Stablecoin giant Paxos caused major panic in the crypto community on Wednesday after minting 300 trillion PayPal USD (PYUSD) tokens on the Ethereum network an amount far exceeding the total supply of any stablecoin in existence. The company quickly addressed the situation, explaining that the event was the result of a technical error, which was identified and resolved within a short period.

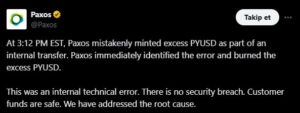

In an official statement shared via X (formerly Twitter), Paxos said:

“Paxos immediately identified the issue and resolved it by burning the excess PYUSD tokens. There was no security breach, and all customer funds remain safe.”

The incident highlights the sensitivity and automation risks involved in stablecoin issuance, even for regulated and enterprise-grade issuers like Paxos. Despite the brief turmoil, the company’s rapid response and transparency appear to have prevented further market disruption.

300 Trillion Dollars — A Number Bigger Than the Global Economy

According to Ethereum blockchain data, the error resulted in the minting of 300 trillion PYUSD tokens. Since PYUSD is pegged 1:1 to the U.S. dollar, this theoretically represented the creation of 300 trillion dollars — a sum that dwarfs the size of the global economy.

To put this into perspective, that figure far exceeds the United States’ national debt of roughly $37 trillion, and even surpasses the estimated $117 trillion global GDP.

Experts note that the incident once again highlights the limitations of automation and smart contract-based stablecoin systems, emphasizing the need for strong oversight and fail-safes in token issuance mechanisms.

Technical Details and Paxos’ Response

Data from Etherscan shows that the erroneous token minting originated from a Paxos-owned hot wallet and was directly sent to PayPal’s PYUSD smart contract.

The anomaly was detected around 3:12, and within approximately 30 minutes, the excess tokens were burned, restoring the proper supply balance. Paxos identified the root cause as a “technical inconsistency in the automated minting mechanism”, adding that the company has updated its internal security protocols to prevent similar incidents in the future.

While no user funds were affected and the system stabilized quickly, the episode underscores how even regulated, institution-backed stablecoins can experience vulnerabilities when automation meets large-scale financial infrastructure.

Temporary Shock in the DeFi Ecosystem

The Paxos incident caused a brief wave of panic across the decentralized finance (DeFi) ecosystem. Shortly after the event, Aave temporarily froze PYUSD markets as a precautionary measure to ensure platform security. The stablecoin’s price briefly deviated from its $1 peg, but quickly stabilized after the excess tokens were burned and the supply returned to normal levels. Following the fix, Paxos resumed normal operations, minting an additional 300 million PYUSD as part of its routine issuance process.

Renewed Debate on Transparency and Risk in Stablecoins

PYUSD currently ranks as the sixth-largest stablecoin globally, with a market capitalization of $2.6 billion. Although the incident showcased Paxos’s strong operational controls and effective crisis management, it also reignited discussions about technical risks, transparency, and auditing practices within the broader stablecoin industry.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.