OpenEden OpenDollar (USDO) is a USD-pegged stablecoin issued by OpenEden Digital (OED), a digital asset issuer licensed by the Bermuda Monetary Authority (BMA). OED operates as a wholly owned subsidiary of the OpenEden Group (OEG). Fully backed by high-quality, liquid reserves such as tokenized U.S. Treasury Bills, USDO ensures stability and security for its holders.

What is OpenEden OpenDollar (USDO)?

USDO is issued by OED under a BMA Digital Assets Business License, authorizing the creation, sale, and redemption of virtual coins, tokens, or other digital assets. Structured as a Bermuda-registered segregated accounts company (SAC), OED ensures that USDO assets are legally separated from its general accounts under the SAC Act. This protects holders in case of insolvency: USDO reserves are held in a distinct account, inaccessible to OED, its shareholders, or creditors. The reserves, primarily tokenized Treasury Bills like TBILL and BUIDL, are managed by OED to maintain a 100% collateralization ratio, ensuring each USDO is backed by equivalent assets. A full list of reserve assets is available on the official website.

USDO supports instant minting with USDC or TBILL for KYC-verified investors, with a 1:1 minting ratio for USDC. The cUSDO, a wrapped version, is designed for platforms that don’t support rebasing tokens, accumulating yield internally while maintaining USDO’s value. Conversion between USDO and cUSDO is seamless via the cUSDO smart contract, with no difference in yield.

Purpose of OpenEden OpenDollar (USDO)

USDO bridges DeFi and traditional finance, offering a secure, USD-pegged stablecoin backed by low-risk assets like U.S. Treasury Bills. These provide predictable yields with minimal interest rate risk due to short maturities. Transparent reserve management, verified by Chainlink Proof of Reserves (PoR), builds user trust. The Bermuda SAC structure ensures bankruptcy remoteness, isolating USDO assets from OED’s general obligations, safeguarding holders even during financial distress.

How Does OpenEden OpenDollar (USDO) Work?

USDO is managed by OED under the SAC framework, with minting and redemption requiring a minimum $100,000 investment and KYC compliance, restricted to non-U.S. residents. Prohibited jurisdictions include Abkhazia, Afghanistan, Angola, and others (full list on the official site).

Minting Process:

-

General Minting: Requests are validated (KYT, whitelist checks), collateralized with tokenized real-world assets (RWAs), and USDO is minted and sent to the client.

-

Instant Minting: Authorized users mint USDO in a single transaction using USDC (1:1 ratio) or TBILL (based on exchange rate), requiring on-chain KYC/KYT clearance.

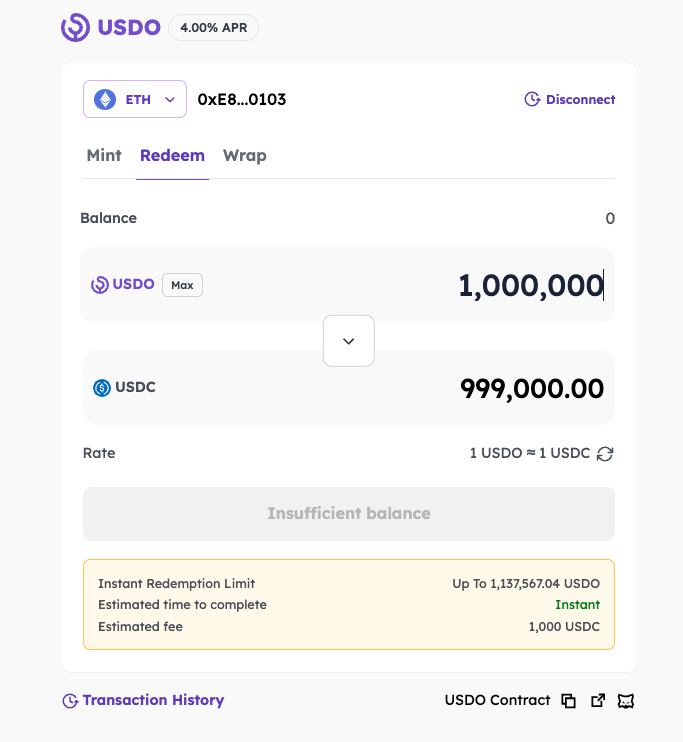

Redemption Process:

