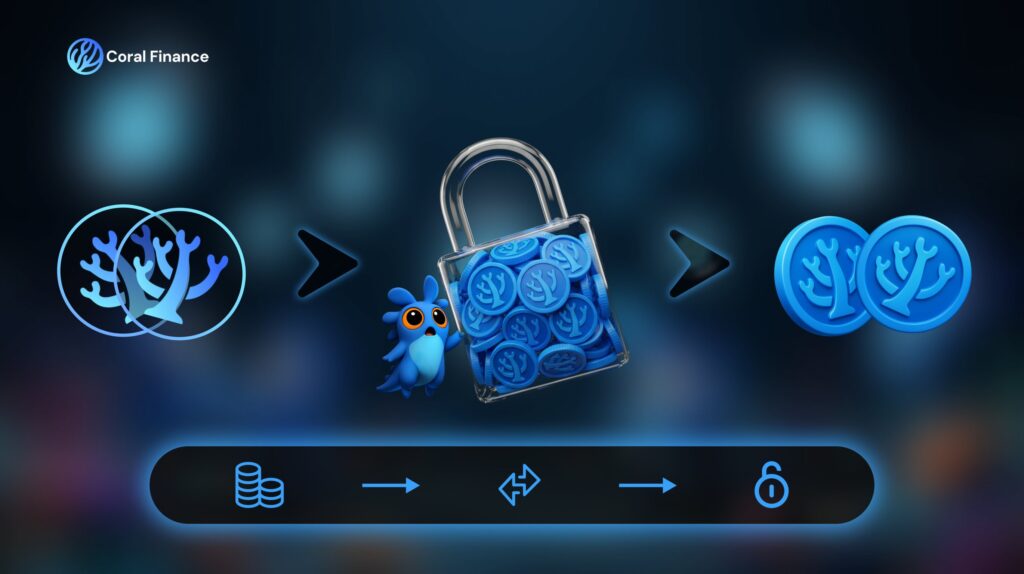

- Coral measures user participation through a points mechanism, which can be converted into corTokens.

How It Works

- Earning Points: Users earn points by contributing to specific protocols. These points reflect their participation and effort.

- Converting to corToken: Earned points are converted 1:1 into corTokens. Initially locked, these tokens gradually unlock and can be used for trading, liquidity provision, or staking.

- Liquidity & Swaps (CorSwap): Users can swap corTokens or provide liquidity to earn trading fees and $CORL rewards.

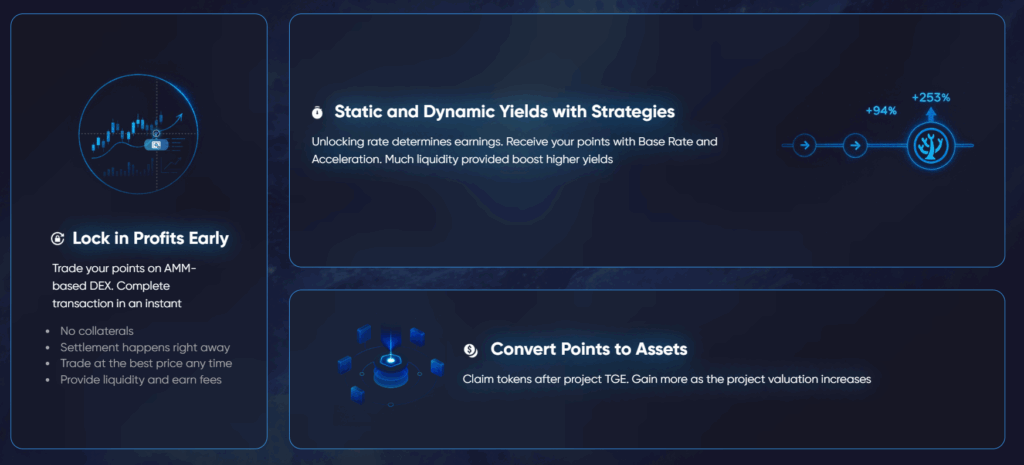

- Early Profit Realization (L.t.U): The Locked to Unlock mechanism allows gradual token unlocking, which can be accelerated by providing liquidity.

