Yei Finance is a decentralized and non-custodial money market protocol built on the Sei network. Its main goal is to unify fragmented liquidity and provide users with borrowing, swapping, and cross-chain transfer functions on a single platform, allowing them to earn stacked yields.

The platform offers flexible tools for managing crypto assets:

-

Earn passive income by increasing liquidity through deposits

-

Borrow using overcollateralized or undercollateralized loans

-

Manage risk with advanced tools

Supported assets include LRTs, LSTs, and major cryptocurrencies such as SEI, USDC, and ETH. The protocol is designed to adapt to new asset classes.

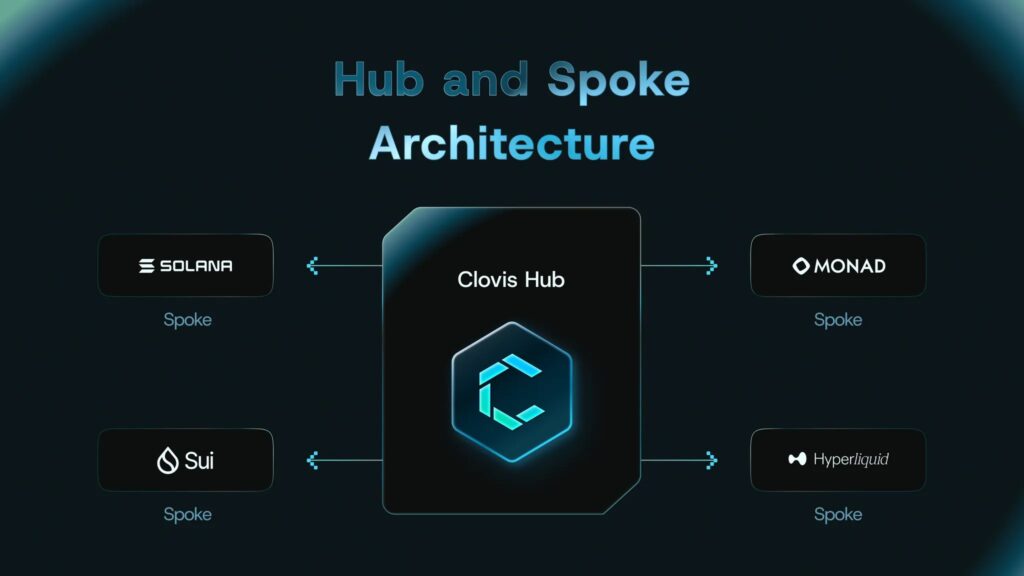

Clovis is Yei’s cross-chain extension — a liquidity abstraction layer that unifies fragmented liquidity.

Using Sei’s hub-and-spoke architecture, it integrates lending, DEX, and bridge services, combining each deposit with lending, swap, and bridge yields (stacked yield).

Currently, Yei Finance has over $600 million TVL and generates $6.6 million in annual revenue, making it one of the largest dApps on Sei.

Team and Founders

Yei Finance was developed by Yei Labs, based in Taipei.

The team consists of experienced DeFi and blockchain professionals:

-

CEO: Austin Chien – Strategic leader with finance and blockchain expertise.

-

CTO: Frank Wang – Smart contract and cross-chain architecture lead.

-

CMO: Jason Hsu – Marketing and community growth head.

Despite maintaining partial anonymity, the team has demonstrated strong technical competence through systems inspired by Aave V3 and Uniswap. Their community-driven approach helped them reach $130M TVL in early stages.

Investors and Key Partners

Seed Round (Dec 2024): $2M

Lead Investor: Manifold Trading

Other Investors: DWF Ventures, Kronos Research, Outlier Ventures, Side Door Ventures, WOO Network

Strategic Partnerships:

-

Sei Network: Core infrastructure, Clovis hub chain

-

Wormhole: Secure cross-chain messaging

-

Sailor Finance: CLO IDO platform for Yeiliens NFT holders

-

KuCoin: CLO spot trading (Oct 14, 2025)

-

Binance Wallet: Bridge and reward campaigns

-

Hypernative & Packshield: Security integrations

These partnerships strengthen liquidity, security, and accessibility across Yei’s ecosystem.