-

Manual Redemption: USDO is sent to OED’s wallet before the daily 8:00 UTC cut-off on U.S. business days. Requests are validated, processed in FIFO order, USDO is burned, and USDC is returned within 1-2 business days.

-

Instant Redemption: Limited by Circle and BlackRock BUIDL liquidity, USDO is burned, TBILL is sent to the TBILL protocol, and USDC is returned via the Circle BUIDL smart contract.

Bonus Multiplier: A daily rebase mechanism adjusts USDO balances (Balance = shares * bonusMultiplier), updated daily, including weekends, reflecting preset APY (adjustable based on market conditions).

Fees:

-

Minting Fee: 0.03% deducted from minted USDO.

-

Redemption Fee: 0.1% deducted from redeemed USDO.

Collateralization Ratio: Ensures 100% backing of USDO with reserves, allowing redemptions at $1 par value.

Transparency:

-

Reserves Dashboard: Publicly accessible for on-chain reserve verification.

-

Chainlink PoR: Validates reserve sufficiency.

OpenEden OpenDollar (USDO) Use Cases

USDO is used in DeFi for:

-

Minting/Redemption: Instant conversion with USDC/TBILL.

-

DeFi Integration: Liquidity provision, lending.

-

cUSDO: Compatible with non-rebasing protocols.

Usage Steps:

-

Log into OpenEden Portal with a valid email and complete the pre-onboarding questionnaire.

-

Request USDO access and submit KYC documents.

-

Upon approval, mint/redeem via the USDO Portal.

Advantages of OpenEden OpenDollar (USDO)

-

Security: Bermuda SAC ensures bankruptcy remoteness.

-

Stability: 100% collateralized with short-term Treasury Bills.

-

Transparency: Chainlink PoR and reserves dashboard.

-

Efficiency: Instant minting/redemption, cUSDO interoperability.

Risks of OpenEden OpenDollar (USDO)

-

Reserve Risk: Potential value loss from counterparty or market events.

-

Blockchain Risk: Irreversible transactions, forks.

-

Smart Contract Risk: Vulnerabilities, despite ChainSecurity audits.

-

Liquidity/Listing Risk: Market fluctuations.

-

Legal Risk: Regulatory changes.

-

Exchange Risk: Platform disruptions.

-

Trading Risk: Market volatility.

-

Banking Risk: Fiat transaction issues.

-

No Deposit Insurance: Assets uninsured.

-

Third-Party Platform Risk: Unverified integrations.

-

Blocked Addresses: Blacklisting for illegal activity.

-

Termination Risk: Inability to redeem post-account closure.

-

Inaccuracies Risk: Losses from incorrect addresses.

OpenEden OpenDollar (USDO) Tokenomics

USDO is a USD-pegged stablecoin; cUSDO is its wrapped, non-rebasing version.

-

Collateral:

-

OpenEden: TBILL

-

Securitize (BlackRock): BUIDL

-

Franklin Templeton: BENJI

-

Securitize (VanEck): VBILL

-

-

Burn Policy: None.

OpenEden OpenDollar (USDO) Team

The OpenEden OpenDollar (USDO) team comprises OpenEden’s founding members, experts in blockchain and financial innovation. Operating under a BMA license, OpenEden, a subsidiary of OpenEden Group, ensures robust stablecoin issuance and management.

-

Jeremy Ng (Founder & CEO): Strategic vision and leadership.

-

Duke Du (CTO): Technical infrastructure.

-

Frederick Chng (Head of Product): Product development.

-

Wayne Tan (General Counsel): Legal compliance.

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.