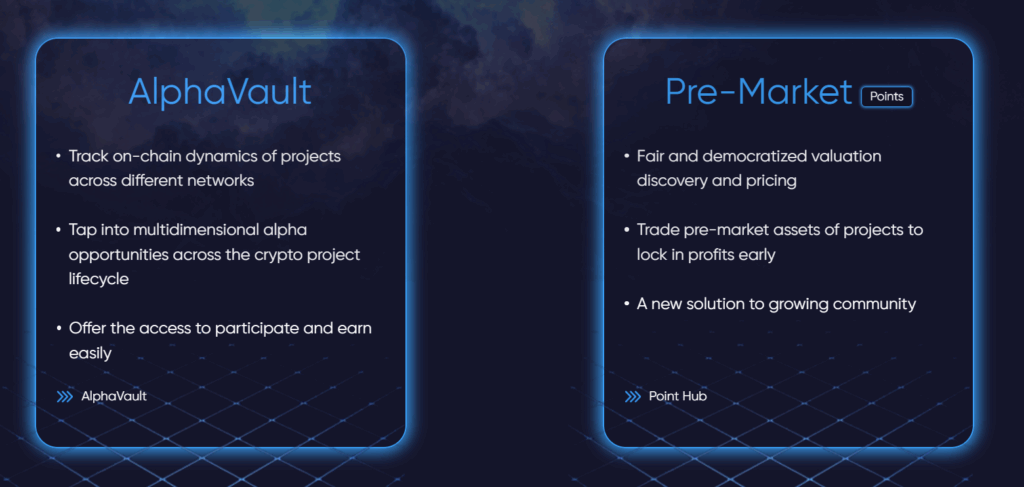

- AlphaVault for Opportunity Discovery: AI-powered EchoTrader and Yield Collection modules help users find early opportunities and profit from high-yield strategies.

Partners & Investors

Coral Finance has raised $3 million and is backed by investors like TAISU, DWF Ventures, KuCoin Ventures, Gate Ventures, Mark, Formless Capital, Movement, XUFLY Labs, Web3PORT, and Goplus. Strategic partners include Avalon Labs, KiloEx, Honeypot Finance, UXLink, Meridian, and Lumoz.

CoralDex

CoralDex is a UniswapV2-based DEX within the Coral Finance ecosystem. Users can swap corTokens and paired tokens, provide liquidity, earn trading fees, and $CORL rewards. Staking corTokens accelerates unlocking and allows early profit realization.

$CORL Token

- Symbol: $CORL

- Blockchain: BNB Chain

- Total Supply: 1,000,000,000 CORL

- Max Supply: 1,000,000,000 CORL

- Circulating Supply: 207,600,000 CORL

$CORL is Coral Finance’s native utility token and will be used across all platform economic activities.

Roadmap

- 2024: Community building, beta product (PC & mobile), airdrop function

- 2024 Q3: Launch on EVM-compatible networks, multi-language support, LP incentives

- 2024 Q4 – 2025 Q1: Testnet and mainnet launch, second funding round, Reef Point trading

- 2025 Q2: AlphaVault and EchoTrader launch, $15M trading volume target

- 2025 Q3-Q4: Yield Collection, on-chain DCA strategy, DeFAI partner program

- Coral Finance’s $CORL token will be listed on Binance Alpha on October 12.

Features

- Pre-Market Assets: Earn points, NFTs, and allowlist rights before TGE for early opportunities.

- corToken & Points: Convert earned points into tradable corTokens

- corSwap: Fast token swaps and liquidity rewards in $CORL

- L.t.U Mechanism: Gradual token unlocking for early profit realization

- AlphaVault: Discover opportunities with AI-powered tools

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.