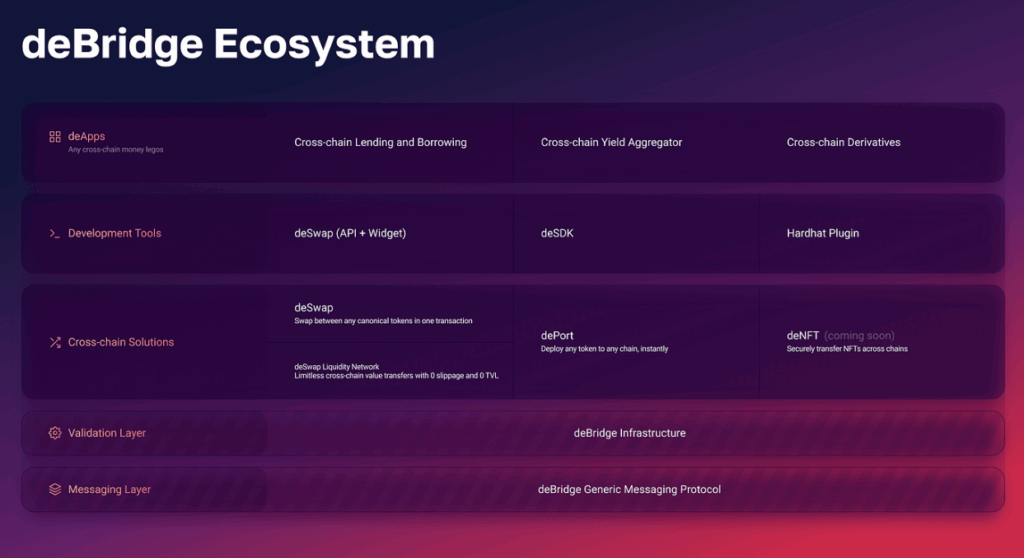

deBridge is a modular protocol described as the “Internet of DeFi,” providing cross-chain interoperability, liquidity, messaging, and bridging infrastructure. The project aims to enable secure, real-time, and capital-efficient transfers of assets and data across more than 30 blockchains.

Launched on mainnet in 2022, deBridge has been used by over 385,000 users, surpassing $2.35 billion in transaction volume without any security incidents or network downtime. Its goal is to unify cross-chain liquidity and empower DeFi applications with seamless interoperability.

Team Information

deBridge was founded in 2021.

Founders:

-

Alex Smirnov – CEO & Co-Founder: Expert in DeFi infrastructure and cross-chain systems.

-

Artem Podgorodnyy – CTO & Co-Founder: Specialist in security, software architecture, and node infrastructure.

-

Andrei Semenov – COO & Co-Founder: Responsible for business development, community, and strategic partnerships.

The team consists of experienced developers active across various blockchain networks. The protocol’s security has been audited by Halborn, Ackee, Zokyo, and other independent firms.

Investors and Key Partners

From its early stages, deBridge has collaborated with numerous strategic partners.

Partners include:

-

Jupiter

-

Solflare

-

Birdeye

-

Zeta Markets

Verified Investors:

-

ParaFi Capital

-

Animoca Brands

-

Lemniscap

-

MGNR

Additionally, several DeFi funds, angel investors, and network validators support the project.

Project Vision

deBridge aims to make asset and data transfers across blockchains secure, modular, and capital-efficient. It was developed to eliminate security flaws, liquidity fragmentation, and TVL lock requirements that exist in conventional bridge protocols.

Project slogan: “Build once — interoperate everywhere.”

This allows developers to build multi-chain DeFi applications using a single unified infrastructure.

How It Works

deBridge operates on an independent validator network that verifies cross-chain transactions. Each validator signs operations through smart contracts deployed on supported blockchains to ensure secure execution.

Core Components:

-

DLN (deBridge Liquidity Network):

Enables single-transaction swaps and transfers without liquidity lockups.

Uses a “just-in-time” liquidity model powered by market makers. -

dePort:

Employs a lock-and-mint system to create 1:1 collateralized cross-chain token representations (deAssets).

Ensures tokens maintain consistent value across all chains. -

deBridge Messaging:

Enables smart contracts to communicate across chains — triggering functions, minting NFTs, or executing custom logic. -

Hooks Framework:

Allows automation of strategies such as auto-trading, vault rebalancing, and custom on-chain flows directly on the bridge.

These four modules can operate independently or in combination to power all cross-chain infrastructures.

Governance

deBridge governance is community-driven through DAO mechanisms involving DBR token holders.

-

The community votes on validator selection, new chain integrations, fund allocation, and protocol parameters.

-

Validators stake DBR tokens as security collateral.

-

A slashing mechanism penalizes misconduct or system breaches.

-

Governance will gradually transition to full DAO control over time.

Roadmap

-

2021: Testnet launch and early development.

-

2022: Mainnet launch.

-

2023: Release of DLN and dePort components.

-

2024–2025:

-

DBR token launch

-

DAO governance activation

-

Delegated staking and validator module

-

Expansion of Interoperability-as-a-Service (IaaS) model

-

Token Utility

The DBR token serves as deBridge’s governance and security token.

Use Cases:

-

DAO governance participation

-

Validator staking and security collateral

-

Ecosystem fund management

-

Chain integration voting

-

Incentives and rewards

What Is DBR?

The DBR token is the native governance and utility asset of the deBridge ecosystem. Holders shape the protocol’s future through voting on validator selection, fee structures, and governance parameters.

Beyond governance, DBR also plays a role in network security — token holders can stake DBR to support validators and earn rewards from protocol fees. This aligns community incentives with the protocol’s long-term sustainability.

