Creditlink (CDL) is a groundbreaking platform revolutionizing decentralized finance through advanced on-chain credit infrastructure. By transforming wallet behaviors into transparent, dynamic, and interoperable credit scores, it enables collateral-free lending, fairer airdrops, smarter DAO governance, and more. This article delves into what Creditlink is, how it operates, and the opportunities it unlocks.

What is Creditlink (CDL)?

Creditlink (CDL) pioneers next-generation on-chain credit and reputation infrastructure. Through ChainProof, OnchainMind, CredScore, and CredVault, it analyzes wallet behavior to enable credit-based DeFi, governance, and airdrops. With a 2025 roadmap targeting ChainProof launch and 300,000+ users, Creditlink drives trust and value in Web3.

Creditlink addresses the challenges posed by the lack of standardized identity and credit scoring in the Web3 ecosystem. As on-chain user data grows, DeFi and DAOs often rely on over-collateralization or off-chain identity checks, stifling innovation. Creditlink establishes an AI-powered on-chain credit scoring system that:

-

Analyzes multi-chain wallet behaviors.

-

Generates AI-driven credit scores and reports.

-

Powers various credit-based applications.

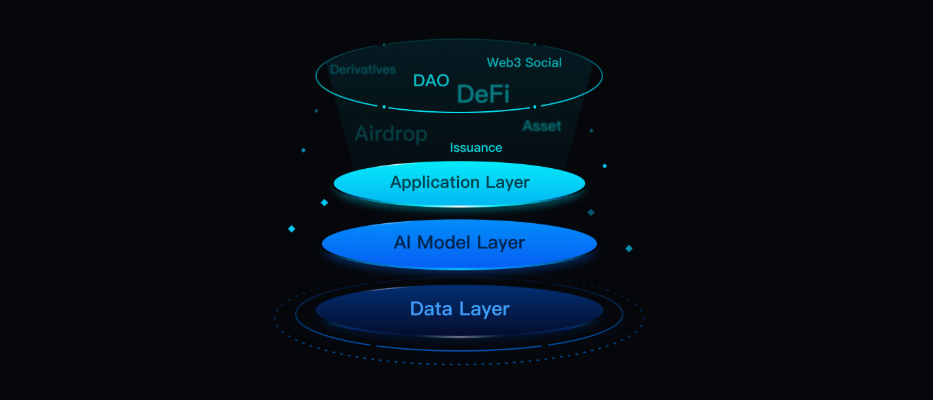

Core Modules:

-

On-Chain Data Engine: Collects historical transaction data, asset compositions, and protocol interactions from Ethereum, Polygon, BNB Chain, Solana, and more.

-

AI Credit Scoring Model: Uses machine learning to produce multidimensional scores: Asset Strength, Behavioral Credit, and Risk Coefficient.

-

Credit-Based Applications: Meets data needs for retail investors and institutions.

Purpose of Creditlink (CDL)

Creditlink aims to build a smart infrastructure for on-chain credit and reputation. It offers modular tools for behavioral analysis, AI credit scoring, and staking-based rewards, empowering protocols, DAOs, and developers to unlock the full potential of blockchain-native identities.

Products:

-

ChainProof: A multi-chain address intelligence database aggregating wallet activity, identity signals, and behavioral patterns.

-

OnchainMind: A behavioral analytics engine using AI clustering and graph models to interpret wallet interactions across contracts and protocols.

-

CredScore: An AI-driven reputation scoring system evaluating asset value, behavioral credit, and risk coefficient.

-

CredVault: A staking and reward platform where reputation scores enhance staking benefits, fostering a cycle of positive behavior.

How Does Creditlink (CDL) Work?

Creditlink leverages on-chain analytics to interpret wallet behavior. Its Smart Analysis evaluates wallet value and creditworthiness, while Batch Analysis filters Sybil addresses for airdrop targeting.

Use Cases:

-

Token Airdrops: Sybil detection, analyzing up to 3,000 wallets per batch.

-

Project Investment/IDO: On-chain trading audits and smart money detection.

-

On-Chain Governance: Multidimensional profiling and risk signal alerts.

-

On-Chain Finance/Lending: Credit evaluation and risk profiling.

2025 Roadmap:

-

Q2: Official website launch, cross-chain data aggregation beta, Sybil labeling, 30,000+ users, Token Generation Event (TGE).