Project Vision

Yei Finance leverages Sei’s sub-second finality to connect fragmented DeFi components. Clovis is positioned as a “DeFi Operating System”, solving liquidity fragmentation through a hub-and-spoke architecture — Sei acts as the hub, while Arbitrum, Ethereum, and other networks function as spokes.

Users can deposit on one chain (e.g., Arbitrum) and borrow on another (e.g., Base) without switching networks. Initially developed as an Aave V3 fork, Yei evolves through Clovis to maximize capital efficiency and optimize yield.

How It Works

Deposit Assets: Users deposit SEI, USDC, ETH, LSTs, LRTs, etc. across 10+ EVM chains.Batch deposits prevent fragmentation and reward users with Clovis Points and APY.

Borrow Assets: Supports overcollateralized and flash loans.Universal interest rates (e.g., fixed APR for USDC) and E-mode optimize capital efficiency.

Swap & Bridge: YeiSwap uses cloTokens (lending receipts) to provide dual yield (lending + swap fees).Clovis Transport enables instant cross-chain transfers using local buffers and netting, cutting execution flow by 80%.

Risk Management: Health factors, borrowing power, and rebalancing thresholds (Rmin/Ropt/Rmax) ensure safety.Penalty and incentive mechanisms maintain stability.

Yield Stacking: Clovis Vaults deploy idle funds into low-risk protocols, offering risk-tranched yield farming with no lock-up.

The Four Pillars of Clovis

-

Clovis Market – Unified lending rates.

-

Clovis Exchange – AMM + aggregator enabling dual yield with cloTokens.

-

Clovis Transport – Instant bridging with local buffers.

-

Clovis Vaults – Tiered yield farming using idle capital.

Clovis Exchange

Clovis Exchange operates as a cross-chain DEX, utilizing liquidity from Clovis Market. It matches cloTokens in AMM pools, enabling both lending and swap rewards (dual yield). Liquidity is concentrated in a single hub chain and optimized for cross-chain transactions.

Governance

Yei Finance is governed by a DAO where CLO token holders can vote on:

-

Asset listings

-

Risk parameters

-

Protocol upgrades

Initially team-led, governance will fully transition to DAO post-TGE. Smart contracts are audited, and proposals are executed via Snapshot voting. The community engages through Galxe quests and Twitter Spaces.

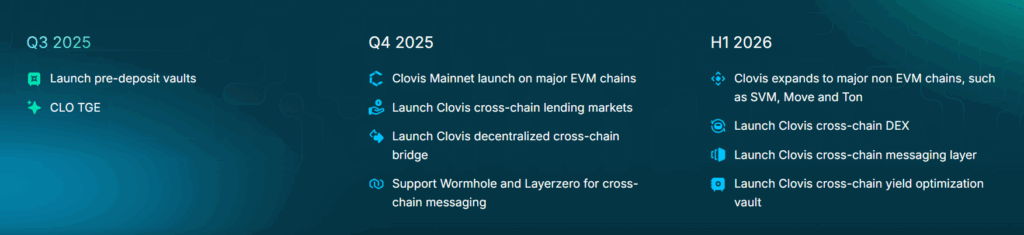

Roadmap

2024 Q1–Q2:

-

Mainnet launch, 60M+ TVL, SEI/USDT/USDC rewards

2024 Q4:

-

$2M seed funding, omnichain lending development

2025 Q4:

-

$CLO TGE

-

Clovis cross-chain lending market launch

-

Clovis decentralized bridge & mainnet across major EVM chains

-

Wormhole & LayerZero cross-chain messaging integration

2026 Q1:

-

Clovis cross-chain DEX launch

-

Messaging layer and yield optimization vaults

-

Expansion to Solana & Sui

CLO Token Utility

CLO serves as both a governance and utility token across Yei Finance’s DeFi products.