DBR combines governance, staking, and transaction capabilities to form the cornerstone of deBridge’s cross-chain ecosystem.

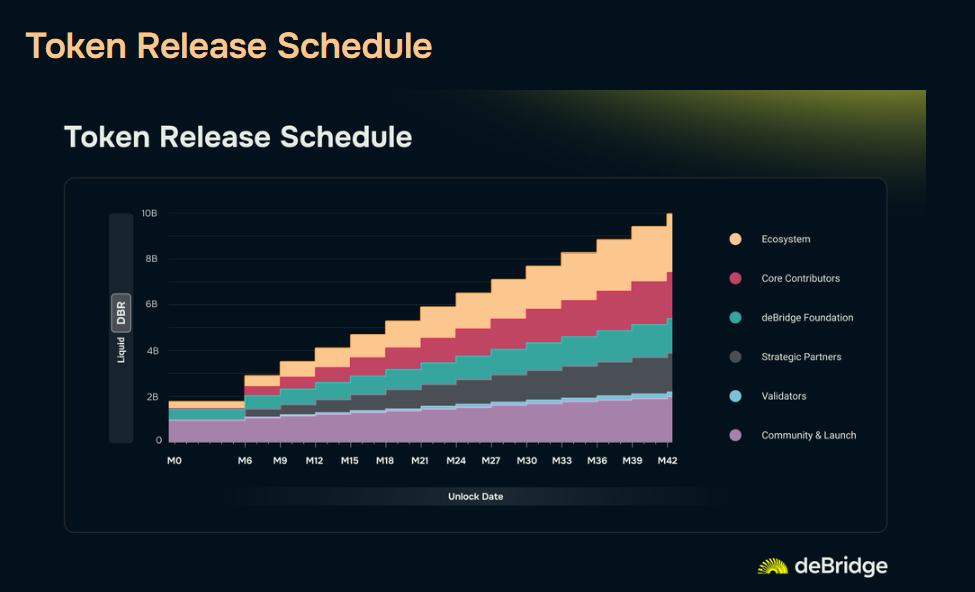

Token Details

-

Token Name: deBridge

-

Symbol: DBR

-

Total Supply: 10,000,000,000 DBR

-

Token Type: Governance & Utility

-

Network: Ethereum (multi-chain support)

-

Max Supply: 10,000,000,000 DBR

-

Circulating Supply: 1,800,000,000 DBR

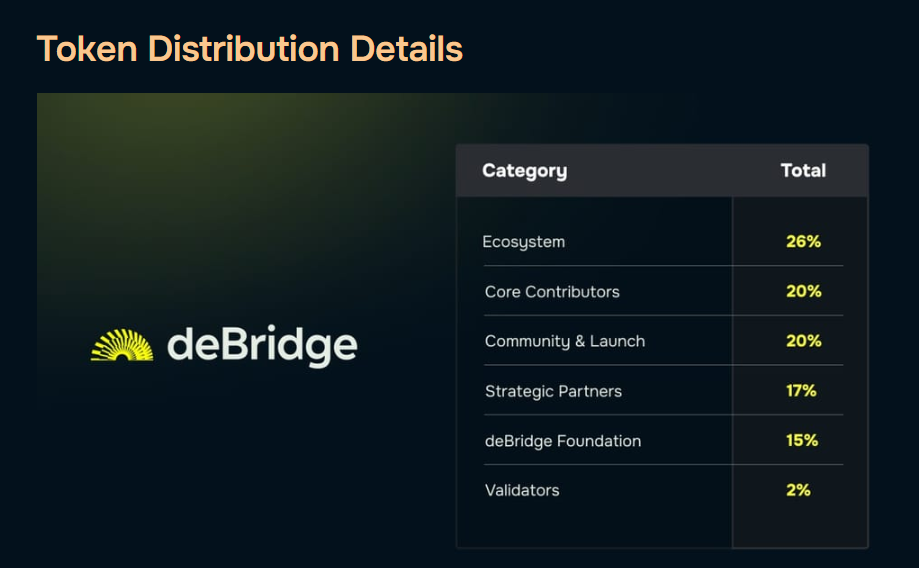

Token Distribution

-

Ecosystem: 26% (2.6B DBR)

-

Community & Launch: 20% (2B DBR)

-

Core Contributors: 20% (2B DBR)

-

Strategic Partners: 17% (1.7B DBR)

-

deBridge Foundation: 15% (1.5B DBR)

-

Validators: 2% (200M DBR)

Ecosystem

deBridge supports EVM-compatible chains, Solana, Cosmos SDK-based networks, and emerging Layer-2 solutions.

This broad compatibility enables both developers and users to interact seamlessly across chains.

Use Cases:

-

DEXs: Cross-chain swaps and liquidity management in a single transaction.

-

DeFi Lending: Deposit collateral on one chain and borrow on another.

-

Staking: Cross-chain staking and yield opportunities.

-

Gaming: Transfer NFTs and in-game assets across blockchains.

-

Governance: Participate in cross-chain DAO voting.

-

Prediction Markets: Place bets and participate in markets seamlessly across chains.

Key Features

-

Modular architecture: Components can be used individually or combined.

-

Capital efficiency: DLN enables liquidity access without TVL lockups.

-

Canonical asset system: 1:1 collateralized deAssets across chains.

-

Developer-friendly: TypeScript SDKs, REST/gRPC APIs, GraphQL, and React widgets.

-

Security: Audited by Halborn, Ackee, and Zokyo.

-

Multi-chain compatibility: Works with EVM, Solana, Cosmos SDK, Layer-2, and emerging blockchains.

Official Links

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.