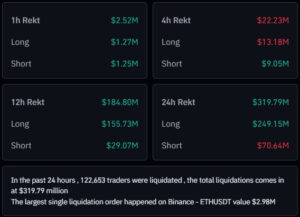

The crypto market started the week with sharp declines. In the past 24 hours, Bitcoin fell below $108,000, while Ethereum dropped below $4,000, unsettling investors. A strong wave of selling swept through the market, leading to a total of $319 million in liquidations within 24 hours. Of this amount, $249 million came from long (buy) positions, indicating that many investors were caught off guard by the downturn.

Sharp Decline in Bitcoin and Ethereum!

The crypto market began the week with a strong wave of selling. On the first trading day of the week, Bitcoin dropped sharply from around $111,000 to below $108,000. On-chain data indicates that this steep move was primarily triggered by the liquidation of highly leveraged long positions in the futures market.

Ethereum (ETH) also came under heavy selling pressure, falling below $3,900 and losing more than 6% on a weekly basis. The increasing selling activity in both spot and futures markets triggered panic selling among investors, while total market trading volume surged by over 25% in a short period.

According to analysts, Bitcoin’s sharp drop to $107,000 indicates that the short-term over-optimism in the market has been broken, and whale sell signals have been quickly reflected in prices.

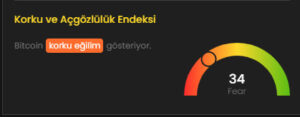

These data clearly show that investors have entered a risk-averse phase in the short term. The Fear and Greed Index currently stands at 34, signaling that fear dominates the market.

According to experienced investor Matthew Dixon, the main factor triggering the downturn was the aggressive moves by large investors (whales). The transfer of around 2,000 BTC across multiple wallets raised concerns about potential selling pressure in the market. In addition, institutional funds saw outflows totaling approximately $950 million, with over $500 million coming from Bitcoin-focused funds alone. This suggests that institutional investors are shifting toward safer assets in the short term.

Macroeconomic Factors: Stronger Dollar and Rising Geopolitical Tension

On-chain data shows that the recent selling pressure was not driven solely by technical factors. Global geopolitical and economic developments have deepened uncertainty in the crypto market.

The renewed escalation of U.S.–China trade tensions has triggered selling pressure in Asian stock markets, while the U.S. dollar index has strengthened.

At the same time, political instability in the Middle East and rising energy costs in Europe have limited global risk appetite. These conditions have prompted investors to redirect capital toward safe-haven assets such as gold, U.S. Treasuries, and other low-risk instruments.

Altcoins Also Took a Hit

The decline wasn’t limited to Bitcoin and Ethereum—major altcoins also experienced sharp losses:

- BNB: –6%

- Solana (SOL): –4.5%

- Avalanche (AVAX): –7.2%

As a result, many altcoins gave back a large portion of their 2025 gains. Meanwhile, outflows from crypto ETFs further intensified the pressure across the market.

Can Bitcoin Recover?

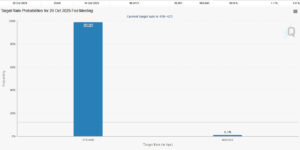

Investors are now turning their attention to the U.S. Federal Reserve’s upcoming interest rate decision. According to the CME FedWatch Tool, there is a 98.9% probability of a small rate cut this month, which could provide short-term relief for crypto prices.

Analysts, however, emphasize that Bitcoin remains highly sensitive to geopolitical risks:

“When the market enters extreme fear territory, short-term rebounds often occur. However, as long as macroeconomic uncertainty persists, it’s difficult for these recoveries to be sustainable.”

October 2025 Crypto Correction Shakes the Market

The October crypto correction has once again demonstrated just how fragile the market remains. A combination of whale movements, institutional fund outflows, and macroeconomic uncertainty has led to a significant decline in investor confidence. This episode highlights how dependent crypto assets still are on global economic developments and market sentiment.

Analysts expect volatility to persist in the short term, but in the long run, factors such as the Federal Reserve’s monetary policy direction, U.S.–China trade relations, and geopolitical developments are expected to shape the future of the crypto market. For investors, the current period represents a critical phase for risk management and maintaining patience in their positions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.