The cryptocurrency market has entered a recovery phase following the sharp sell-off triggered by U.S. President Donald Trump’s threat to impose 100% tariffs on Chinese goods. Bitcoin (BTC) has climbed back above $115,000, while Ethereum (ETH) tested the $4,100 level. However, the recent volatility has also raised investor concerns over exchange security and liquidation processes.

Trump’s Tariff Threat Sparks Global Sell-Off

On Friday, Trump’s announcement of 100% tariffs on Chinese imports rattled global markets. The crypto sector saw $19 billion in liquidations, with many traders affected by forced closures of leveraged positions.

Major exchanges such as Binance, OKX, and Bybit experienced surging trading volumes, while some users reported system slowdowns and losses, expressing their frustration on social media. Trump’s “open to dialogue with China” remarks over the weekend helped spark partial relief across markets by Monday morning.

BNB Regains Strength

Amid the turbulence, Binance Coin (BNB) showed a remarkable recovery. Despite the weekend’s decline, BNB surged past $1,300, reclaiming its place among the strongest assets in the market. The token’s market capitalization reached $185 billion, surpassing Tether (USDT) to become the third-largest cryptocurrency.

However, some analysts note that BNB’s rebound may be driven as much by investor sentiment as by organic demand. Given past network congestion and liquidation-related frustrations, certain users remain cautious about Binance’s operational stability, despite the coin’s impressive recovery.

CZ: “BNB’s Strength Comes from Its Long-Term Ecosystem”

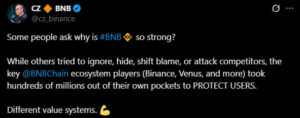

Binance co-founder Changpeng Zhao (CZ) commented on the recent rally, emphasizing that BNB’s value is driven by real-world utility rather than short-term speculation:

“Short-term fluctuations are normal. BNB’s success is sustained through daily use and strong community support.”

CZ’s statement received mixed reactions within the Binance community. While some users demanded compensation for recent losses, saying “cover the losses first,” others expressed confidence in BNB’s long-term potential and the continued growth of the Binance ecosystem.

Analyst Commentary: “Recovery Is Conditional on Confidence”

Crypto analysts assessed the current situation as follows:

“BNB’s rally is technically impressive, but investor confidence remains fragile. Binance’s communication and compensation process during the recent volatility are critical to restoring trust in the market.”

Experts note that Binance’s $283 million compensation last week was a key step in maintaining user confidence. However, the general consensus is that fully restoring market trust will take time.

As the crypto market gradually recovers from the Trump-induced turmoil, BNB’s price is showing strong signs of rebound. At the same time, user confidence and expectations for exchange transparency remain central. Market observers believe that BNB’s future will depend not only on price performance but also on the trust Binance builds with its users during crisis periods.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.