YieldBasis (YB) is an innovative DeFi protocol that allows users to provide BTC liquidity to an automated market maker (AMM) pool without impermanent loss (IL) while earning trading fees. This article explores what YieldBasis is, how it functions, and the opportunities it presents.

What is YieldBasis (YB)?

YieldBasis is a platform that leverages BTC liquidity in a 2x leveraged BTC/crvUSD pool. Users deposit BTC and receive ybBTC tokens, which track BTC’s price 1:1 and generate Curve trading fees. The protocol borrows crvUSD to maintain a 2x leverage (50% debt-to-value ratio), eliminating impermanent loss. Users can hold unstaked ybBTC to earn BTC-denominated fees or stake ybBTC to receive YB token emissions. YB tokens, when vote-locked as veYB, grant governance power and a share of protocol fees.

Purpose of YieldBasis (YB)

YieldBasis addresses impermanent loss in traditional AMMs, where position value grows as √p, leading to losses compared to holding BTC directly. By applying 2x leverage, YieldBasis ensures position value scales with p (BTC price), eliminating IL while still capturing trading fees.

How Does YieldBasis (YB) Work?

YieldBasis creates a 2x leveraged position and maintains it through automated rebalancing:

-

BTC Deposit: Users deposit BTC and receive ybBTC.

-

crvUSD Borrowing: The protocol borrows crvUSD equal to the USD value of the BTC and adds both to the Curve BTC/crvUSD pool.

-

LP Collateral: The resulting Curve LP token serves as collateral for the debt.

-

2x Leverage: The debt-to-value ratio is kept at 50%.

-

Automated Rebalancing: When BTC price shifts, the Rebalancing AMM and Virtual Pool incentivize arbitrageurs to restore the 50% ratio.

BTC Price Changes:

-

Price Up: Debt ratio falls below 50%; arbitrageurs add crvUSD, mint LP, and increase debt.

-

Price Down: Debt ratio exceeds 50%; arbitrageurs withdraw LP to repay debt.

Fee Distribution:

-

50% is used for pool rebalancing.

-

50% is split between unstaked ybBTC (BTC fees) and veYB (admin fees) via a dynamic admin fee.

-

Staked ybBTC earns YB emissions.

YieldBasis (YB) Use Cases

YieldBasis serves the following DeFi purposes:

-

Liquidity Provision: Deposit BTC to earn fees without impermanent loss.

-

Staking: Stake ybBTC to earn YB token emissions.

-

Governance: Lock YB as veYB for voting rights and fee sharing.

Usage Steps:

-

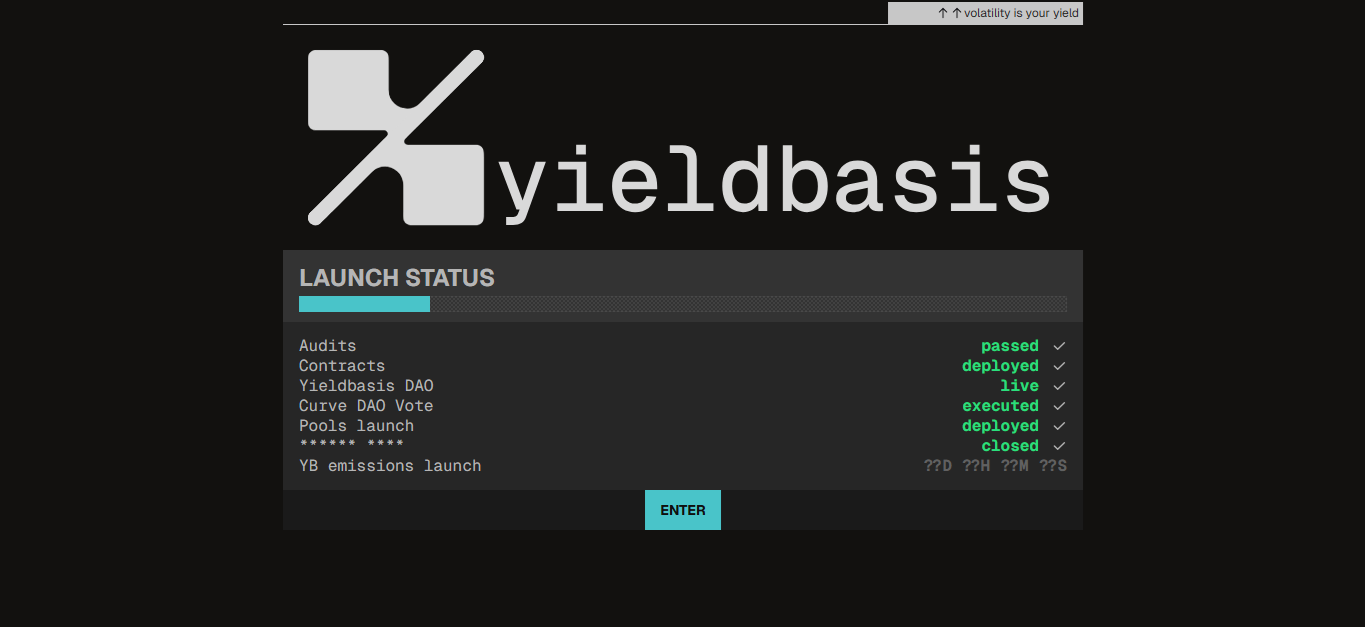

Visit the YieldBasis website and connect a wallet.

-

Deposit BTC to receive ybBTC.

-

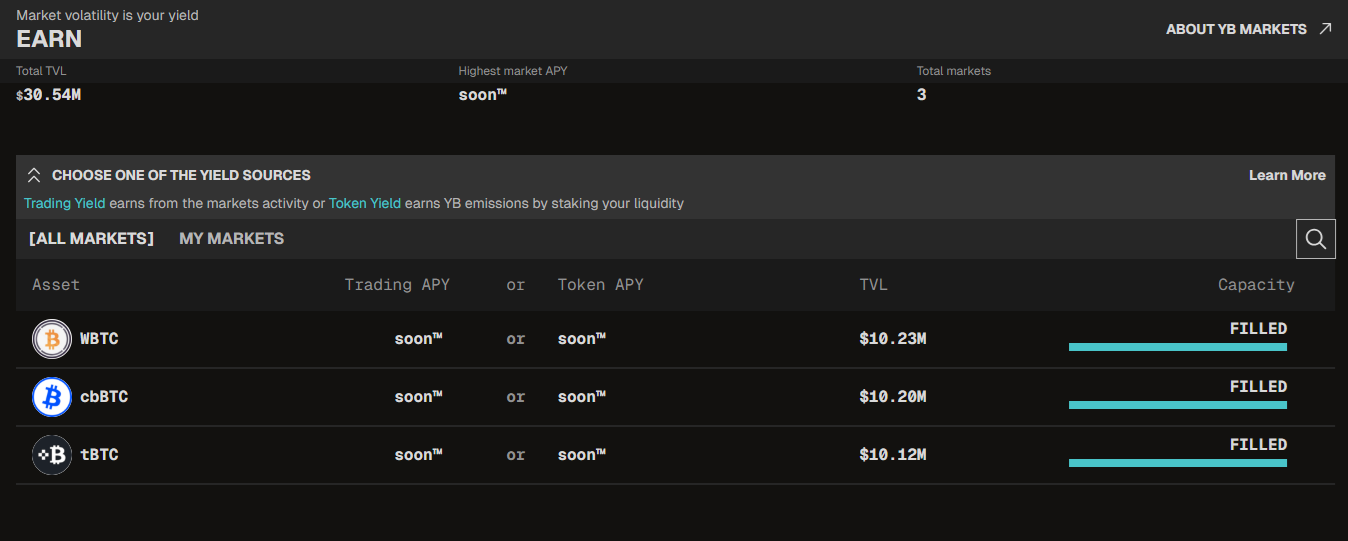

Choose Trading Yield (BTC fees) or Token Yield (YB emissions).

-

Burn ybBTC to withdraw BTC and accrued yield anytime.

Advantages of YieldBasis (YB)

-

No Impermanent Loss: 2x leverage ensures 1:1 BTC tracking.

-

Yield: Curve trading fees and YB emissions.

-

Automation: Arbitrageurs handle rebalancing.

-

Flexibility: Deposit or withdraw anytime.

Risks of YieldBasis (YB)

-

Debt Risk: crvUSD peg deviations.

-

Rapid Price Swings: Temporary spread widening.

-

Governance: Adjustments to debt ratios.

