The correlation between Bitcoin (BTC) and gold has reached record highs, reinforcing the “digital gold” narrative that has long surrounded the leading cryptocurrency. According to CryptoQuant CEO Ki Young Ju, the BTC–gold correlation has now exceeded 0.85, one of the strongest levels seen in recent years.

Bitcoin and Gold Move in Sync

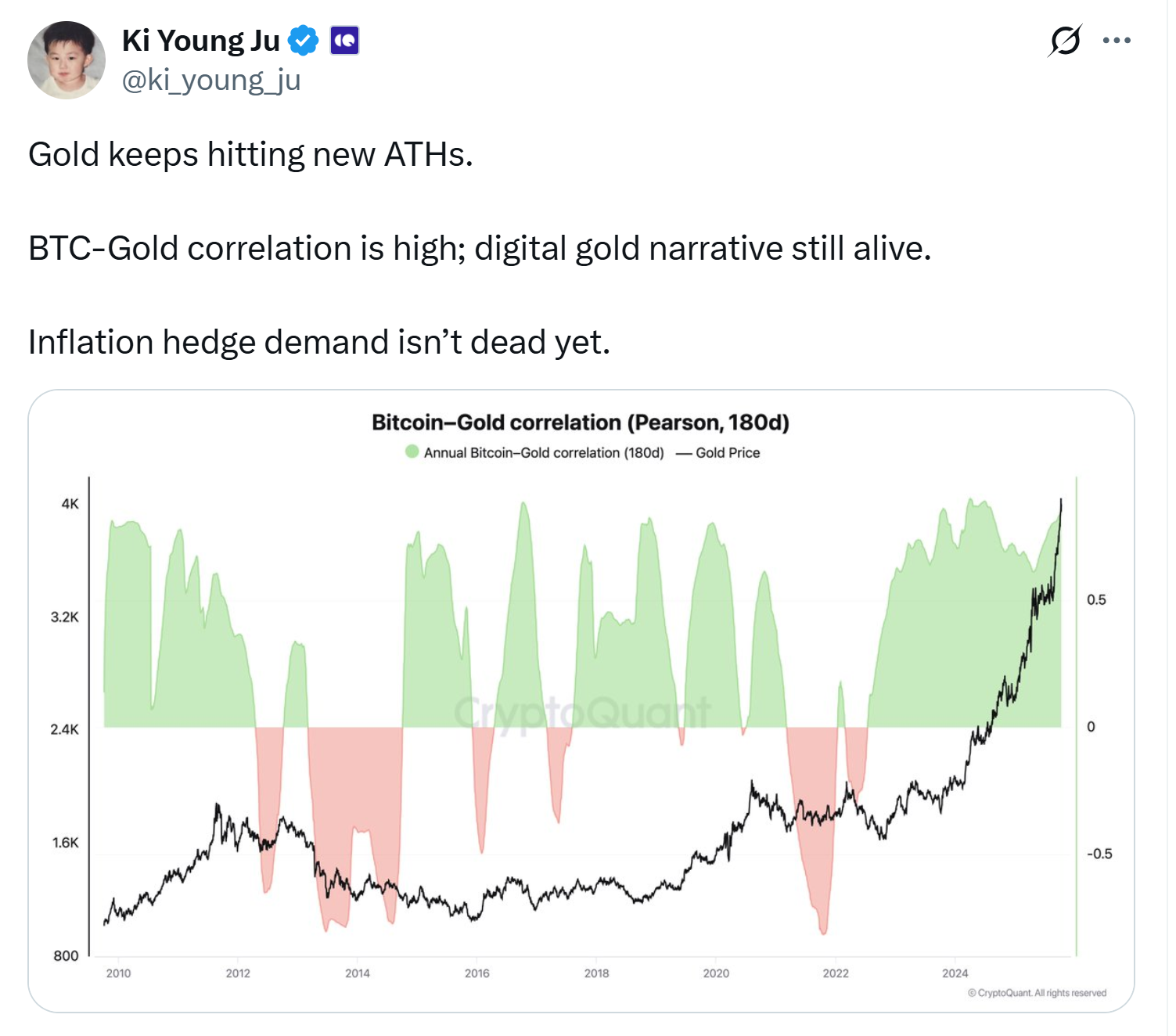

Ki Young Ju highlighted in a recent post on X (formerly Twitter) that Bitcoin’s correlation with gold has surged as the precious metal continues to hit new all-time highs.

“Gold keeps hitting new all-time highs. BTC–gold correlation is high; the digital gold narrative remains alive. Inflation hedge demand isn’t dead yet,” he wrote.

Data from CryptoQuant shows that the correlation was -0.8 in October 2021, demonstrating a remarkable shift in market sentiment. The correlation previously peaked at 0.9 in April last year, further confirming Bitcoin’s growing status as a macro hedge similar to gold.

Bitcoin Mirrors Gold’s Evolution

According to Andrei Grachev, managing partner at DWF Labs, the rising correlation reflects institutional investors’ changing perception of Bitcoin. “Capital naturally rotates into assets perceived as stable stores of value,” he noted.

Grachev compared Bitcoin’s journey to gold’s historical transformation — from an active currency to a long-term store of value. Similarly, Ben Elvidge from Trilitech emphasized that Bitcoin’s programmatic scarcity makes it more suitable as a store of value rather than a payment method.

Hard Assets Gain Momentum

Gold reached a new record of $4,179 per ounce this week, with spot prices around $4,128 and December futures at $4,158, marking a 57% increase this year. Silver also soared to $53.60, up 85% year-to-date, outpacing gold’s rally.

Analysts suggest that institutional investors are turning to hard assets amid fears of ongoing fiat currency debasement. As Anthony Pompliano recently stated, “No one is ever going to stop printing money” — a realization that continues to drive capital toward Bitcoin and gold as reliable, finite stores of value.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’ t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news.