Aave DAO has announced a groundbreaking governance proposal set to make waves in the DeFi sector. The protocol aims to enhance the sustainability of its ecosystem through a $50 million annual AAVE token buyback plan. This initiative seeks to optimize revenue distribution, strengthen protocol stability, and redefine Aave’s token economy (Aavenomics).

Aavenomics: The Start of a New Era for Aave

The comprehensive upgrade known as “Aavenomics” aims to redesign Aave’s long-term financial framework. The proposal, led by the Aave Chan Initiative (ACI), envisions a new decentralized governance structure that will support Aave’s continued growth and maturity as a DeFi protocol.

The $50 Million Buyback Plan: How It Works

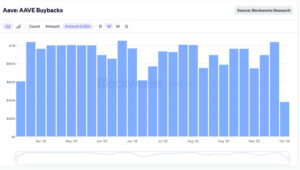

According to the proposal, the Aave Finance Committee will use protocol-generated revenue to repurchase AAVE tokens from secondary markets. These repurchased tokens will then be transferred to the ecosystem reserve, with the goal of reducing circulating supply, boosting investor confidence, and actively reinvesting protocol income.

The plan will begin with a weekly purchase rate of $1 million, following a conservative strategy focused on fund security. According to Zeller, this model mirrors a shareholder dividend system, establishing a sustainable revenue framework within the DeFi ecosystem.

Umbrella Security Module: A New Layer of Protection

As part of the Aavenomics upgrade, Aave plans to launch a new risk management framework called the Umbrella Security Module. This system is designed to reduce default risks and provide insurance-like protection within borrowing processes. Operating automatically through smart contracts, the module will enhance the resilience and liquidity security of the protocol.

Aave generated approximately $500 million in revenue last year. With the new system, these revenues will no longer remain idle in the treasury but will instead be redistributed to the community, reinforcing economic sustainability within the ecosystem.

Setting a New Standard in the DeFi Ecosystem

This proposal underscores the growing importance of restructuring token economies in the DeFi landscape. Similar buyback and protection models have been successfully implemented by MakerDAO and Curve Finance, helping stabilize token price volatility and improve market confidence.

According to analysts, if the Aave proposal is approved:

- The supply-demand balance of the AAVE token will strengthen,

- Long-term price stability will be supported, and

- The protocol’s revenue model will become more attractive to investors.

Market Reaction and Potential Impact

The announcement has been well received by the market, especially amid heightened macroeconomic uncertainty. Following the news, AAVE’s price surged by 8%, rising from $215 to $219. Investors view this move as a validation of AAVE’s intrinsic value and a sign of growing protocol maturity.

While short-term speculative movements may occur, analysts expect this model to boost revenue stability and investor confidence in the long run.

The proposal is currently in the community voting stage.

Aave Redefines the Future of DeFi Economics

The Aave DAO’s $50 million AAVE buyback proposal represents more than just a financial strategy — it marks a new paradigm shift in the evolution of decentralized finance (DeFi).

With the Aavenomics upgrade, Aave is expected to further strengthen its position as one of the most trusted and resilient protocols in the DeFi ecosystem.

This model has the potential to set a new economic standard not only for the Aave ecosystem but also for the entire DeFi market in the long run.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.