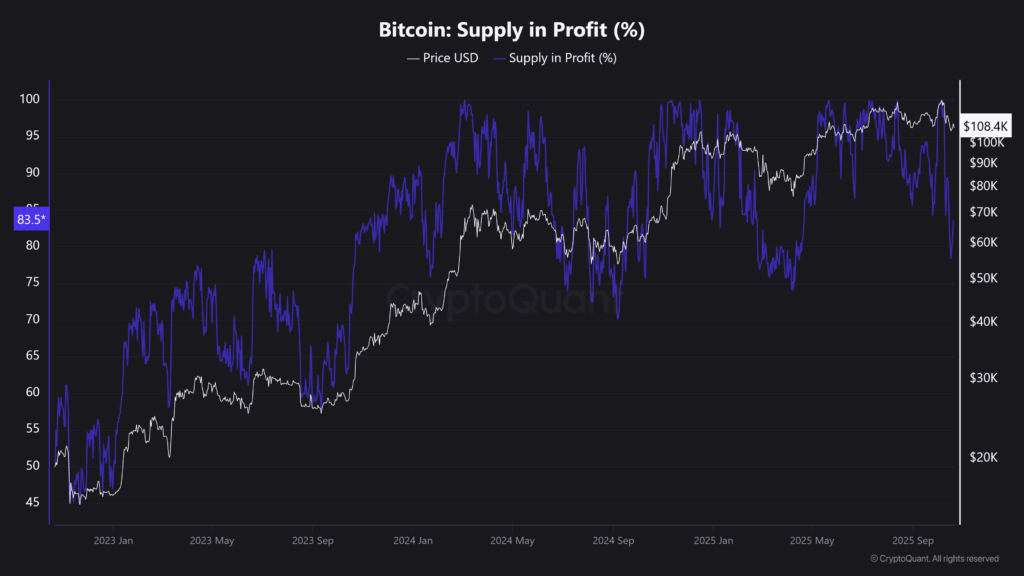

Bitcoin (BTC) remains stuck below the $108,000 resistance, failing to break the two-week downward trend. Profitable supply and RPL indicators highlight growing investor caution and panic-like sell-offs.

Bitcoin’s Profitable Supply and RPL Decline

Profitable BTC supply dropped from 98% to 78% over the past two weeks, indicating that most investors are at a loss or break-even and selling in panic.

The Realized Profit/Loss (RPL) ratio also fell from 1.2 to 0.7, reflecting more investors selling at a loss and a capitulation-like environment emerging in the market.

Panic Selling Accelerates

-

Buyers remain cautious

-

Market sentiment fragile

Low RPL suggests participants are exiting quickly rather than strategically taking profits. Combined with macro conditions (tight liquidity, risk-off sentiment), the market faces pressure.

Resistance and Support Levels

BTC lost its critical 4-hour support at $109,200 and pulled back to $107,300. If this level fails, a decline toward $105,000 is possible. Conversely, if the market reacts upward, intermediate resistance stands at $111,700 and major resistance at $116,000.

At the time of writing, BTC trades around $108,400.

Our analyst emphasizes that investors should closely monitor these critical levels. Stay updated with our latest Bitcoin analyses to track price movements.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.