Use Cases:

-

Governance: Voting on protocol decisions.

-

Liquidity Incentives: Staking rewards & Clovis points.

-

Fee Sharing: Portion of lending, swap, and bridge fees.

-

Airdrops & IDO Access: Early user benefits.

-

Cross-Chain Utility: Discounts on bridge & swap fees.

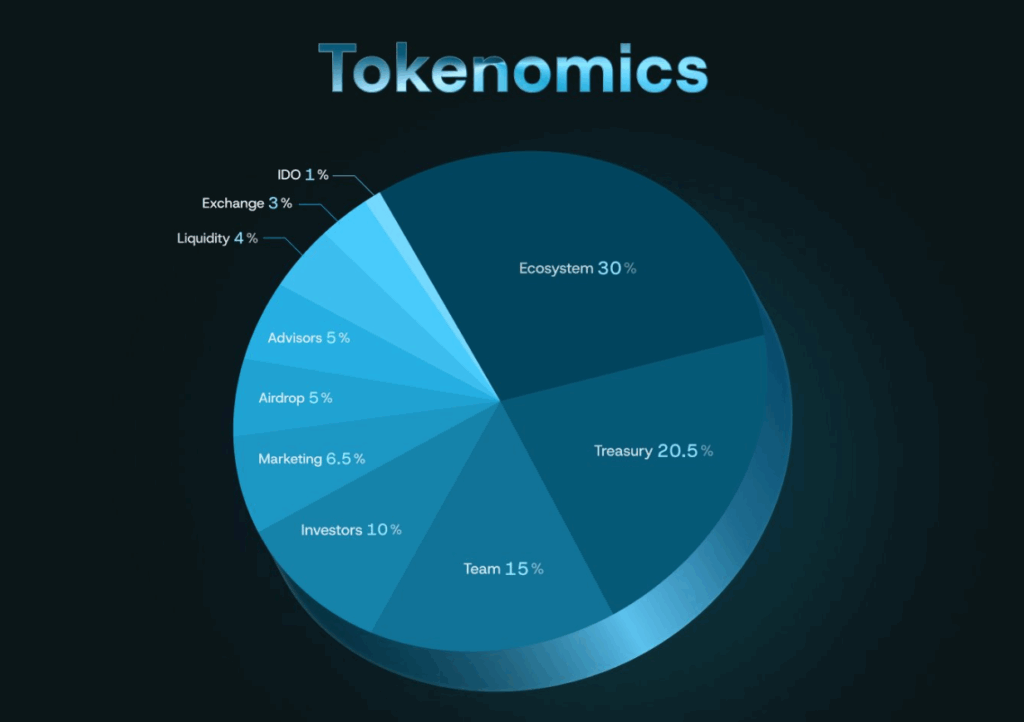

Tokenomics

-

Ticker: CLO

-

Total Supply: 1,000,000,000 CLO

-

Circulating Supply: 129,100,000 CLO

Token Allocation:

-

Ecosystem: 30%

-

Treasury: 20.5%

-

Team: 15%

-

Investors: 10%

-

Marketing: 6.5%

-

Airdrop: 5%

-

Advisors: 5%

-

Liquidity: 4%

-

Exchange: 3%

-

IDO: 1%

Ecosystem and Products

Yei Finance’s Sei-based ecosystem includes:

-

YeiLend: Lending platform

-

YeiSwap: DualYield V2 DEX

-

Yeiliens NFT: IDO access for NFT holders

-

YeiBridge: Cross-chain bridging

Key Features:

-

Shared Liquidity: Clovis pools eliminate bootstrap needs.

-

Dual Yield: cloTokens earn both lending and swap fees.

-

Instant Bridging: Low latency and 70%+ cost reduction.

-

Risk Management: Real-time rebalancing & mempool monitoring.

-

Plug-and-Play: Easy integration for new L1/L2 networks.

-

User-Centric UX: One-click cross-chain experience.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.