YieldBasis (YB) Tokenomics

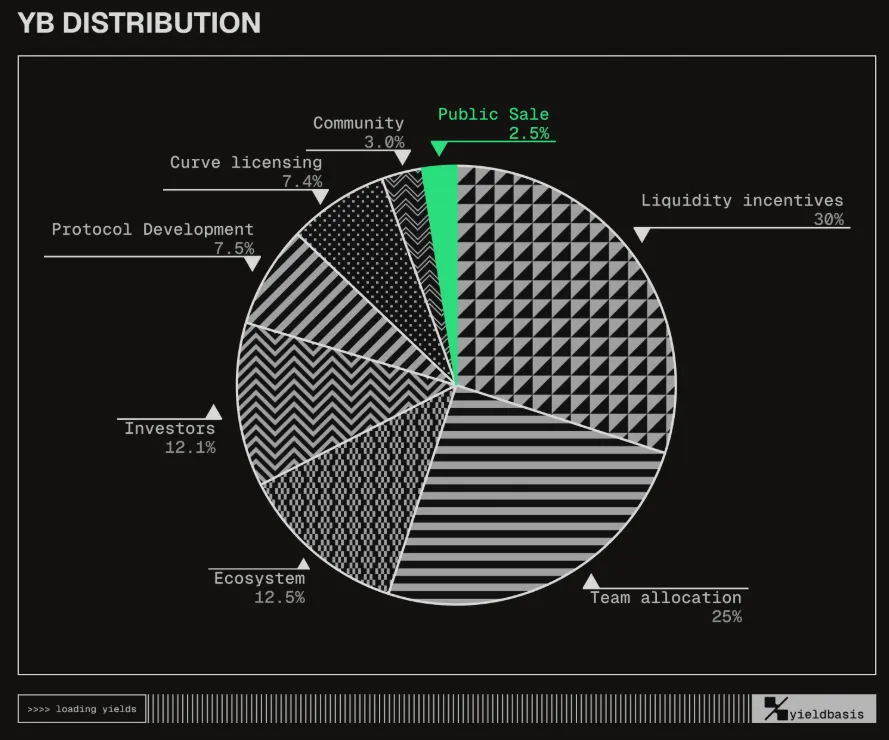

Total YB supply is not specified. Allocation:

-

Team: 25%

-

Liquidity Incentives: 30%

-

Public Sale: 2.5%

-

Community: 3%

-

Curve Licensing: 7.4%

-

Protocol Development: 7.5%

-

Investors: 12.1%

-

Ecosystem: 12.5%

YB Utilities:

-

Access: Unlock premium features.

-

Incentives: Rewards for community contributions.

-

Governance: veYB enables voting.

-

Staking: Locking YB for fee sharing.

veYB: Lock YB for up to 4 years; 4 years = 1 veYB, 1 year = 0.25 veYB. veYB is transferable as an NFT (only for max lock).

YieldBasis (YB) Investors

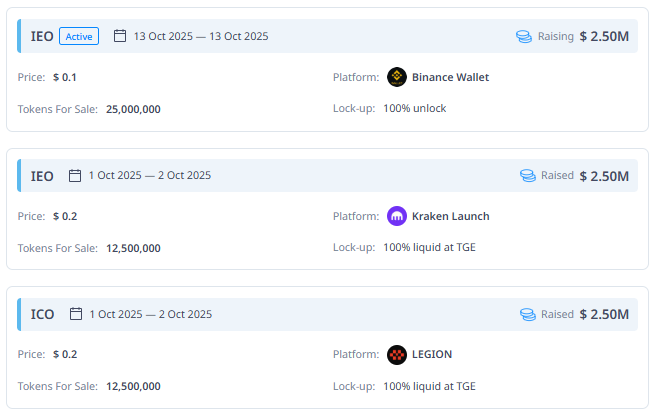

YieldBasis secured significant funding in 2025. On October 13, 2025, an Initial Exchange Offering (IEO) on Binance Wallet raised $2.5 million by selling 25 million YB tokens at $0.1 each, with tokens fully unlocked.

Between October 1-2, 2025, another IEO on Kraken Launch raised $2.5 million by selling 12.5 million YB tokens at $0.2 each, fully liquid at the Token Generation Event (TGE). Concurrently, an Initial Coin Offering (ICO) on the LEGION platform raised $2.5 million by selling 12.5 million YB tokens at $0.2 each, also fully liquid at TGE.

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.