The cryptocurrency market is expected to gain momentum in the new week with a series of important economic indicators and altcoin events. The market direction led primarily by Bitcoin will largely depend on how these developments unfold.

Over the past week, the crypto market experienced sharp fluctuations due to uncertainties surrounding U.S. customs tariffs. Although the selling wave led by Bitcoin (BTC) eased slightly toward the weekend, the shadow of the tariff crisis, set to end on November 1, continues to weigh on market sentiment. Within this context, the week of October 20–24 is expected to be intensely active, both in terms of macro-economic data releases and major altcoin-related events.

October 20 – Monday

- SOL (Solana) → The project team announced that it will make an important announcement.

- GENIUS Act → The public comment period ends.

- S. CFTC → Deadline for public comments on new draft regulations related to crypto assets.

These developments could have a short-term impact particularly on regulation-focused crypto projects.

October 21 – Tuesday

Federal Reserve Payments Innovation Conference

The U.S. Federal Reserve (Fed) will hold its Payments Innovation Conference, addressing topics such as payment systems, digital finance, and central bank digital currencies (CBDCs).

Statements made during the event will be of critical importance regarding crypto regulations and the digital dollar strategy.

Messages from Fed officials about the integration of digital assets into the financial infrastructure and the future of the digital dollar could have short-term effects on both Bitcoin and stablecoin projects.

October 23 – Thursday

- MET (Meteora): MET token launch

- ADA (Cardano): Deadline for the SEC’s decision on the ADA Spot ETF

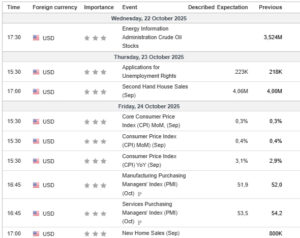

- 15:30 – U.S. Initial Jobless Claims: (Expectation: 223K, Previous: 218K)

This is a critical day for ADA. A potential ETF approval could trigger short-term upward price reactions, while a delay or rejection may increase volatility and selling pressure. If the macro data (jobless claims) deviates from expectations, it could affect overall risk appetite and therefore influence the direction of BTC and altcoins.

October 24 – Friday

- 15:30 – U.S. Core CPI (Monthly): Expectation 3% (Previous 0.3%)

- 15:30 – U.S. CPI (Yearly): Expectation 1% (Previous 2.9%)

- 15:30 – U.S. CPI (Monthly): Expectation 4% (Previous 0.4%)

U.S. inflation data carries major significance for the Fed’s interest rate policy. If the data comes in above expectations, it could create short-term selling pressure on Bitcoin and altcoins; however, a weaker inflation figure might boost risk appetite, pushing prices higher.

Weekly Overview

In the new week, both macro-economic data and altcoin events will play a decisive role in determining the market’s direction.

- Bitcoin (BTC) continues to show high correlation with U.S. data and interest rate commentary.

- For altcoin investors, Solana, Cardano, and Meteora should be closely monitored.

- The Fed Conference and CPI data will be the two key factors shaping the market this week.

A Critical Week Begins

With the combination of the tariff crisis, ETF decisions, and U.S. economic data, the crypto market is bracing for a highly volatile week. Investors should closely monitor both on-chain metrics and macro-economic developments throughout the week.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.