-

Q3: ChainProof launch, OnchainMind deployment, Credit-to-Earn model, 150,000+ users, CSL token listing.

-

Q4: CredScore development, API access with PDF report exports, CredVault launch, 300,000+ users.

Creditlink (CDL) Use Cases

Creditlink provides on-chain intelligence for Web3 projects and users:

-

Airdrop Targeting: Sybil filtering and high-value wallet identification.

-

Investment/IDO: On-chain audits and smart money tracking.

-

Governance: Fair voting and Sybil resistance.

-

DeFi: Credit-based lending and risk analysis.

Usage Steps:

-

Visit the Creditlink website and connect a wallet.

-

Use Address Analysis to obtain wallet scores.

-

Perform batch filtering with Batch Analysis.

-

Integrate via API for advanced functionality.

Advantages of Creditlink (CDL)

-

Transparency: On-chain behavioral analysis.

-

Security: Sybil and risk detection.

-

Efficiency: AI scoring and batch analytics.

-

Inclusivity: Credit-driven DeFi solutions.

Creditlink (CDL) Tokenomics

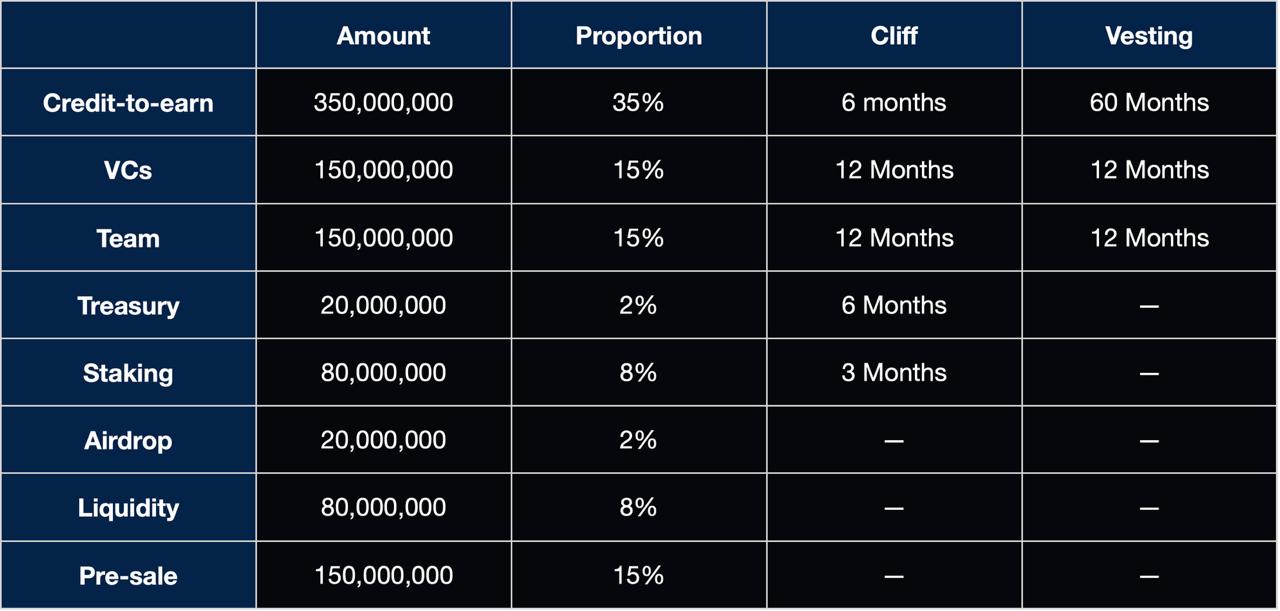

$CDL operates on BNB Chain with a fixed total supply of 1,000,000,000.

-

Allocation:

-

Credit-to-Earn: 35%

-

Venture Capital: 15%

-

Team: 15%

-

Treasury: 2%

-

Staking: 8%

-

Airdrop: 2%

-

Liquidity: 8%

-

Pre-Sale: 15%

-

Utilities: Access (premium features), Incentives (community contributions), Governance (1 Token = 1 Vote), Reputation/Staking (score weight), Ecosystem Integration (dApps).

Creditlink (CDL) Team

The Creditlink team is dedicated to building modular infrastructure for Web3 reputation and intelligence.

Official Links

You can share your comments on the topic with us. Moreover, if you would like to see more informative content like this, you can follow us on our Telegram, Youtube, and Twitter channels.