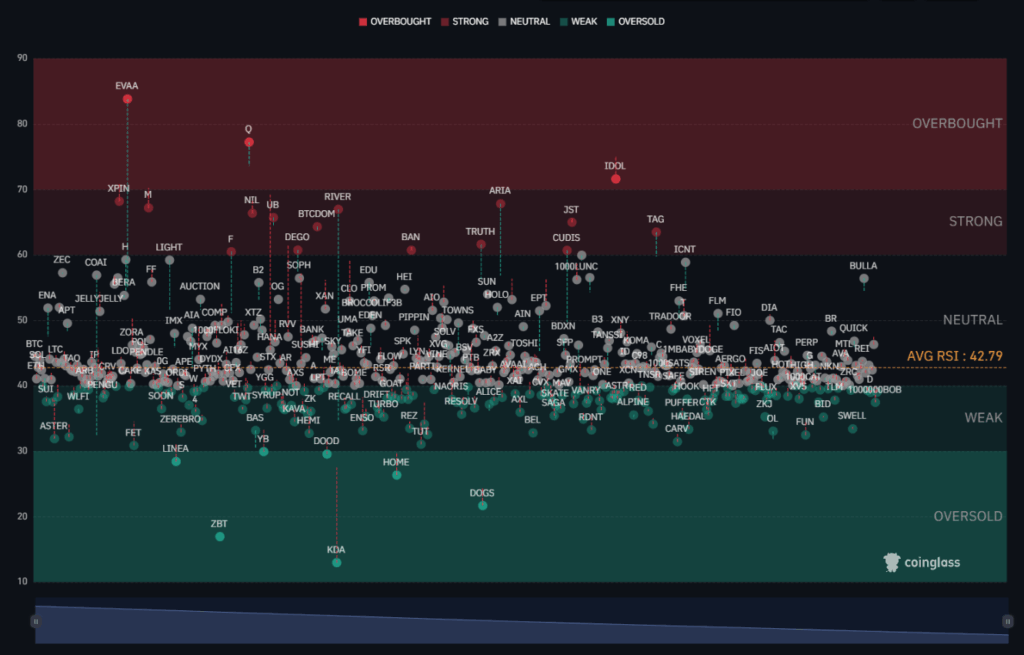

The Coinglass RSI Heatmap is a powerful tool for investors to visualize short-term market momentum. By analyzing RSI values, you can quickly identify which altcoins are in overbought or oversold zones and anticipate potential price movements. RSI typically ranges between 0 and 100.

Overbought Altcoins (RSI ≥ 70)

Altcoins in this category have RSI values of 70 or higher, indicating an overbought condition. These assets may face short-term price corrections.

-

EVAA: Shows the highest RSI on the chart (approximately 85-90), making it the altcoin with the highest short-term risk for profit-taking.

-

AEUR: Multiple periods exceed 70, with RSI even reaching 76.52. Exhibits strong momentum.

-

Q & IDOL: RSI values above 70 (around 75 and 72), indicating strong upward momentum.

Note for Readers: These coins have strong bullish trends, but the overbought RSI zone signals potential short-term pullbacks.

Strong and Near Overbought Altcoins (RSI 60–70)

These altcoins have RSI values between 60 and 70. They are not overbought yet but show strong momentum approaching the 70 threshold.

-

Top Momentum Coins: DEGO (RSI up to 67.44), JST (67.03), NIL (65.80), EDU (65.15).

-

Other Notable Coins: XPIN, M, NBL, UB, BTCCOM, ARIA, TAG, RIVER, BAN.

Note for Readers: These coins may continue rising, but monitoring volume and trend is essential before they reach overbought levels.

Potential Buying Opportunities: Oversold Altcoins (RSI ≤ 40)

Altcoins with RSI values below 30 are technically “undervalued” and may present short-term recovery potential. Coins below 40 generally indicate weak momentum.

-

Classic Oversold (RSI ≤ 30): KDA, DOGS, HOME, ZBT (around 20). Highest potential for short-term rebound.

-

Weak Momentum (RSI 30–40): PUNDIX (35.03), LUNC (36.18), SUN (40.01). These coins exhibit weak momentum and may present recovery opportunities.

-

Borderline: DOOD (~30).

Note for Readers: RSI ≤ 30 is a classic buy signal, but values below 40 indicate weak momentum. RSI should always be considered alongside other technical analysis tools and market conditions.

RSI Levels Explained

| RSI Value (Approx.) | Zone Name | Color | Meaning |

|---|---|---|---|

| 70–100 | OVERBOUGHT | Dark Red | Price rose rapidly recently; high risk of correction. |

| 60–70 | STRONG | Light Red | Strong upward momentum, approaching overbought. |

| 40–60 | NEUTRAL | Gray | Market balanced; no clear overbought or oversold (Avg RSI: 42.79). |

| 30–40 | WEAK | Light Green | Downward momentum present, approaching oversold. |

| 0–30 | OVERSOLD | Dark Green | Price dropped sharply recently; high recovery potential. |

How to Read the Heatmap

-

Each point represents a cryptocurrency (e.g., BTC, ETH, EVA, ZEC).

-

Higher positions (redder) indicate overbought conditions (e.g., EVAA at the top).

-

Lower positions (greener) indicate oversold conditions (e.g., KDA, DOGS at the bottom).

-

BTC, LTC, ETH, ZEC, COAL, FF, and other coins are near or within the neutral zone.

For an in-depth view of different coins’ RSI levels in selected timeframes, check the heatmap directly.

Neutral and Weak Altcoins

Coins with RSI in the neutral (40–60) or weak (30–40) range don’t give a clear buy or sell signal but reflect average market movement.

-

Neutral Zone (≈40–60): ZEC, COAL, OG, SUN, EDU, AIO, ADA, BTC, ETH, LUNA, and other high-volume coins.

-

Weak Zone (≈30–40): ASTER, FET, LINEA, ZERÉBRO, BAS, HÈMI, RDNT; these coins show weak momentum.

Conclusion

The RSI Heatmap clearly highlights altcoins with strong overbought momentum, such as EVAA and AEUR, as well as potential buying opportunities in oversold coins like KDA and ZBT. Investors should use RSI alongside volume, trend, and fundamental analysis to make informed decisions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.